More banks are preparing to deal with the economic fallout of the coronavirus pandemic well into the future, according to a new survey of industry executives, who cited one category of loans as a special concern: commercial real estate.

More than one in three executives said they expect to be grappling with the pandemic’s impact into 2022 or later, according to a survey of CEOs, presidents and chief financial officers from 557 banks by Promontory Interfinancial Network that’s scheduled to be issued next week. About 26% said they expect the economic fallout to linger into the back half of next year, the survey said, with another 28% anticipating a bounceback in the first half of 2021.

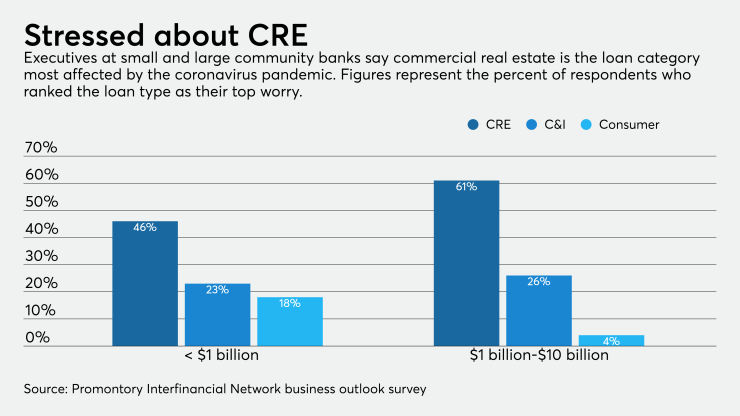

Almost half of the respondents, polled during the first two weeks of July, said CRE lending was their biggest worry.

“It confirms what everyone is hearing,” said Paul Weinstein, a senior adviser to Promontory who helped put the survey together. “When Starbucks closes 400 of its storefronts and major retailers are deciding to use bankruptcy to get out of their leases, it’s not surprising that banks would say we may have a problem in commercial real estate.”

About 9.5% of loans bundled into commercial mortgage-backed securities had been transferred into special servicing as of July because the borrower has fallen behind on payments, more than a full percentage point jump from the previous month, according to the analytics firm Trepp.

The most problematic categories are lodging and retail as travelers and shoppers have been grounded to ward off the spread of the disease. Roughly one in four hotel CMBS loans are in special servicing, according to Trepp. That number was just 2% a year earlier.

After commercial real estate, 24% of banking executives listed commercial and industrial loans as their biggest worry, followed by 16% who were most concerned about consumer loans, according to the Promontory survey.

Only about 7% of executives predicted that the economic impact from the pandemic will have run its course by this fall and winter, when health experts have warned of the possibility of a second wave of cases. All but 9% have abandoned the hope of a snapback, or “V-shaped” recovery, in the economy, with the rest expecting a protracted climb from the shutdowns.

To some the recovery could take even longer than two years, mirroring the gradual pace to pull out of the last recession caused by the 2008 financial crisis, because of the scope of the initial shock to the economy from the pandemic, said Scott Colbert, executive vice president and chief economist for Commerce Trust Co., a division of the $30.5 billion-asset Commerce Bancshares in Kansas City, Mo.

“We believe it will take a similar three-year period to simply get aggregate economic activity back to where it was at the end of 2019,” Colbert said. “That is probably a bit longer than a more consensus two to two-and-a-half-year time frame.”

Not only should banks expect to be taking credit losses into 2022, but because interest rates are lower at the start of this recession than the last one, it could take longer to recover the lost revenue, Colbert said.

“Our best guess is cumulative credit costs are likely to be less than the previous Great Recession, but net interest margin compression will be more severe,” Colbert said. “And unfortunately this will still take several years to accrue as we recover in a steady but slow pace over the next two to three years.”

That said, nine in 10 respondents to the Promontory survey reported that funding costs were below where they were a year earlier, and almost half said they've seen a "significant decrease." Sixty percent of executives expect funding costs to decrease even further in the 12 months ahead.

More than three-quarters of executives reported overall economic conditions for their bank were worse than they were 12 months prior, the survey said. That was down from 81% in the company’s survey in April.

Sixty-two percent of respondents said they expect economic conditions to worsen over the next year, according to the survey, down from 75% who shared this outlook in the first quarter. But only 17% expect the economy to improve over the next 12 months, while one in five expect the economy will bump along largely unchanged.

Meanwhile, negotiations have stalled in Congress last week over a new round of stimulus. The Trump administration is moving ahead with executive orders, but some are

The Promontory survey results indicated banks are wary of the rescue program for midsize businesses. Nearly three in four executives surveyed said they are not planning to participate in the Federal Reserve’s Main Street Lending Program, according to the survey.

The program was officially launched on July 6 as a way for the Fed to fund loans through banks to companies with up to 15,000 employees and $5 billion in revenue.

An industry official

“They may need to take a look at it to make it more appealing,” Weinstein said.