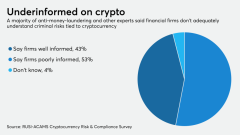

Government officials and many bankers are

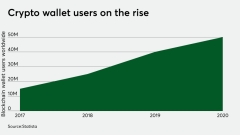

But

Here are some of the key developments in 2020 that suggest how entwined these nascent sectors are with the future of banking — including new applications for the technology, the Federal Reserve’s interest in creating a digital currency, notable moves by Visa and Mastercard, major advances with regulatory acceptance, and the milestone achievement of several crypto firms securing bank charters.