Citizens Financial Group’s first bank acquisition since going public — a deal for a lender with a large footprint in commercial real estate — represents a bid to build a bigger foothold in New York.

Citizens had just 0.04% of deposits in the New York metropolitan area as of June 2020, but it would have a substantially larger share in the region once it closes the $3.5 billion deal for New Jersey-based Investors Bancorp, as well as its previously announced acquisition of 80 branches from HSBC.

“Investors made a lot of sense in combination with HSBC,” Citizens Chairman and CEO Bruce Van Saun said Wednesday in a phone interview. “It’s also in a very densely populated area, and it’s very good for the visibility of our brand and the business we’re trying to get done in the Tri-state region.”

The acquisition, which still needs regulatory approval, would add $27 billion of assets, $20 billion in deposits and 154 branches across New York City, Philadelphia and New Jersey.

“We view this transaction as sizable, but not a game-changer in terms of size,” Scott Siefers, a managing director at Piper Sandler, wrote in a note to investors. Siefers, who noted that Piper Sandler was a financial advisor on the deal, said the transaction is significant for the scale it offers Citizens in key markets, as well as the 30% in cost savings Citizens expects to achieve.

Short Hills, New Jersey-based Investors is the third small regional bank in the Northeast that has agreed to sell itself in recent months, following

Allen Tischler, a senior vice president at Moody’s Investors Service, said regional banks like Investors are being squeezed by low interest rates, anemic loan growth and an increasing need to invest in technology, all of which have combined to prompt several institutions to sell over the past year. Tischler doesn’t see things changing any time soon.

“The main drivers of consolidation look locked in place for the next year or so,” Tischler said Wednesday.

“If you think about the profitability pressures, obviously protracted low rates are a challenge because they squeeze net interest income,” Tischler said. “Then, you have pretty minimal loan growth. We don’t see that accelerating significantly. One of the reasons is the huge amount of cash U.S. corporates and households have been sitting on.”

Investors was reported to have hired an investment bank to explore a possible sale back in 2018, but no deal materialized at that time. There were apparent concerns about the bank’s relatively high concentration in multifamily and other commercial real estate loans, which together amounted to 60% of its total loan portfolio at the end of 2018.

More recently, Investors has placed a greater emphasis on commercial and industrial loans, growing its portfolio in that category grow from $2.4 billion at Dec. 31, 2018 to $3.8 billion on June 30, but its CRE concentration has seen only a slight decline to date.

Citizens expects to accelerate that turn away from CRE, including multifamily, but to do so gradually and without major divestitures, Van Saun said on a conference call with analysts.

“I think over time you’ll see commercial real estate become a smaller element of the balance sheet as we grow consumer lending and also expand in the commercial side of the house,” Van Saun said.

“Investors has been on that journey. They’ve been migrating away from commercial real estate and growing C&I. I think we can help accelerate that.”

Citizens will also push for more noninterest and “lower-cost relationship” deposits to reduce the overall cost of funding, Chief Financial Officer John Woods said on the conference call.

Investors has around 5,000 commercial customers, and they skew toward smaller businesses, a segment Van Saun would like to introduce to some of the capital markets capabilities that Citizens has spent years building.

Since it spun off from the Royal Bank of Scotland in 2015, Citizens has acquired a number of non-bank firms in fee-generating businesses, including

The pending HSBC deal, meanwhile, figures to add around $9 billion in low-cost retail deposits, plus 80 East Coast branches.

Earlier this month, the Biden Administration

At roughly $220 billion, the pro forma Citizens is still too small to attract the added attention President Biden envisions, Van Saun said.

"That's not top of mind in terms of creating the kind of concentration in the banking industry that should be the focus," he said.

Citizens expects to have around 200 branches in the New York region if the deals get approved. The $185 billion-asset company could prune some of those branches over time, but Van Saun said the main priority will be achieving “a similar look and feel” to Citizens’ existing branches.

While Citizens could reduce employees in some administrative areas, Van Saun said he expects to keep all of Investors’ customer-facing workers. “If we see talent that we can redeploy to other parts of Citizens, we’d certainly be open to that,” he said.

Investors’ history stretches back to 1926, when business owners in the Short Hills-Millburn area founded the Washington Rock Building and Loan Association of Millburn. The name was changed to Investors Savings and Loan Association of Millburn in 1942, to Investors Savings Bank in 1992 and finally to Investors Bank in 2011.

