Women executives headlined a number of key moves in the banking industry as summer wound down.

Wells Fargo hired veteran bank executive Colleen Taylor, formerly of Mastercard, to oversee its merchant services strategy. Taylor was named one of PaymentsSource’s

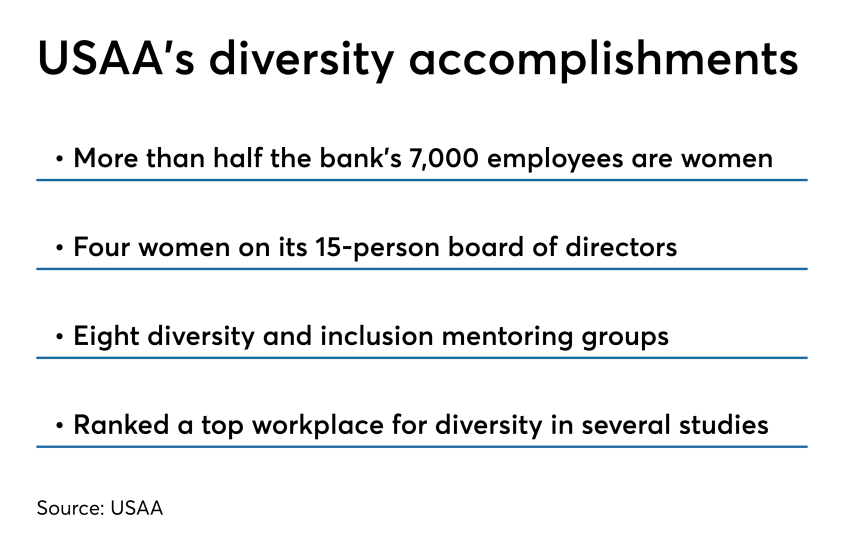

USAA announced three women tech executive hires: Maria Alvarez Mann as its chief information officer for bank technology, Judith Frey as vice president of digital banking, and Carri Arnold as bank technology officer.

Melinda McClure joined Old Dominion National Bank in Tysons Corner, Va., as its chief strategy officer, and in August former Federal Deposit Insurance Corp. Chair Sheila Bair was named to Fannie Mae's board of directors.

Retiring from banking was Karen Simon, one of JPMorgan Chase's most senior women executives. Simon, 60, had spent 36 years with the bank.

Following is a look at these and other recent industry moves: