BofA, Chase, Wells Fargo pilot service to rein in screen scraping

(Full story

Huntington shuttering dozens of in-store branches in Michigan

(Full story

Biden team lays groundwork to reverse Trump-era banking policies

(Full story

Fifth Third CEO 'very concerned' about fintechs

(Full story

Truist spending $1.8 billion on tech, customer service upgrades

(Full story

Deposit glut ties Regions' hands

(Full story

What will incoming CFPB chief do with $570 million consumer aid fund?

(Full story

What will drive bank M&A in 2021

(Full story

KeyCorp set to roll out digital bank for doctors

(Full story

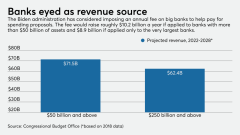

Will Biden, Democrats renew push to tax big banks?

(Full story