-

Federal rules for technology-based firms providing the fast-moving sector certainty and consistency would be a benefit, even if rules are suboptimal.

April 8 Mercatus Center at George Mason University

Mercatus Center at George Mason University -

Banks should prepare for renewed scrutiny of their anti-money-laundering efforts in the wake of the headline-grabbing leak of the Panama Papers.

April 8

-

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

April 8 -

In a panel featuring the four living chairs of the Federal Reserve Board, Janet Yellen said that she does not share Minneapolis Fed President Neel Kashkari's view that the biggest banks need to be broken up but respects his opinion and the role of regional banks in the Fed system.

April 7 -

Sen. Jeff Merkley, D-Ore., and nine other Democrats are attempting to block a go-around they say payday lenders use to avoid complying with state laws.

April 7 -

Speaking before the Senate Banking Committee, CFPB Director Richard Cordray said fintech companies should be held to the same standards as depository institutions. At the hearing, Cordray fielded questions on payday loans, indirect auto lending and regulation by enforcement rather than rulemaking.

April 7 -

Sens. Sherrod Brown, D-Ohio, and Elizabeth Warren, D-Mass., sent a letter to the Treasury Department on Thursday urging an investigation into whether any U.S. or U.S.-linked entities are associated with the Panama-based law firm Mossack Fonseca & Co. and its schemes to help wealthy individuals and businesses evade taxes and launder money.

April 7 -

LAS VEGAS Office of the Comptroller of the Currency chief Thomas Curry said Thursday that banks have reached a do-or-die moment and it is up to them to keep up and outinnovate nonbank rivals.

April 7 -

The housing market has been improving but mortgage credit remains "stubbornly" tight on loans bought by the government-sponsored enterprises, according to a chief housing adviser at the White House.

April 7 -

Richard Hunt, the president and CEO of the Consumer Bankers Association, weighs in on recent moves by regulators to scrutinize fintech firms and whether the agencies are going far enough.

April 7 -

In a ruling that was unsealed Thursday, D.C. District Court Judge Rosemary Collyer upbraided the Financial Stability Oversight Council for disregarding its own rules in its decision to designate the insurer MetLife as a systemically risky nonbank.

April 7 -

Charlie Hallinan, who pioneered the tactics payday lenders have used for years to stymie state regulators, was indicted on federal conspiracy and fraud charges.

April 7 -

The U.S. government panel that decided MetLife was too big to fail erred by not evaluating the insurer's vulnerability to financial distress, according to the federal judge who rescinded that designation last week.

April 7 -

Regulators and lawmakers must exercise healthy caution before granting fintech firms preemptive powers via national bank charters or otherwise.

April 7 Alvarez & Marsal

Alvarez & Marsal -

As actions such as Operation Choke Point continue, the government should acknowledge the tension institutions face between serving a community and facing increased regulatory scrutiny.

April 7

-

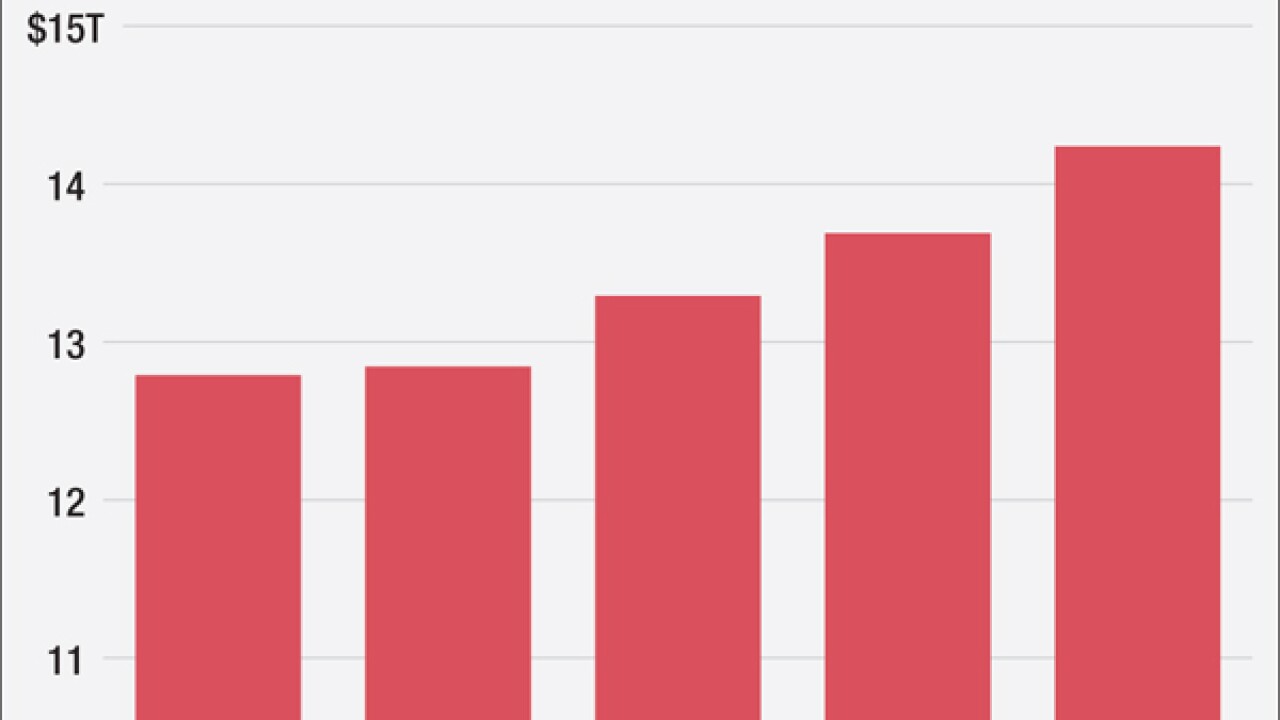

Democratic presidential hopeful Hillary Clinton has made reining in the shadow banking system a focal point of her campaign platform, but there are fears that doing so could come with a high price tag for the U.S. economy.

April 6 -

If you're ever wondered about the scope of risks facing your financial institution from "insiders" potentially involved in shell company dealings, the Panama Papers provide some insight.

April 6

-

Wealth management units have been a surefire source of fees for banks over the last few years, as low rates dragged down spread income. But a policy change will likely be a crucial test to the business model.

April 6 -

The agency plans to reduce the period of heightened regulatory scrutiny to which de novo institutions are subjected to three years, down from the seven-year period established in the wake of the financial crisis.

April 6 -

Banking industry representatives immediately raised significant questions about Donald Trump's plan to block remittances to Mexico, including the appropriateness of using financial institutions as a tool to carry out immigration policy, as well as how the policy would be executed.

April 6