-

Ebanx isn't new to the payments technology game in Latin America, having focused on cross-border e-commerce technology a few years ago to allow consumers in that region to make purchases from international merchants.

January 21 -

Director Kathy Kraninger has told lawmakers that the agency will delay the expiration of the so-called QM patch, now set for January 2021.

January 21 -

Banks in the U.S. should take note of these requirements before opening their systems to third-party developers.

January 21 Regions Bank

Regions Bank -

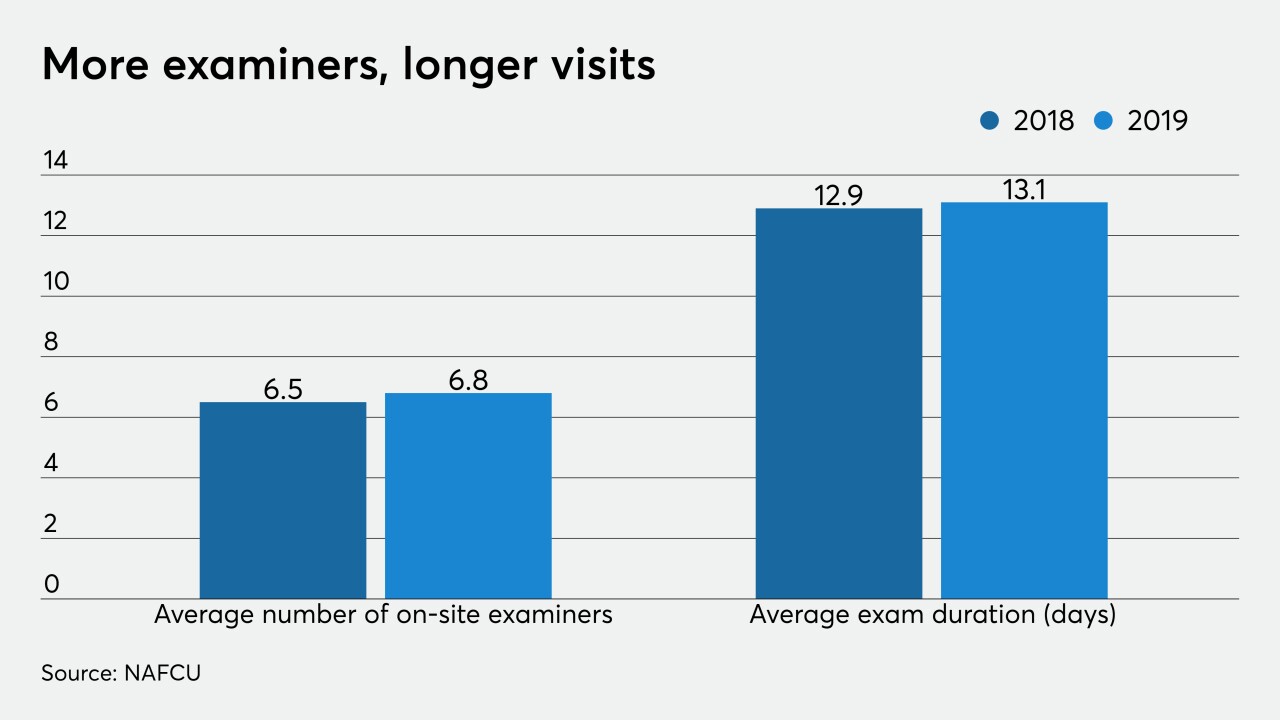

The National Credit Union Administration promised qualified credit unions under $1 billion in assets would be on an 18-month exam timeline by the end of 2019. A recent report says that hasn't happened.

January 21 -

New smartphones have subtle differences that require more complex security solutions, says Fingerprints' Ted Hansson.

January 21 Fingerprints

Fingerprints -

Doug Nielson at U.S. Bank and Jane Barratt at MX explain how men can be more supportive of their female colleagues.

January 20 -

Pushback from banks, a smaller pool of sellers and potential regulatory hurdles could pose setbacks for credit unions this year.

January 20 -

Last week, Indian regulators ordered an antitrust probe of Walmart and Amazon while Jeff Bezos and other Amazon execs traveled to New Delhi to tout a $1 billion investment to digitize local businesses. The message is U.S. investment is welcome, as long as U.S.-driven data mining is kept at bay.

January 20 -

Adam Dell, founder of Clarity Money and now head of product at Marcus by Goldman Sachs, explains the design theory behind the new app.

January 19 -

Federal legislation introduced this week by Rep. Gregory Meeks, D-N.Y., would ensure that taxi drivers don't get taxed on medallion debt that gets forgiven. The bill dovetails with a debt forgiveness plan under development in New York, where hundreds of drivers have filed for bankruptcy.

January 17