-

The Federal Reserve’s FedNow instant payments system will dramatically speed up payment processing, essentially allowing people and businesses to receive money in their accounts within seconds of a transaction, says the Retail Industry Leaders Association's Austen Jensen.

October 10

-

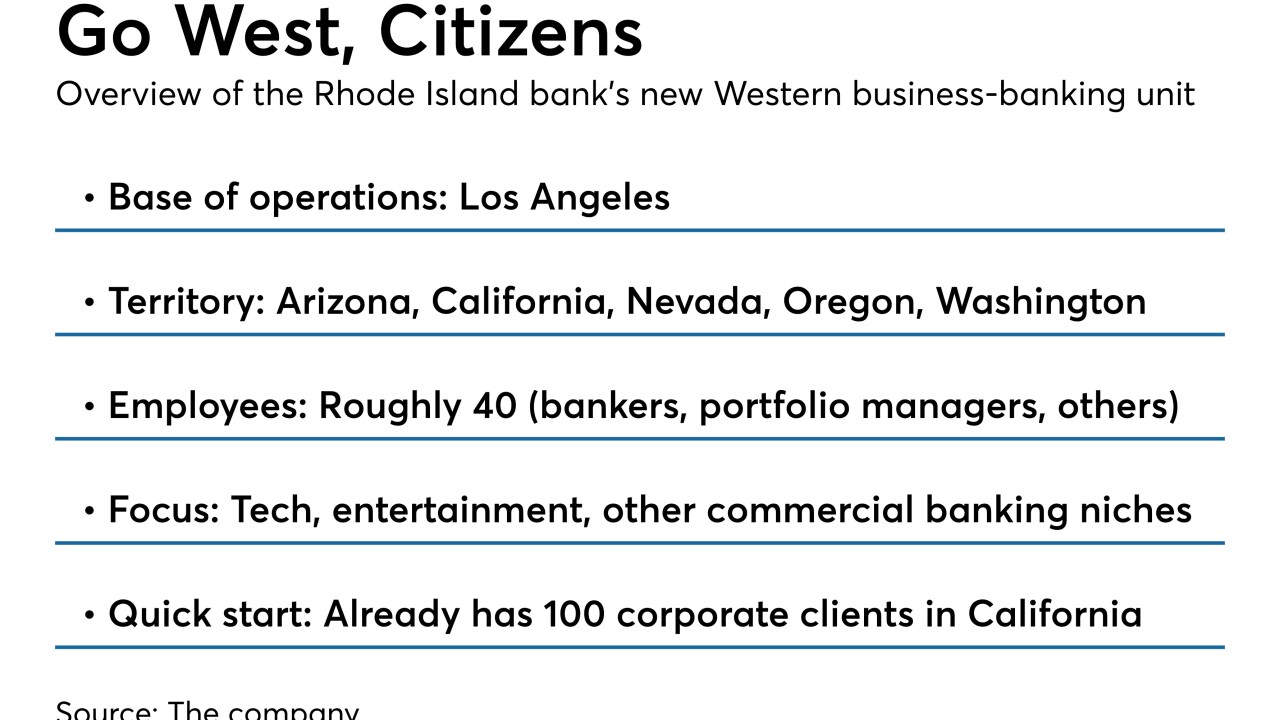

The Providence, R.I., bank recently installed a new regional head in California to oversee a commercial banking expansion into five western states. The bank says it’s trying to craft a successful growth strategy while reassuring investors it isn’t overreaching.

October 9 -

The court passed up a recent opportunity to clarify confusion about Americans with Disabilities Act requirements for business websites, raising concerns among bankers that they could become an even more inviting litigation target.

October 9 -

Maine Harvest Federal Credit Union, which will serve farmers and the food industry, opened this week and aims to make $12 million in loans over the next six years.

October 9 -

All personnel will qualify for up to six weeks of paid leave following the birth, adoption, or foster-care placement of a child in their home, the agency said.

October 9 -

A digital currency firm has been accused of recruiting actors to pretend to be Comerica and Mastercard employees, writing a fake prospectus and taking other steps to make it look like the two U.S. companies were its partners in an investment venture.

October 9 -

Credit unions have until Monday night to submit pictures for the popular Day in the Life of Credit Unions photo essay.

October 9 -

Following a two-year pilot, several Sri Lanka banks are rolling out co-branded credit and debit cards connecting LankaPay, the local payments network, with Japan’s JCB brand, extending the cards’ reach to any global merchant or ATM that accepts JCB.

October 9 -

Bank executives at the Most Powerful Women in Banking and Finance gala stressed the importance of male allies in combating gender inequities.

October 9 -

Ripple is collaborating with financial software company Finastra, boosting both companies' reach in the cross-border transaction market.

October 9