-

B2B cross-border payments provider Currencycloud is partnering with online foreign exchange trading service OANDA to establish an international money transfer network for companies in North America.

January 27 -

The credit union will provide a one-time stimulus check for all employees who worked through the COVID-19 crisis, similar to a recent move at Bank of America.

January 27 -

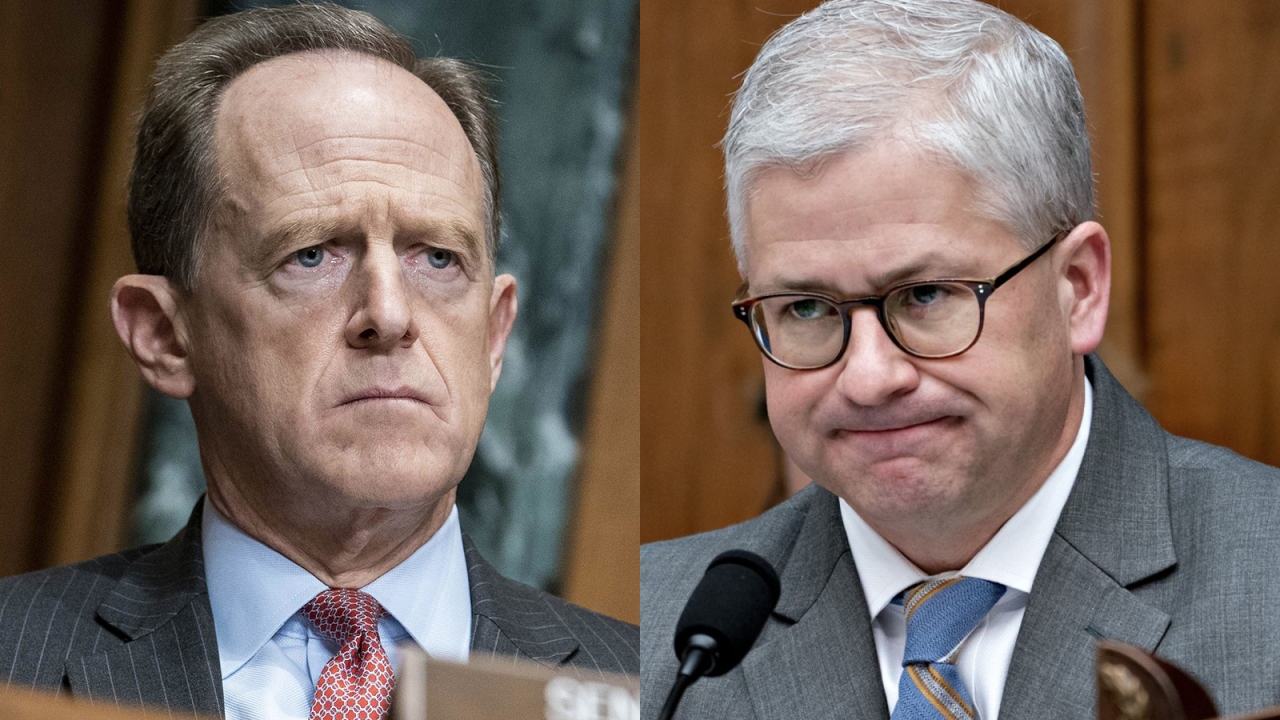

The Senate’s confirmation of Treasury Secretary Janet Yellen was notably bipartisan. But experts say congressional Republicans are poised to give nominees for the federal banking agencies heavier scrutiny.

January 27 -

Y-Combinator fintech Stilt has secured a new loan facility from Silicon Valley Bank to diversify its funding sources and expand its lending efforts to immigrants and thin-file borrowers.

January 27 -

Bank of America scrapped a proposed bonus policy this week after it provoked the ire of high-earning traders and dealmakers, some of whom could have missed out on a big chunk of their compensation.

January 27 -

The most likely picks for comptroller of the currency have pushed tech-driven approaches to financial inclusion and anti-money-laundering, and would bring new perspective to regulating cryptocurrencies.

January 27 -

By holding themselves accountable and following smart standards, organizations will be able to provide consumers with strong security and peace of mind the next time they swap those paper menus for a set of scannable squares on their phone, says Nok Nok's Phil Dunkelberger.

January 27 Nok Nok Labs

Nok Nok Labs -

President Biden’s executive order requiring agencies to weigh the impact of pending policies on underserved groups could have a lasting effect on issues from reforming the Community Reinvestment Act to fair lending.

January 27

-

The bank will start with a mobile checking account for U.K. customers this year, followed by a full slate of products that could include credit cards, mortgages and car loans.

January 27 -

The banks are publicly committing to interview more minorities for top positions; the agency says automated compliance checks are preventing lenders from approving loan applications.

January 27