-

The measure, which has been compared to the EU’s new consumer privacy rules, grants Californians new rights over how companies collect and use their personal data.

June 29 -

Banc of California in Santa Ana will cut roughly 9% of its workforce as it looks to trim $15 million in expenses.

June 29 -

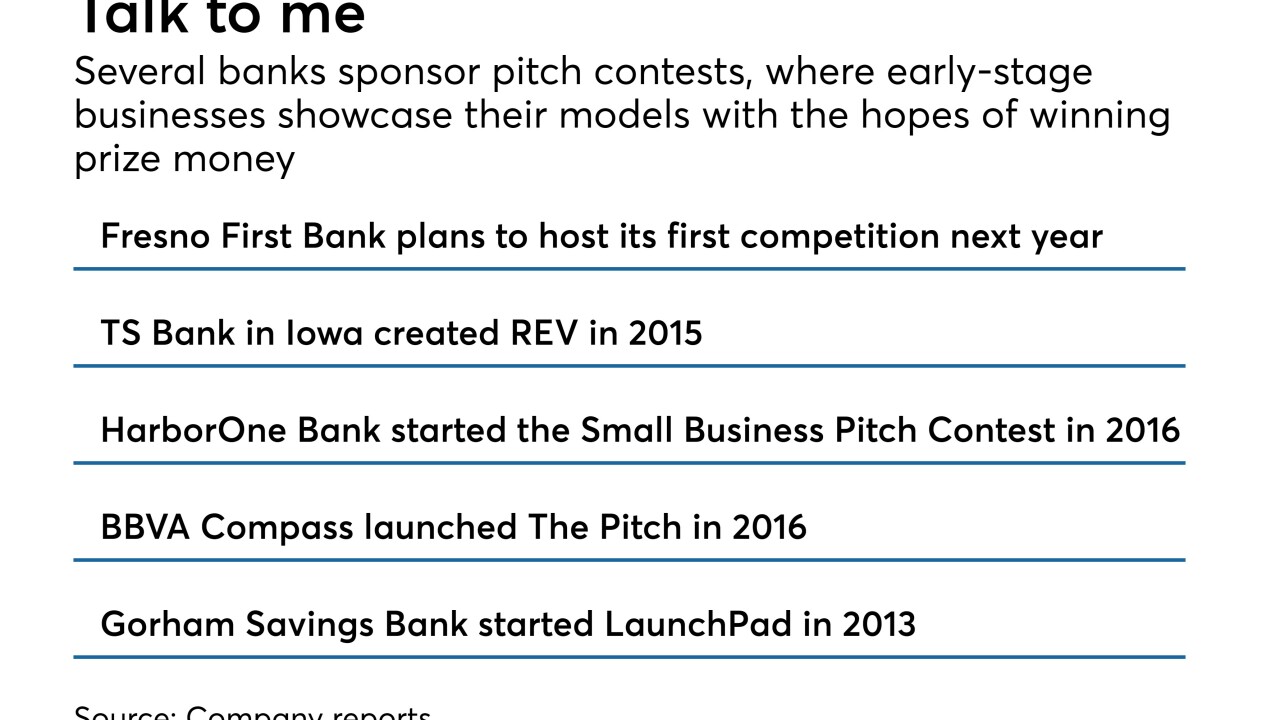

Sponsoring so-called pitch competitions helps lenders gain Community Reinvestment Act credit and gather deposits.

June 28 -

Former chief operations officer Anne McClure spent nearly two months as interim CEO.

June 28 -

Under a consent order with Texas and seven other states, the Atlanta-based credit reporting firm agreed to shore up its information security efforts, but it will not have to pay any financial penalties.

June 27 -

A number of banks are upgrading technology and hiring more lenders to better reach small-business owners, who are becoming more confident in their outlooks.

June 27 -

A ballot initiative that taps into the public's anger about online data abuses has qualified for the November ballot. But lawmakers are considering whether to head off the statewide vote by passing a measure that may be more amenable to the financial industry.

June 26 -

The trend may be partly attributable to a strong economy. Growth in high-cost installment lending could also be a factor.

June 22 -

C.G. Kum, who has been the Los Angeles company's CEO the past five years, plans to retire in May.

June 15 -

A bill moving through the California Legislature seeks to tame the largely unregulated world of online small-business lending. If passed, it would be the first of its kind nationally, but so far it has failed to satisfy either the industry or its critics.

June 12 -

Umpqua Bank has hired veteran lender Tom Farrell to help it grow its homebuilder finance group in California.

June 5 -

The advisory vote came two weeks after Preferred Bank in Los Angeles disclosed a major loan default.

June 5 -

A lack of talent, capital and good business planning proved fatal for bank organizers in California and Georgia.

June 1 -

California lawmakers have voted to authorize the establishment of state-chartered banks for the limited purpose of serving the marijuana industry.

June 1 -

Blue Gate Bank, which opened in January 2017, is being sold to Big Poppy Holdings.

May 30 -

Heading into its sixth year, the XDI Chili Challenge isn't just about cooking up some spicy stew: it can also be a great way to develop rapport with employees and members alike.

May 23 -

A first-in-the-nation ballot initiative would give consumers more control over their personal information, but banks and other companies say that it would amount to a tax on doing business in the Golden State.

May 22 -

The Asian-American bank agreed to buy SWNB Bancorp for $77 million.

May 22 -

The San Diego-based credit union’s member base increases 10.5 percent in the first quarter, with total assets up to $8.4 billion.

May 11 -

The California-based credit union says membership saw ‘solid’ growth in the first quarter of 2018.

May 10