Why banks are putting PPP forgiveness on the back burner

(Full story

Fee to shield Fannie, Freddie from COVID losses draws instant backlash

(Full story

What Trump's reelection would mean for banks

(Full story

Wells Fargo names new compliance chief, other risk executives

(Full story

Truist's pandemic chatbot could have staying power

(Full story

Capital One fine is latest wake-up call for banks using the cloud

(Full story

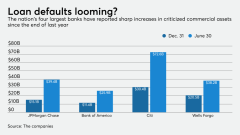

Here's the credit quality metric to keep an eye on

(Full story

Bankers don't see economy recovering anytime soon

(Full story

Diversity chiefs gain prominence as banks confront racial inequality

(Full story

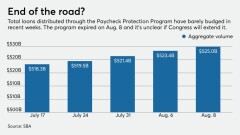

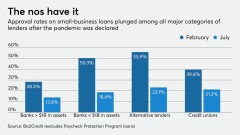

Outside of PPP, it's crickets in small-business lending

(Full story