Hard sell ahead for BB&T-SunTrust as 'Truist' lands with a thud

(Full story

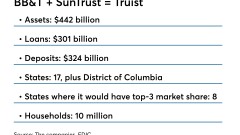

BB&T-SunTrust unveil postmerger name that nods to legacies

(Full story

Citizens looks to poach BB&T-SunTrust talent, but should expect a fight

(Full story

First Tennessee, Capital Bank to be rebranded as First Horizon

(Full story

Capital One, Discover prepping for next downturn

(Full story

Credit union shopping spree funded by taxpayers

(Full story

Cheat sheet: What Senate AML bill means for financial industry

(Full story

Legalizing pot may be only way to lift cloud over pot banking

(Full story

Credit union courts nonmember deposits (and trouble with banks)

(Full story

Why U.S. consumers are less willing to embrace fintechs

(Full story