Could Ripple's XRP replace correspondent banks? This bank says yes

(Full story

LendUp spins off credit card business, names new CEO

(Full story

Regulatory competition is hot again — and that's worrisome

(Full story

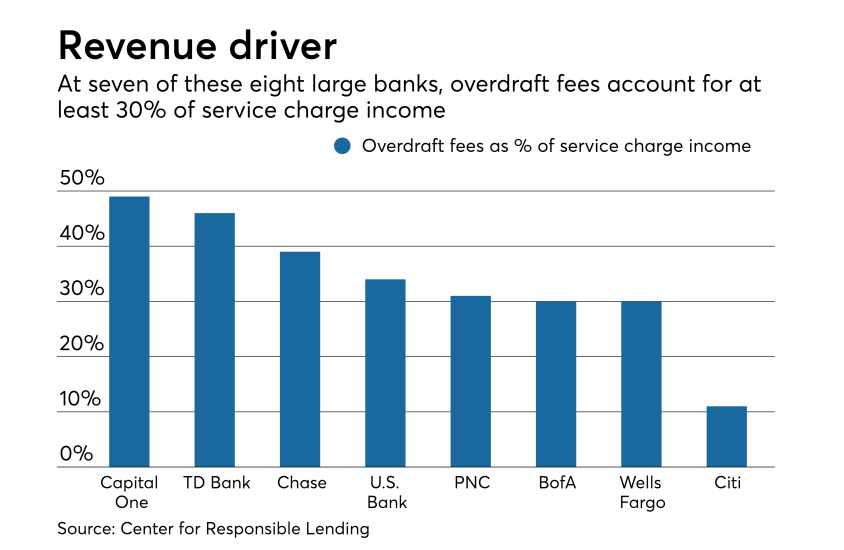

Banks shouldn't count on overdraft fees forever

(Full story

Warren: Comerica fraud shows need for security fix in prepaid program

(Full story

PenFed deal feeds bankers' fears of unlimited credit union membership

(Full story

House diversity panel a doubled-edged sword for banks

(Full story

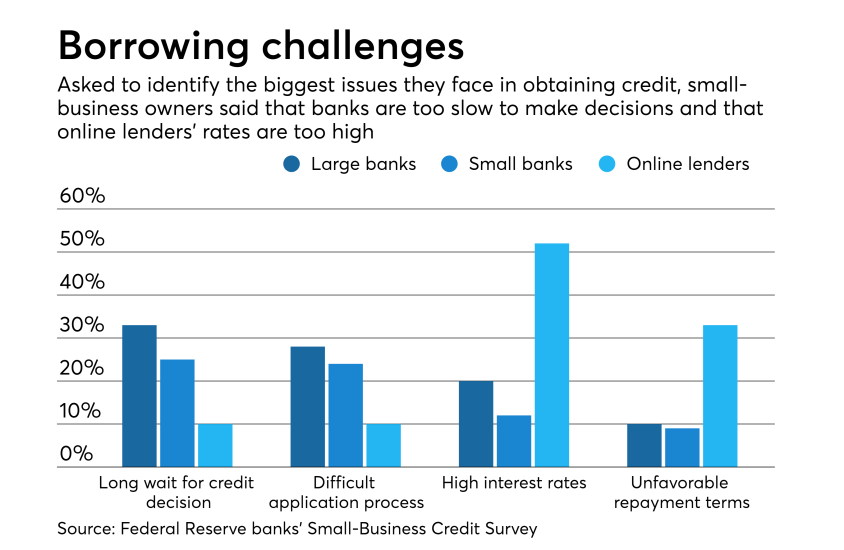

Banks have need for speed in small-business lending

(Full story

Fintechs may finally win charter chase in 2019

(Full story

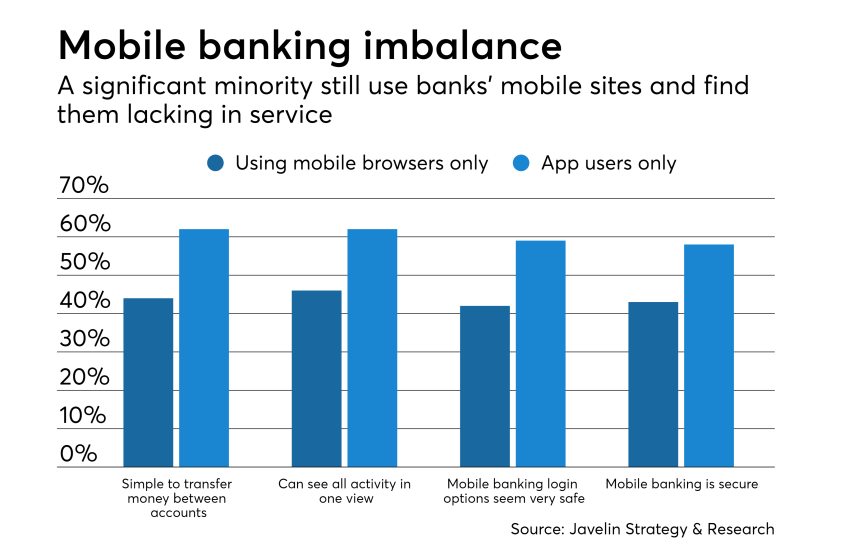

What banks are losing sight of in rush to upgrade mobile apps

(Full story