House lawmakers go light on BB&T-SunTrust merger

(Full story

Santander Bank names longtime MUFG Union executive its CEO

(Full story

The fintechs trying to solve America's retirement problem

(Full story

What the big banks left out when they slammed Fed over real-time payments

(Full story

CFPB ending special treatment for Fannie, Freddie in mortgage rule

(Full story

Democrats try to force Fed's hand on faster payments

(Full story

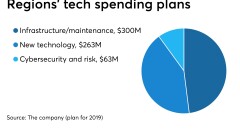

Regions' big investment in digital is paying off

(Full story

A regional bank chief's case for the long view

(Full story

Inside BB&T-SunTrust's community reinvestment plan

(Full story

Regional banks use hedging tactics to combat rate cuts

(Full story