As the biggest banks have gone to great lengths to capture young customers, including sometimes creating separate, digital-only brands, small banks without the same advertising and product development firepower have often struggled to reach the next wave of consumers.

Kathleen Craig, founder and chief executive of HTMA Holdings, is trying to change that. Her firm has developed Plinqit, a goal-oriented savings app meant to get millennials and Generation Z excited about saving while helping them connect with community banks.

What distinguishes Plinqit from similar popular apps such as Digit and Qapital is that HTMA and partner banks reward users in small amounts for reaching preset savings goals, or for viewing media associated with financial literacy. Sparta, Mich.-based ChoiceOne Bank, with $666.7 million of assets, and $761 million-asset First Arkansas Bank & Trust, based in Jacksonville, are the first two banks to offer the app to existing and potential customers.

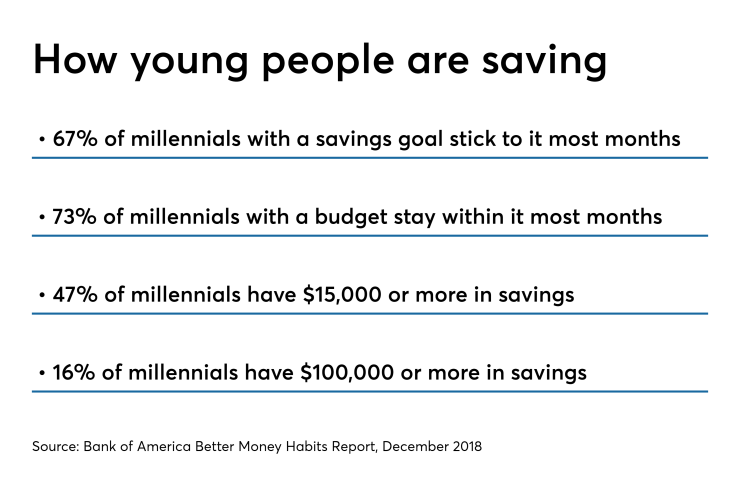

HTMA developed Plinqit after it received a grant from the Michigan government to study millennials’ financial behavior and attempt to find a reason why the demographic hesitates to bank with smaller institutions. Craig and her team found that millennials are “mission driven,” much in the same way as community banks and credit unions. The problem, she said, is those consumers are unaware of the potentials benefits of doing business with smaller institutions.

“We wanted to find a way to bridge the gap and we thought a really great first way to do that would be in savings,” Craig said.

Plinqit is meant to work best in partnership with a financial institution though any consumer is free to use it without that incentive. Users link their primary checking account to Plinqit and can set various savings goals within the app. Those deposits, exceeding $300,000 total to date, are held at ChoiceOne and First Arkansas. (ChoiceOne holds the deposits for national Plinqit users.)

Craig said the average goal is $1,100 and is reached in 12 months. HTMA brings in revenue from Plinqit through one-time bank set up fees, as well as a base platform fee and per account fees.

“For most people, that goal is either a vacation or something fun,” she said. “It also serves as that basic emergency fund, which is how we originally positioned this.”

Plinqit is free to use, but users can penalize themselves with a “break the safe” option. Craig said it’s a way to keep users honest about their savings intentions. A user pays the penalty only if they withdraw funds before their selected end date for a goal. Craig said most users set the penalty between $3.50 and $5.

“We’ve had zero complaints about the penalty,” she said.

HTMA rewards users in small amounts such as five and 10 cents for reaching goals and viewing content. Craig claims Plinqit sees over 50% engagement in its financial literacy content. Bank partners are free to add their own content as well, and those institutions also will reward users in the same as HTMA.

The banks associated with Plinqit market the app in slightly different ways. ChoiceOne offers Plinqit to new customers, but also uses it to incentivize existing ones to save “in an easy and fun way,” said Adom Greenland, the bank’s chief operating officer.

“The demand from our customers was, ‘Help me save, make it easy for me to save so I can set it and forget it,’ ” Greenland said.

Greenland views Plinqit as a modern day version of the Christmas Club, a program it eliminated years ago, which attracts customers from various demographics.

“One of the passions of ChoiceOne Bank is to help people save,” he said. “This allows us to have an answer to those digital savings apps that are more national.”

For First Arkansas, Plinqit is a way to introduce military personnel stationed at nearby Little Rock Air Force Base to the institution’s products. Roger Sundermeier, the chief brand officer at First Arkansas, said that while those service members likely have primary checking accounts with USAA and Bank of America, it doesn’t hurt to establish a local connection with potential customers.

“This is something used as an entry point or a welcome mat to our institution and get them interested in us and allows us an opportunity to cross-sell them as they become more familiar with our brand,” he said.

Once a Plinqit user becomes more familiar with the bank, First Arkansas will push a conversation into other products.

“Once we develop that initial relationship, they’re a little more receptive to communication around other products,” Sundermeier said.

Both Greenland and Sundermeier were blunt about their institutions’ inability to create a product such as Plinqit. Neither has the necessary personnel on staff to research and develop a new app. And both cited a lack of funds to properly launch this kind of offering.

Greenland took it a step further and pointed to the creativity needed to take a mundane task such as savings and make it an enjoyable interactive experience.

“Kathleen is a banker, but her team is not,” he said. “They are bringing in creativity, energy and new ideas. They are trying something new and those are things we would struggle with as a small bank.”