Bankers cry foul over Robinhood's checking and savings accounts

(Full story

Silicon Valley Bank recruits former Capital One exec as chief product officer

(Full story

Amazon, Google at odds with big banks over Fed's role in faster payments

(Full story

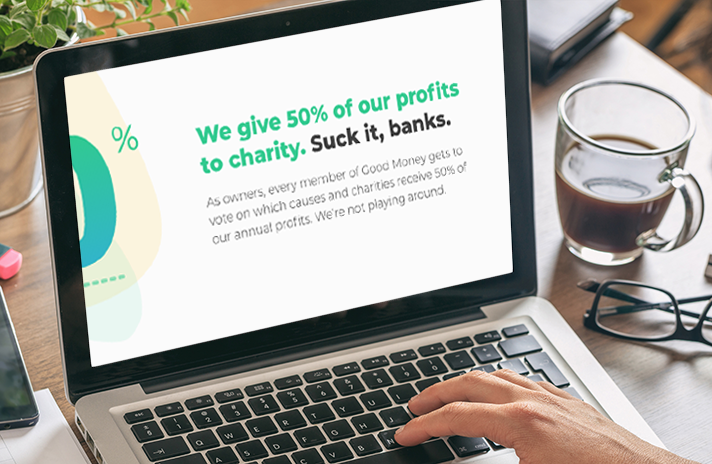

This fintech is taking anti-bank marketing to extremes. It may pay for it

(Full story

SBA's biggest lender is overhauling its business model

(Full story

Are branch deals still worthwhile?

(Full story

'BCFP' no more: Kraninger scraps plan to rebrand CFPB

(Full story

Kraninger's move to ditch CFPB name change is a savvy one

(Full story

Robinhood's checking account poses legal issues: SIPC chief

(Full story

In reg relief era, appraisers become endangered species

(Full story