-

Apple and Affirm's PayBright are planning to launch a buy now/pay later program for Apple device purchases in Canada, stepping up the iPhone maker’s ambitions to offer more financial services.

August 4 -

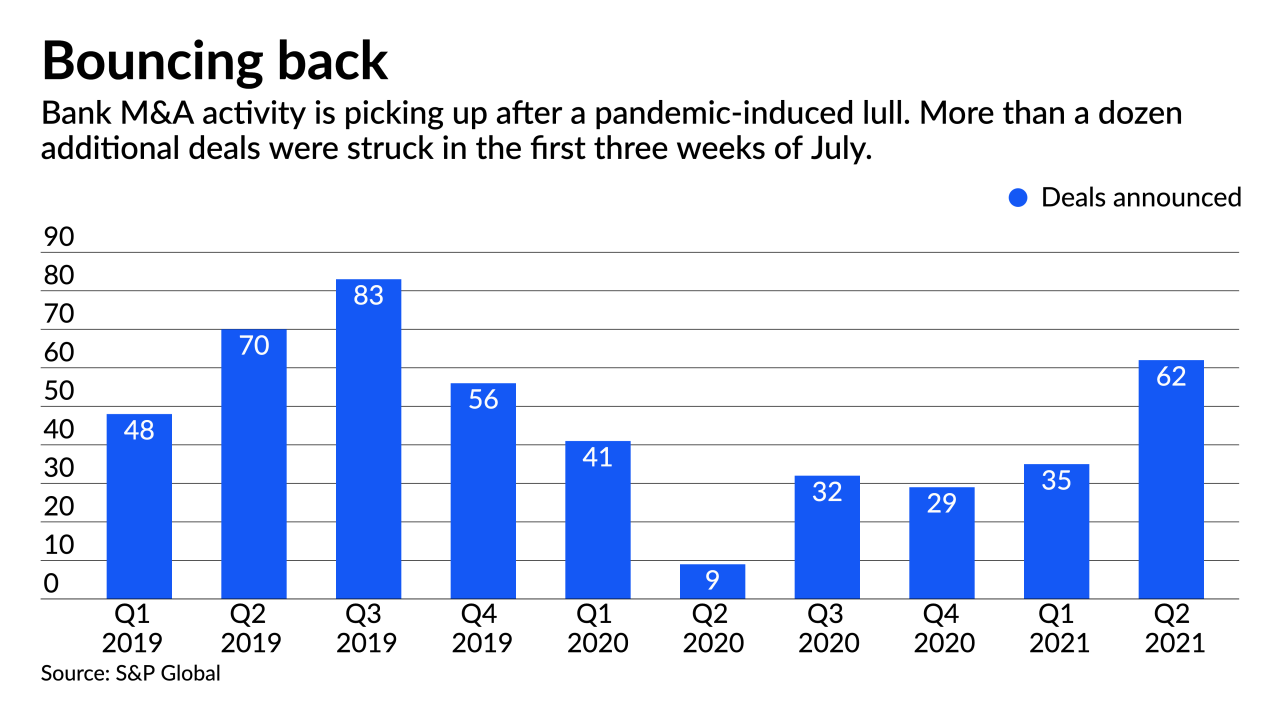

“You need scale to keep up with necessary technology spend and regulatory costs,” CEO James Hillebrand said in explaining why the bank agreed to buy Commonwealth Bank & Trust just three months after it bought Kentucky Bancshares.

August 3 -

Stored-value cards are growing in popularity with underbanked gig workers who need an easier way to get paid as well as with younger consumers in Canada who have traditional bank accounts but prefer the cards for e-commerce transactions.

August 3 -

First Hawaiian and Bank of Hawaii are warning that a global spike in coronavirus cases could stunt the state's momentum and threaten credit quality.

August 2 -

The $29 billion deal would enable Square to better compete with PayPal and Apple, and provide an opportunity to cross-sell other services to the Australian lender's global audience.

August 2 -

Mutual banks tend to combine only with fellow mutuals. Spencer Savings' deal to acquire a stock-traded rival shows how the pressure to expand is forcing some buyers to get creative.

July 30 -

Two upstate New York credit unions are combining to create an $8 billion-asset institution, continuing a trend of bigger deals driven by a need to match the scale and technological capability of rival banks.

July 29 -

The high cost of living in the state's bigger markets is limiting growth and turning off buyers. CVB Financial and TriCo Bancshares found sellers in the more affordable cities of Visalia and Bakersfield.

July 28 -

The Rhode Island bank is doubling down on the nation’s largest market after agreeing in May to buy dozens of branches from HSBC. Meanwhile, Investors Bancorp’s decision to sell itself underlines the challenges facing smaller regionals.