For its first 79 years, Investors operated as a depositor-owned mutual institution. It conducted a first-step conversion, selling a minority stake to investors in 2005, followed six years later by a second-step transaction that resulted in full stock ownership.

Kevin Cummings, who had served as chief operating officer since 2003, was appointed CEO in January 2008, then chairman of the board in April 2018. He was not made available for comment Wednesday.

Throughout Cummings tenure, Investors’ credit quality metrics have consistently outperformed industry averages. Since 2014, the company’s ratio of net chargeoffs to total loans has remained below 0.10%, including during the first six months of 2021, when net chargeoffs of $2.4 million amounted to a scant 0.01% of loans.

While Investors has been solidly profitable over the past decade, it has faced some strategic and operational headwinds.

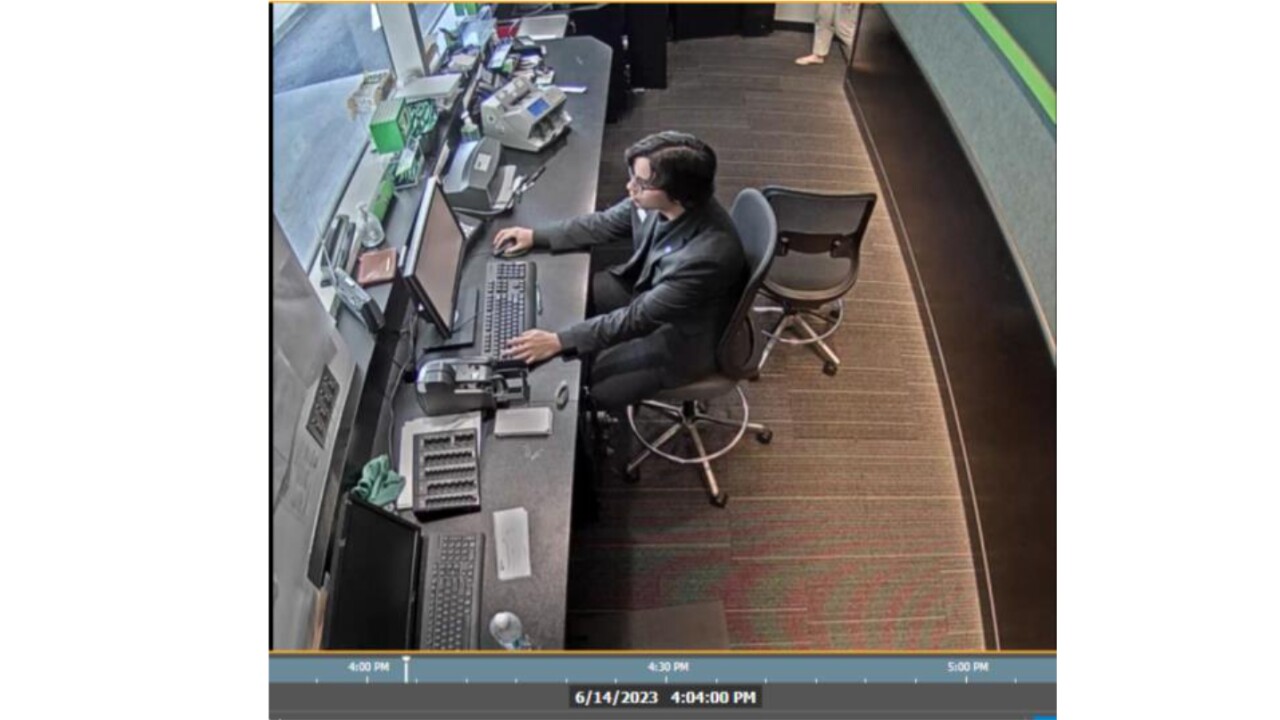

In August 2016, it entered into an informal agreement with the Federal Deposit Insurance Corp. and state regulators tied to anti-money laundering issues that took more than two years

Correction: An earlier version of this story and an accompanying chart erroneously stated that Citizens would have 6.23% of deposits in the New York metro area, the fifth largest share in the region, if the acquisitions of Investors and 80 HSBC branches are approved. Though precise data is not available, Citizens' deposit share in the region would be smaller than 6.23%. The bank has said that it would be a top-10 New York City metro bank by deposits, including branches under $5 billion.