-

“You need scale to keep up with necessary technology spend and regulatory costs,” CEO James Hillebrand said in explaining why the bank agreed to buy Commonwealth Bank & Trust just three months after it bought Kentucky Bancshares.

August 3 -

Stock Yards Bancorp in Louisville says it would pay $190 million in cash and stock for Kentucky Bancshares.

January 27 -

Muhlenberg Community Hospital CU said in a notice to members it needed a merger partner in part because it did not have the resources to keep up with monitoring for "cybersecurity and terrorism activities."

November 6 -

The West Virginia company has an agreement to buy WinFirst Financial for $21.7 million in cash.

September 28 -

Mike Duncan had kept a low profile as chairman of the U.S. Postal Service’s board of governors until it hired Louis DeJoy as postmaster general. Now he is sharing an unwanted spotlight with the embattled DeJoy.

August 28 -

The Louisville, Ky.-based credit union has been open to consumers in nine counties across two states since 2004, but the new name is intended to prevent confusion about who is eligible to join.

July 17 -

The company agreed to pay $41 million for Victory Community Bank.

December 2 -

Recent closings could portend a stiffer regulatory stance on capital adequacy and risk.

November 5 -

Louisa Community Bank and Resolute Bank were closed on Friday, raising the year's total to three failures.

October 25 -

The Tennessee company will gain access to the Bowling Green, Ky., market as part of the $52 million deal.

September 18 -

First Mutual Holding is buying the tiny Blue Grass Federal and keeping its charter. The deal will allow the seller to save costs and maintain its autonomy.

August 20 -

The company will also gain deposits and loans from its deal with Republic Bancorp.

July 26 -

There have now been a record 10 credit union-bank merger deals in 2019.

July 23 -

There have been six of these transactions announced this year and more are likely as credit unions look for loan and deposit growth.

May 22 -

The Indiana company will pay $68 million for Citizens First.

February 22 -

The $128 million acquisition will provide First Financial with its first branches in Kentucky and Tennessee.

January 8 -

Stock Yards will remove a competitor in Louisville, Ky., and enter two markets outside of the city.

December 19 -

Banks were reluctant to offer services to an industry that had a hazy legal status. That’s about to change.

December 19 -

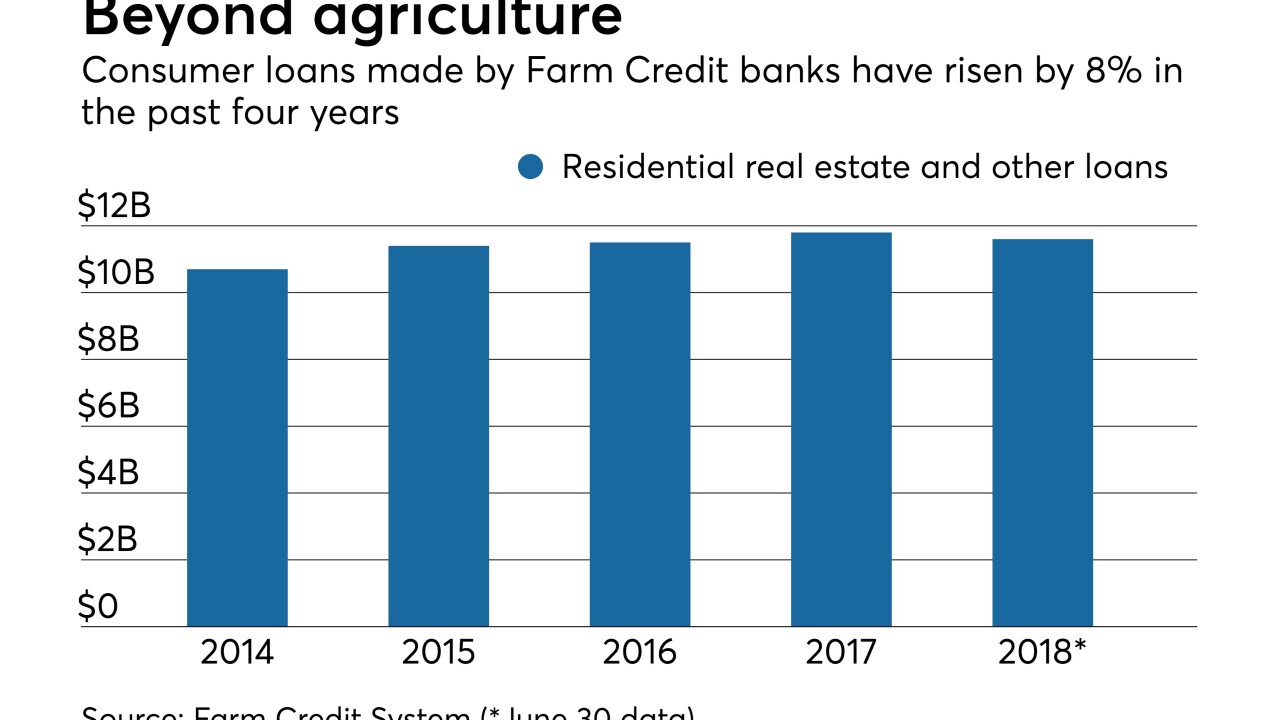

Bankers complain that the quasi-governmental system's new program designed to make more residential loans in four states goes well beyond its original mission.

October 31 -

The $45 million purchase will provide Peoples with eight branches and $244 million in deposits.

October 30