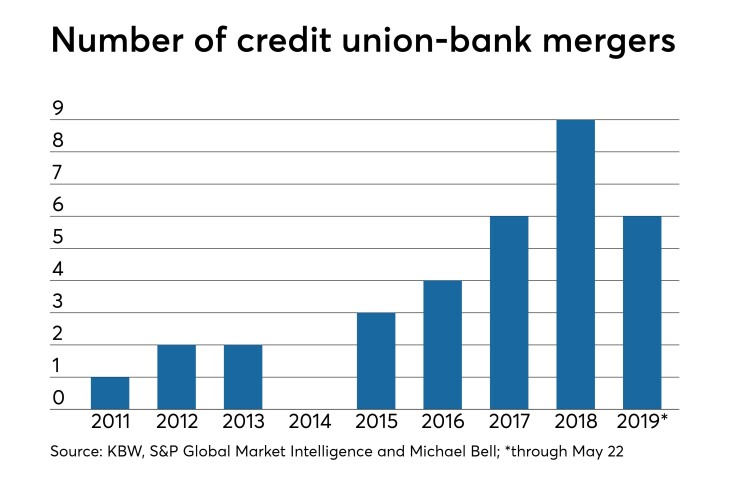

The credit union industry is currently experiencing a “magic moment” when it comes to buying banks, according to one advisor who works on these deals.

This year is on

More credit unions are acquiring a whole bank or a bank branch to generate growth in assets, loans and deposits, Michael Bell, an attorney at Howard & Howard who specializes in credit union-bank mergers, said during a conference on Tuesday.

“We will see more bank acquisitions by credit unions than ever before. Pricing is such that it’s advantageous for both buyers and sellers driving successful deal volume,” Bell said after the conference. “Additionally, critical mass has been reached and selling banks are willing to include credit union buyers on bid lists.”

Pricing has been a big factor in these deals getting done, Bell said during the CUNA Finance Council conference in New York. In the fourth quarter of 2018, the average price for all bank acquisitions was 173% of the seller’s book value. That’s down from the premium of 237% of the seller’s book value posted in 2006, according to Bell.

Because of that, pricing is low enough for credit unions to consider being buyers but high enough for some banks to contemplate being acquired.

Over the past 10 years, a range of banks have decided to sell to credit unions, including smaller and larger institutions. Earlier this month,

Credit unions are interested in these deals because they can quickly expand geographically and add new streams of revenue. Buyers could also obtain new talent, especially bank employees who have expertise in new areas for the credit union, like commercial lending or business services.

Acquisitions can go beyond buying banks. Bell pointed out that credit unions have even acquired non-depository institutions. For example, Beacon Credit Union of Wabash, Ind., bought Midwest Ag Finance, which provides agricultural loans, in 2015, and Evansville Teachers Federal Credit Union of Indiana purchased First Liberty Financial Mortgage, a Kentucky-based mortgage finance company, in 2017. Bell advised on both of those deals.

To be sure, there are still risks involved in these transactions. Even though pricing is more reasonable now, it can still be a hindrance since credit unions usually have to pay in all cash.

“How often do you go to the credit union board to approve a check for $80 million,” Bell said.

These transactions also require a lot of time and commitment from management. For example, the negotiations to reach a definitive agreement may take as long as a month of constant work.

It can take another six months after an agreement is reached to get regulatory approval and finally close the deal.

Beyond that, the selling bank could face a number of issues. For example, the seller’s privacy must be maintained due to non-disclosure agreements.

Despite these challenges, Bell predicted more of these deals would be announced this year.