-

Granting a third party access to a bank's systems in exchange for more advanced technology can help prevent fraud, but it can also attract cyberattacks.

January 6 Regions Bank

Regions Bank -

Dort Financial is the latest to switch from a federal charter to a state charter, a move that also widens its field of membership.

January 6 -

The SAFE Banking Act is on hold after Sen. Mike Crapo announced his opposition to it. One observer suggested that could have a "chilling effect" on CUs looking to enter the pot banking space.

January 6 -

Traditional phishing attacks on email are easier for most users to spot, causing crooks to migrate to new venues, argues The ai Corporation's James Crawshaw.

January 6 The ai Corporation

The ai Corporation -

Europe's PSD2 data-sharing mandate is inspiring banks such as BBVA to form unconventional alliances.

January 6 -

Though there were several high-profile mergers of equals among bigger banks, deal activity rose only slightly, and the vast majority of transactions involved the smallest of institutions. Here's an overview of those trends and others that stood out in bank dealmaking last year.

January 5 -

Several former high-level Wells Fargo executives are under criminal investigation in connection with the bank's fake-accounts scandal and could be indicted as soon as this month.

January 3 -

One credit union's experience helping Puerto Ricans after Hurricane Maria illustrates how powerful financial wellness tools can be.

January 3 PenFed

PenFed -

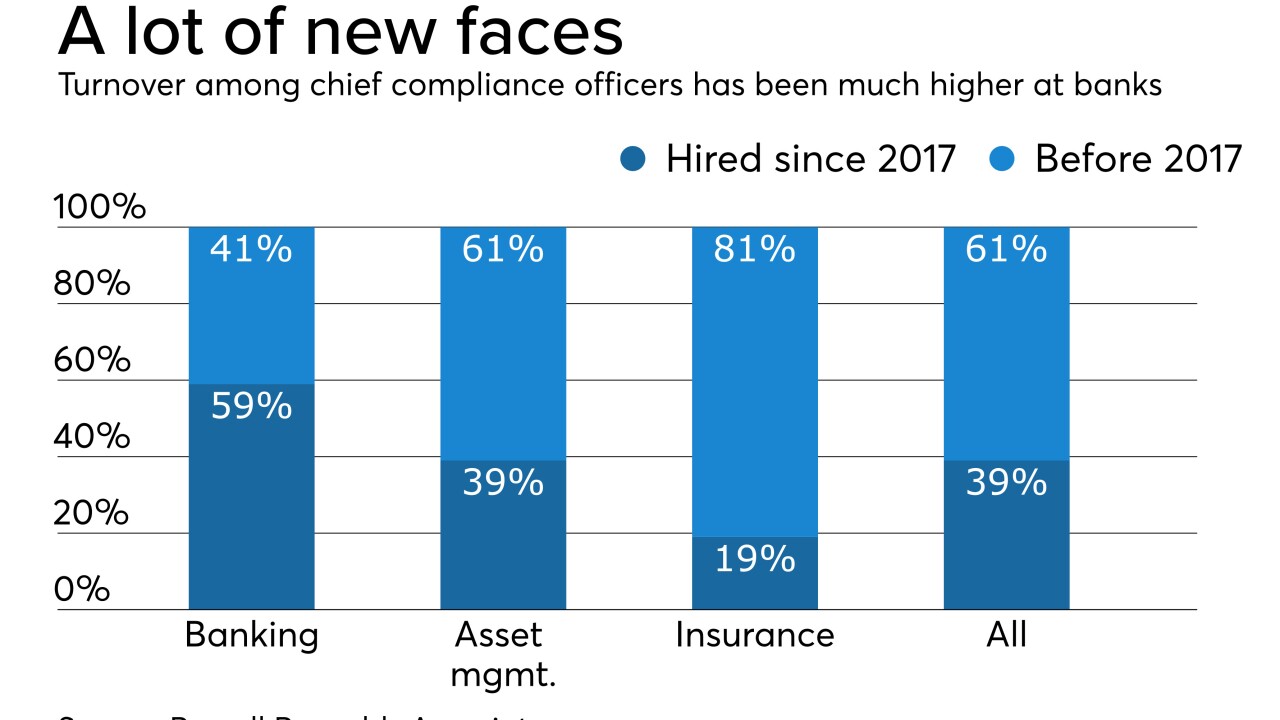

Banks had the highest turnover of chief compliance officers among the 100 largest financial services firms in the world, according to a recent study. Recruiters say that’s a function of changing job demands, high pressure and poaching by fintechs — plus old-fashioned demographics.

January 3 -

After declining to support the proposal drafted by the OCC and FDIC, the Federal Reserve could issue its own framework or just keep the current CRA regime.

January 3