-

SDCCU’s member base increased by 35,000 during 2017, with total assets up to $8.3 billion.

March 2 -

The issue had forced the Los Angeles company to scuttle its deal to acquire U&I Financial in Washington state.

March 2 -

The company will also surpass $10 billion in assets when it buys Community Bank.

February 27 -

Carson Lappetito has a long history of working with firms tied to Eric Hovde, chairman and CEO of Sunwest's holding company.

February 23 -

Readers weigh in on the idea of using banks to effectively ban assault rifles, slam a pot-banking proposal, opine on social media strategies and more.

February 22 -

CU in the heart of California’s Silicon Valley will change its core system this summer.

February 22 -

Hot on the heels of the January debut of the first Amazon Go store in Seattle, the e-tailer is reportedly planning to open six more stores over the course of 2018. It's a surprising show of confidence from Amazon.

February 22 -

Provider of lending, marketing automation technology predicts more growth in 2018.

February 22 -

The effort would help the state support its burgeoning cannabis industry without interference from federal financial regulators.

February 20 The 42nd Group

The 42nd Group -

The Silicon Valley-based CU is funding development of an apartment building.

February 14 -

The company, which recently shared a three-year plan to bring in more lower-cost deposits and commercial loans, seems ready to play offense a year after the ouster of its CEO.

February 14 -

The California-based CU says its 2018 emphasis will be on member retention and expansion.

February 13 -

The California company has agreed to buy Grandpoint Capital, a business bank in Los Angeles, for $641 million.

February 12 -

Patriot National in Connecticut planned to build a regional small-business lending operation on its own — until it had a chance to buy a national platform.

February 7 -

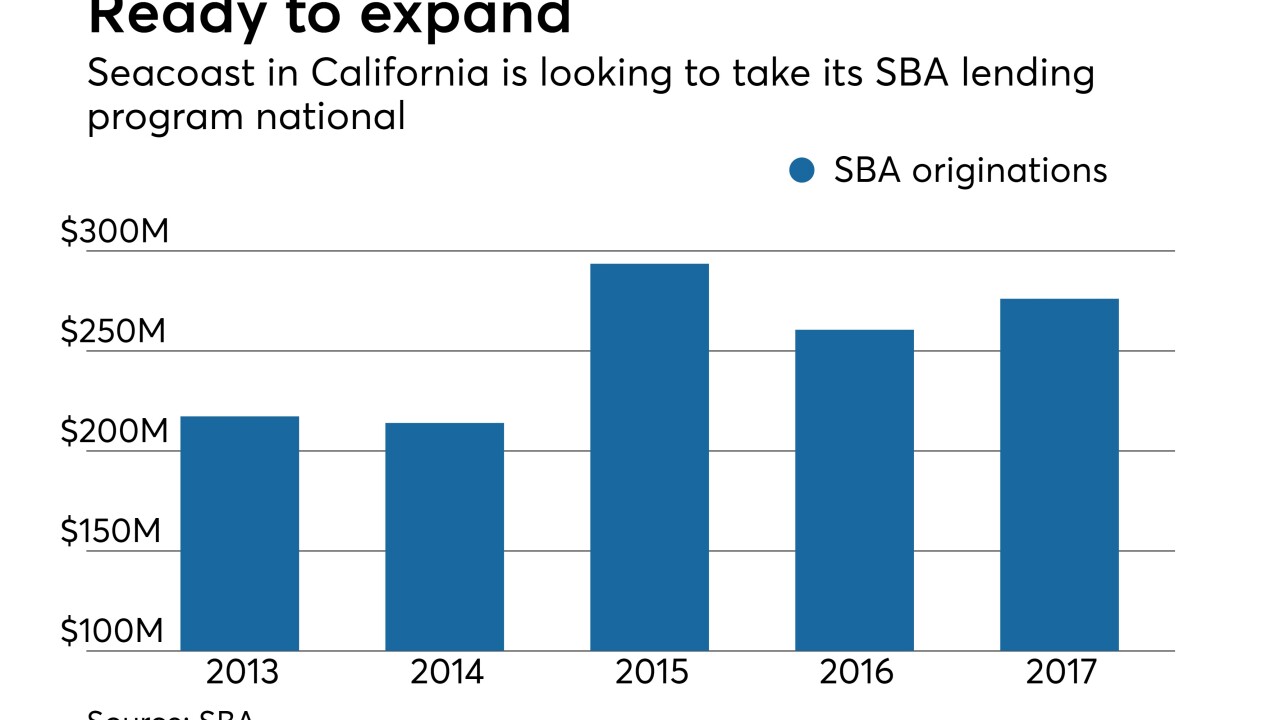

Seacoast Commerce is San Diego is already one of the biggest Small Business Administration lenders — half the loans on its books are tied to SBA programs. But will its underwriting hold up outside its traditional markets?

February 2 -

San Diego-based CU is the first new owner of the CUSO in 2018.

February 1 -

Nano Financial will offer new technology to Commerce Bank's commercial customers as it considers ways to license it to other financial institutions.

January 25 -

It's the 13th year in a row that the CUSO has been able to give money back to its CU shareholders, capping a record-setting year for indirect auto loan growth driven by the firm.

January 24 -

The client groups aim to take an active role in shaping the future of payments.

January 23 -

Attorney General Jeff Sessions did not keep the rest of Washington apprised of his plan to rescind an Obama-era memo on pot. Now Fincen and other federal banking agencies are dealing with the backlash from that decision.

January 18