With competition for deposits heating up, many small and medium-sized banks are turning to technology to give them an edge.

First Arkansas & Trust, for example, is using Plinqit, a goal-oriented savings app from a fintech called HTMA Holdings, in the hopes of boosting deposits.

“Obviously, keeping deposits local allows us to loan to small businesses in the area,” said Roger Sundermeier, the chief brand officer at $761 million-asset First Arkansas in Jacksonville. “And that helps to keep our local communities thriving and moving forward."

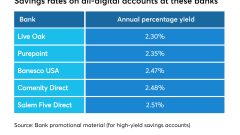

Banks also are using the lure of high-yield savings accounts to entice consumers to look outside their primary banks for services. And some banks have begun to specialize in the banking-as-a-service model to increase deposits.

Following is a look at how regional and community banks are employing tech to help in the race for deposit growth: