The Federal Reserve recently

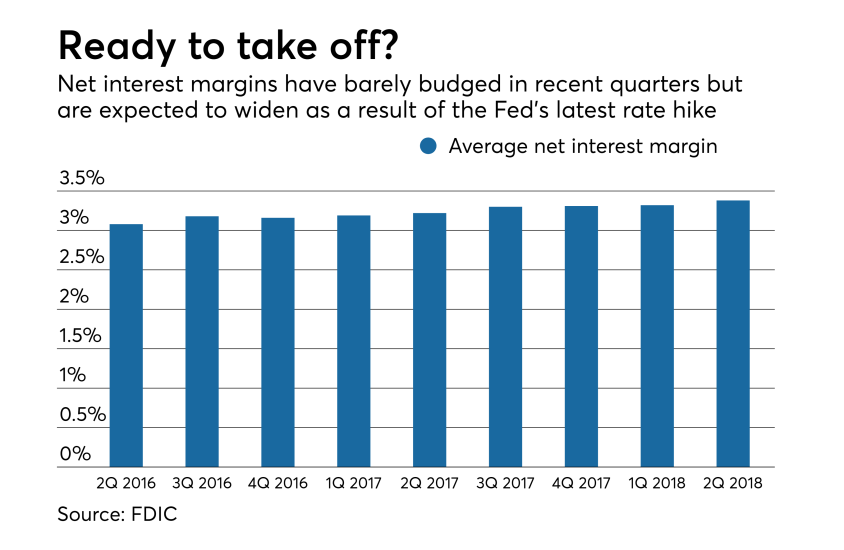

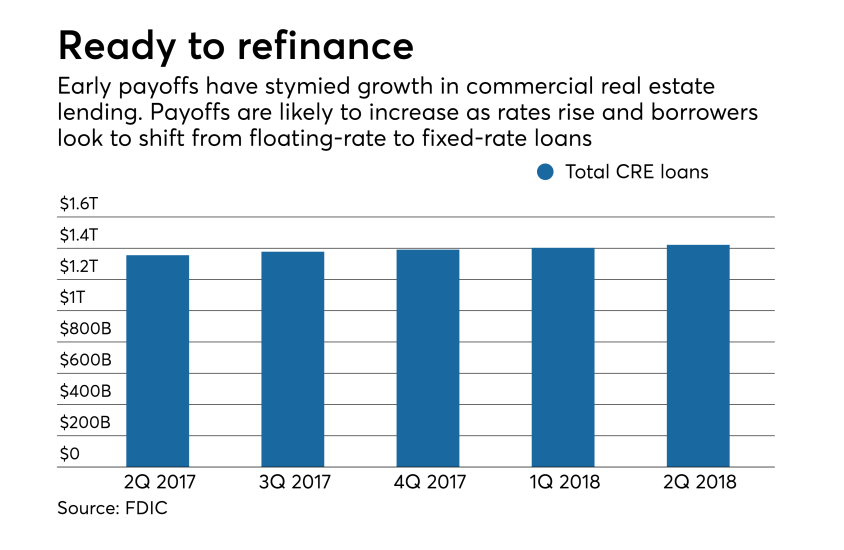

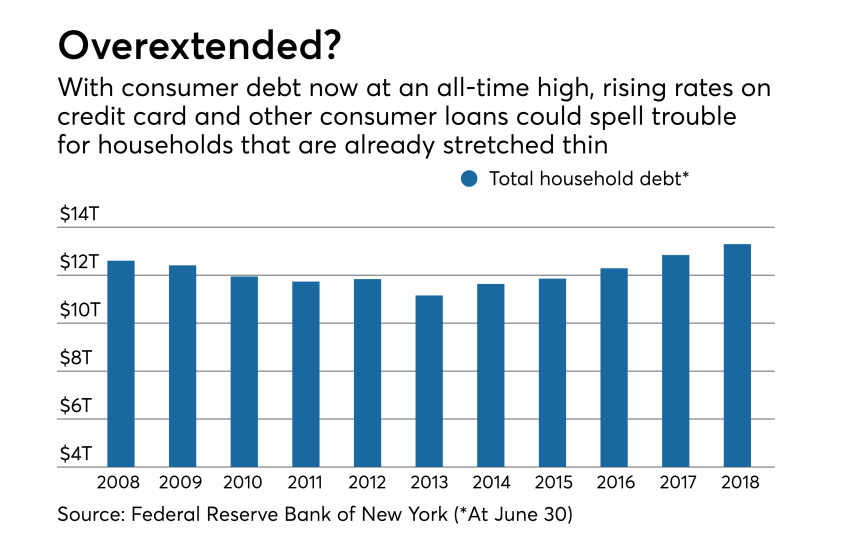

On the plus side, higher rates typically mean improved yields on loans. Commercial and consumer loans should both benefit from higher interest rates, though the timing of the impact could be delayed, depending on specific floating-rate loans’ repricing schedules.

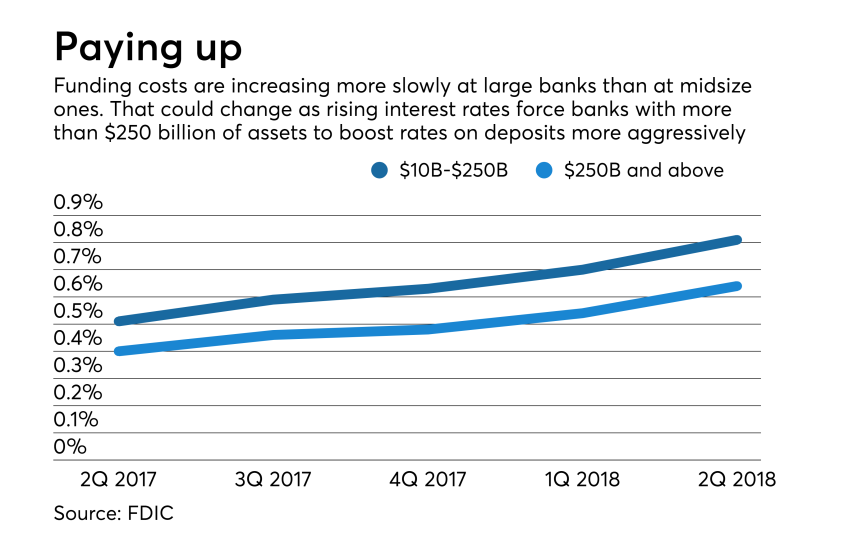

On the negative side, higher rates put added pressure to pay more to depositors on money markets, certificates of deposit and savings accounts, potentially squeezing net interest margins. Rising rates also tend to dampen mortgage-refinance volumes.

Then there are the unknowns, such as the impact a rising rate environment could have on mergers and acquisitions. Here’s a look at how rising rates could affect banks’ decision-making, and bottom lines.