Wells Fargo consumer chief may testify of 'fear' her predecessor inspired

(Full story

When customers contact Wells Fargo, AI system goes to work

(Full story

Why Amex is buying Kabbage

(Full story

Fannie, Freddie refi fee will wipe out millions in mortgage profits

(Full story

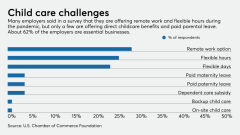

Banks ramp up child care, home-schooling support for working parents

(Full story

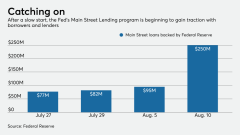

Small banks are dominating the Fed's Main Street Lending Program

(Full story

Congress, not the OCC, decides what is and isn't a bank

(Full story

Is Texas commissioner sending message with de novo rejection?

(Full story

California's 'mini-CFPB' plan is back in play. Banks aren't happy.

(Full story

MUFG Union Bank hires chief information security officer

(Full story