-

While the federal banking agencies are not changing any current rules, they issued a joint statement Thursday cautioning banks about risks in third-party deposit partnerships. They are also seeking public input on bank-fintech partnerships more generally.

July 25 -

The San Antonio-based bank is in the midst of a yearslong expansion effort spanning Houston, Dallas and Austin — all of which are fueling loan growth.

July 25 -

Project Fortress encompasses four initiatives Deputy Secretary Wally Adeyemo hopes will "improve the security and resilience of the financial services sector."

July 25 -

ChoiceOne Financial Services would pay about $180 million to acquire Fentura Financial in a bid to expand in Detroit's suburbs. The deal would create a bank with more than $4 billion of assets.

July 25 -

But following the gross domestic product and personal consumption expenditures reports, Treasury yields and mortgage rates fell.

July 25 -

The Raleigh, North Carolina-based bank grew loans and deposits in the second quarter as it won back business from former customers of the failed Silicon Valley Bank. First Citizens bought the remains of SVB last spring.

July 25 -

Third-party origination operations are also going to Mr. Cooper in the $1.4 billion deal, in which the seller cited interest in improving its capital position.

July 25 -

The big box retailer's move comes amid a broader decline for the traditional payment option.

July 25 -

The siren song of greater regulatory uniformity will lead the industry to disaster, as the kind of innovation that benefits consumers is stifled.

July 25

-

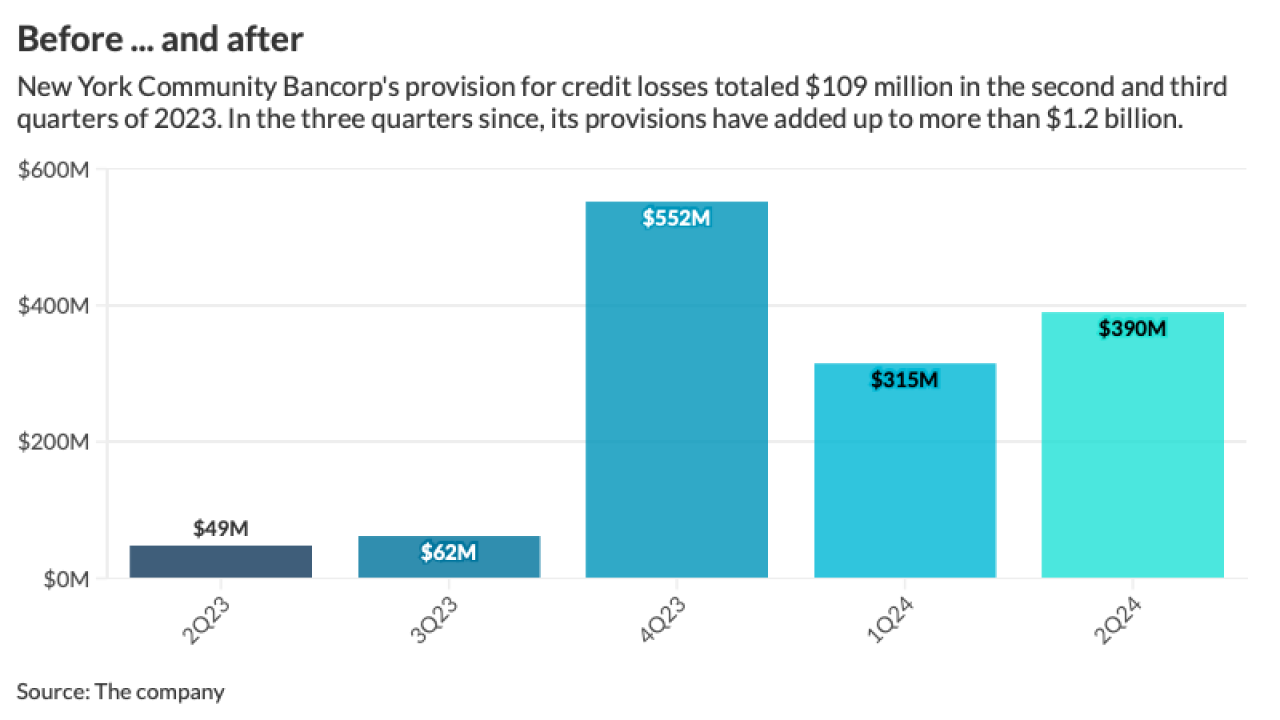

The parent company of Flagstar Bank reported a net loss of $323 million for the second quarter after boosting loan-loss provisions and recording a steep increase in net charge-offs. Still, it says it's making progress on a turnaround plan, including by agreeing to the sale of its mortgage servicing business.

July 25