-

From stimulus checks to the Paycheck Protection Program, the government’s infusion of cash into an economy reeling from the coronavirus pandemic has primarily helped those who already strong banking relationships.

April 20 American Banker

American Banker -

Congress won’t be back to Washington for at least two weeks but credit unions already have a laundry list of requests for lawmakers to consider.

April 20 -

The trend to mobile is accelerating due to government stimulus checks, closed bank branches and the move to e-commerce, sayd Mitek's Michael Diamond.

April 20Mitek Systems -

Minorities are often hit harder financially during a crisis, but if regulators move forward on revamping the Community Reinvestment Act, they’ll only make matters worse.

April 20 D-N.Y.

D-N.Y. -

This is the first time since 2014 that the regulator won't penalize credit unions that file within 30 days of the deadline.

April 20 -

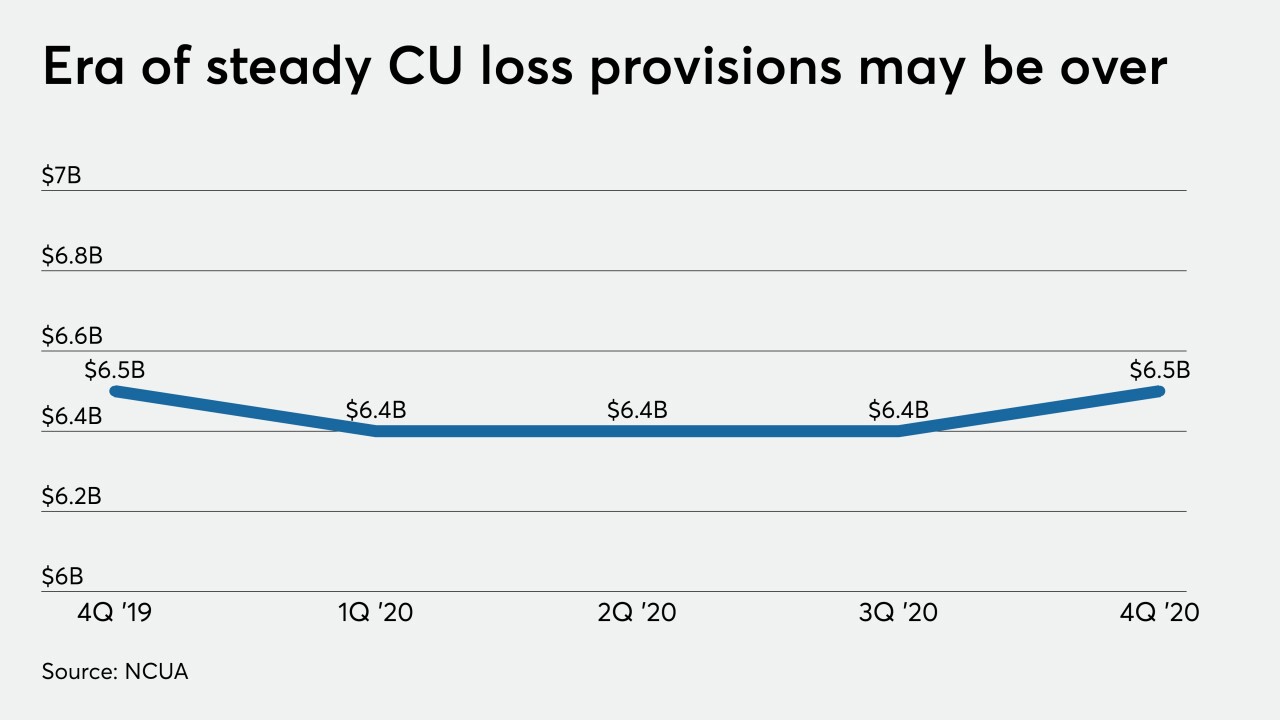

Smaller institutions should prepare themselves for some of what the competition has experienced, including increased provisions for losses and declining net interest margins.

April 20 -

When we go back to normal, it's our opportunity to start making long-overdue infrastructure upgrades, says Nvoicepay's Derek Halpern.

April 20 Nvoicepay

Nvoicepay -

Fast-moving payments innovation was already threatening comfortable connections between consumers and businesses before the pandemic turned the trend into an outright crisis.

April 20 -

Citizens, Regions and others say business investments initiated before the COVID-19 pandemic, including technology improvements and new consumer offerings, are on track.

April 19 -

The Senate Banking Committee chair will work with the heads of other panels in overseeing the $2 trillion stimulus package that Congress passed last month.

April 17