-

First Hawaiian and Bank of Hawaii are warning that a global spike in coronavirus cases could stunt the state's momentum and threaten credit quality.

August 2 -

A prosperous decade leading up to the pandemic had left lenders in good shape, but they're worried the economic shock to the state's most vital industry could linger into 2022.

November 2 -

The Hawaii bank has paid employees who carpool, bike or walk to work. About a third of the workforce bought into the program before the pandemic, and it's expected to continue once life returns to normal.

October 28 -

Karl Yoneshige has been with the Honolulu-based institution since 1988, including two decades as CEO.

September 21 -

Wallace Watanabe spent more than 40 years at the Honolulu-based credit union, including serving as CEO from 1992 until his retirement in 2013.

September 4 -

Some states aren't waiting on the Federal Reserve to help with the historic hits to their budgets. Instead, they're working with a lender that they have a much longer history with: Bank of America.

April 16 -

Some of the year-over-year drop in net income can be attributed to higher-than-normal figures in 2018 and costs associated with opening three new branches in 2019.

February 7 -

All but a handful of states now allow a gamified way for consumers o save money, and some credit unions have adopted these programs to help boost deposits.

January 7 -

The Honolulu-based credit union saw a nearly 7% increase in new members, thanks in part to an expanded branch presence in West Oahu.

November 7 -

Hawaii Pacific Federal Credit Union merged into the Honolulu-based institution last week.

October 7 -

Hawaii State FCU has a dedicated branch for testing new products. It's a format that other institutions could follow.

September 16 -

Loan balances at the end of the second quarter were up by double digits from a year earlier for the Honolulu-based institution.

August 2 -

The Honolulu-based institution has doubled its loan portfolio over the past five years as its commercial lending has increased.

July 9 -

EVP Dan Terada is set to take over following the longtime CEO Neal Takase's retirement.

July 2 -

The Honolulu-based credit union said its earnings dropped by more than 37% from a year earlier.

May 2 -

The bank is expecting to benefit from the discount airline's first flights to the Aloha State even as a white-hot local housing market starts to cool.

April 22 -

About 100 financial institutions are owned by or work with Native Americans, yet traditional banking services remain out of reach for many in this demographic.

April 15 -

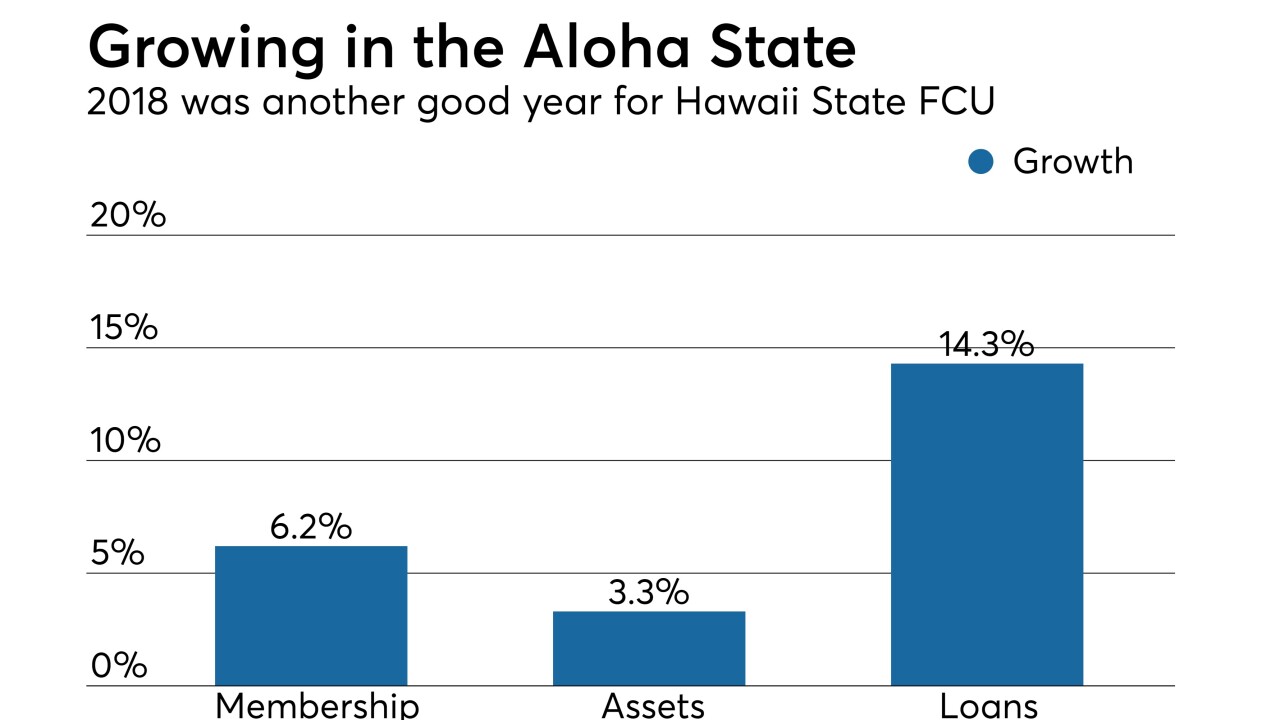

Among the 2018 highlights for the Honolulu-based credit union were a 108% rise in net income.

February 11 -

The French banking giant has spent months winding down its holdings in the $20 billion-asset bank.

January 30 -

The company, which has yet to report quarterly earnings, said the moves will turn a profit over time.

January 14