-

The former chief marketing officer of the failed Mirae Bank in Los Angeles was arrested following an eight-count indictment stemming from alleged loan fraud.

January 15 -

WASHINGTON The public portions of resolution plans submitted by three systemically important nonbanks and certain midsize banks were published Friday by the Federal Deposit Insurance Corp. and Federal Reserve Board.

January 15 -

Drafting internal honor codes, and having employees pledge to follow them, could be a good first step to reversing negative opinions about banking.

January 15

-

Goldman Sachs Group Inc. said it agreed to settle a U.S. probe into its handling of mortgage-backed securities for about $5.1 billion, cutting fourth-quarter profit by about $1.5 billion and closing out a year of record legal and litigation costs.

January 15 -

Several Republican presidential candidates called for a rollback of regulations on Thursday, saying that over-regulation is choking off job growth and the economy.

January 15 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

January 15 -

An international regulatory body said this week that they are looking at setting new, enhanced leverage ratio requirements for the largest global banks, a move that echoes the higher standards in the U.S.' supplemental leverage ratio and demonstrates why going beyond international accords can influence the rest of the world.

January 14 -

Roughly 28% of Swift's correspondent bank users have signed up for the cooperative's KYC Registry, defying early skepticism about financial institutions' willingness to share information.

January 14 -

Financial services issues that helped define a presidency were largely absent from Tuesday's State of the Union address, including the crucial policy items that have not yet been resolved.

January 14

-

The Basel Committee on Banking Supervision released the text of its anticipated revised market risk framework on Thursday, one of the last and most important remaining unfinished aspects of the 2010 Basel III accords.

January 14 -

Nine former officers and directors accused of hiding problems at Superior Bank in Birmingham, Ala., will pay more than $1 million in penalties as part of settlements with the Securities and Exchange Commission.

January 13 -

Lending continues to improve overall across the Federal Reserves regional banks but the level of demand varies significantly across the country, according to the Feds most recent Beige Book released Wednesday.

January 13 -

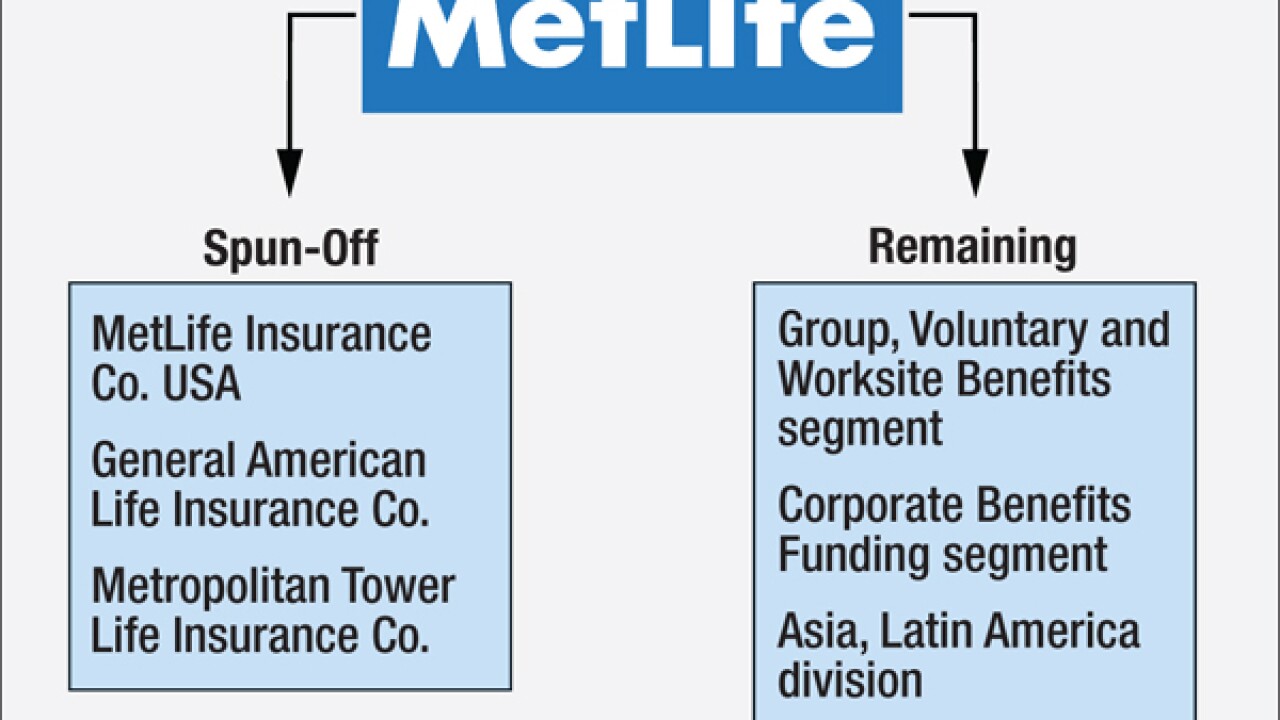

The conventional wisdom is that MetLife is breaking itself up partly as a response to its designation as a systemically important company. But there is significant evidence that's wrong here's why.

January 13 -

U.S. lawmakers called for federal investigations into Clayton Homes, the mobile-home business at Warren Buffett's Berkshire Hathaway, after the Seattle Times and BuzzFeed News wrote that the company targeted minority borrowers and charged them higher interest rates on average than whites.

January 13 -

President Obama's administration, citing concern about the origin of funds used for all-cash purchases of luxury real estate, said it is stepping up scrutiny of transactions in New York City and Miami.

January 13 -

The project is likely to be mirrored at banks around the country as the automated clearing house evolves from settling payments in three to five days currently to same-day settlement in September and faster payments beyond that.

January 13 -

The project is likely to be mirrored at banks around the country as the automated clearing house evolves from settling payments in three to five days currently to same-day settlement in September and faster payments beyond that.

January 13 -

As fintech pitches itself as the future of consumer financial services to bankers, regulators, legislative staffers and journalists, it's not enough to claim that innovations are better. We nontechies want an explanation why, in layman's terms.

January 13

-

Republican lawmakers agree with Obama that outdated regulations need to be changed, but were pessimistic that the administration would support efforts to roll back the compliance burden on banks.

January 13 -

Community bankers and credit unions scored a significant victory while others in the mortgage industry lost out in the Federal Housing Finance Agency's final rule establishing membership standards for the Home Loan banks.

January 12