July 28 -

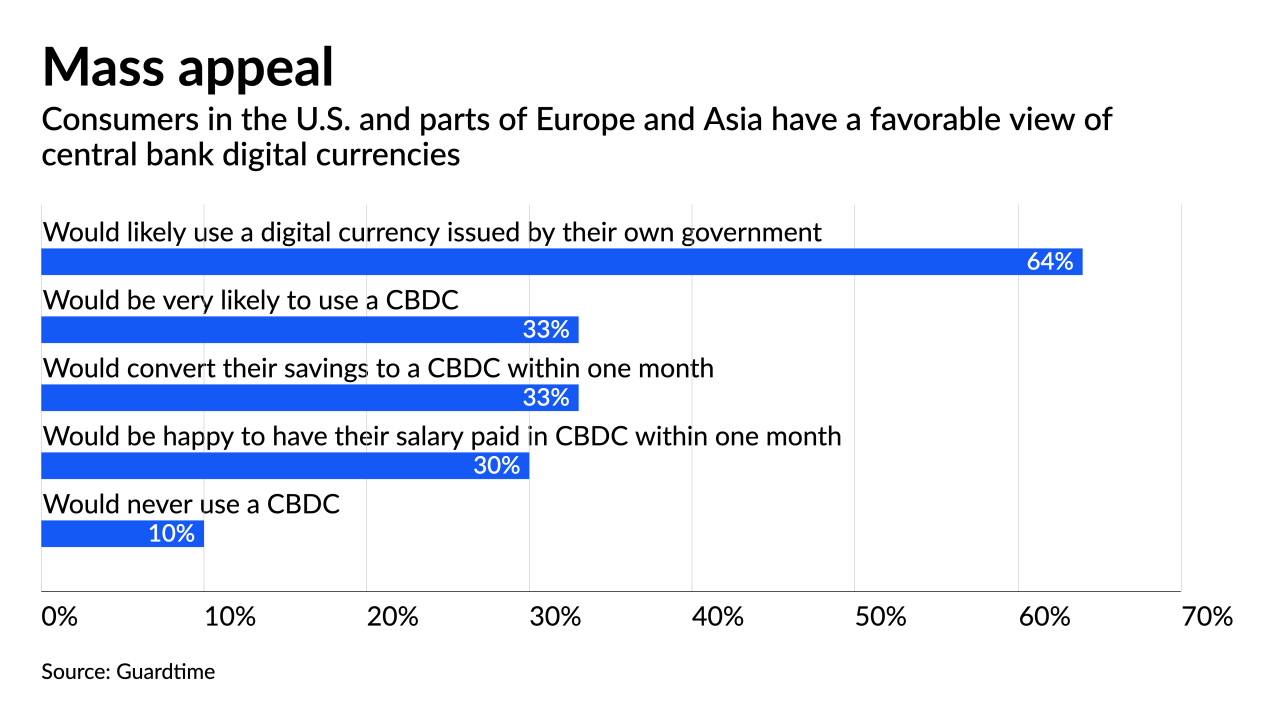

Western central banks trying to develop sovereign cryptocurrency models face pushback from lawmakers and other obstacles, while the digital yuan has a much clearer path.

July 27 -

The Aurora, Illinois-based buyer said it would pay $297 million to acquire West Suburban Bancorp in Lombard, Illinois.

July 26 -

The company has long focused on customers with ties to the two states. But as it emerges from the pandemic seeking new lending opportunities, CEO Rajinder Singh says, “We are looking at markets from Boston all the way down to Atlanta.”

July 22 -

While pandemic restrictions cloud the sector's outlook, the London-based payment and fintech company is making hotel booking and other services part of its financial super app strategy.

July 22 -

The European Union has updated value-added-tax regulations that predate digital payments, hoping to reduce compliance burdens for foreign online sellers and simplify consumer billing.

July 19 -

The Reserve Bank of India says the card brand failed to comply with a requirement to store transaction details locally. The handling of payment information has become a point of contention between the Asian nation and American firms.

July 15 -

Novus, a startup whose app helps consumers make environmentally conscious purchases, is using application programming interfaces provided by the two companies to expand quickly. The effort shows how open banking can extend the reach of small companies and create new business lines for larger ones.

July 12 -

Lakeland is paying $244 million for 1st Constitution Bancorp. The combined bank would be the fifth largest by deposit market share in New Jersey.

July 12 -

The national debit network Interac is working with Payments Canada, which oversees the country's payment system, on an instant payment rail while demand from local shoppers and a need for faster supply chain finance grow more pronounced.

July 9 -

The San Francisco data aggregator, which also operates out of London, provides international connections between fintechs and traditional banks.

July 8 -

Sam Susser, who built a family business of more than 630 convenience stores in the state, thinks he can find similar success in community banking by courting small commercial clients that larger rivals have outgrown.

July 7