-

Chief Administrative Officer Jane Verret will succeed CEO Dawn Harris, who plans to retire at the end of this year.

June 12 -

The company will gain $305 million in assets after completing the $51 million acquisition.

June 4 -

The company said the move would help it become more efficient at a time when clients are making greater use of digital channels.

May 21 -

In letting the community suggest new names, can Red River Mill Employees FCU avoid the “Boaty McBoatface” problem?

May 18 -

The company agreed to buy the parent of First National Bank of Crossett for about $13 million.

May 16 -

Dawn Harris has been with the Baton Rouge, La.-based credit union since 1983.

May 8 -

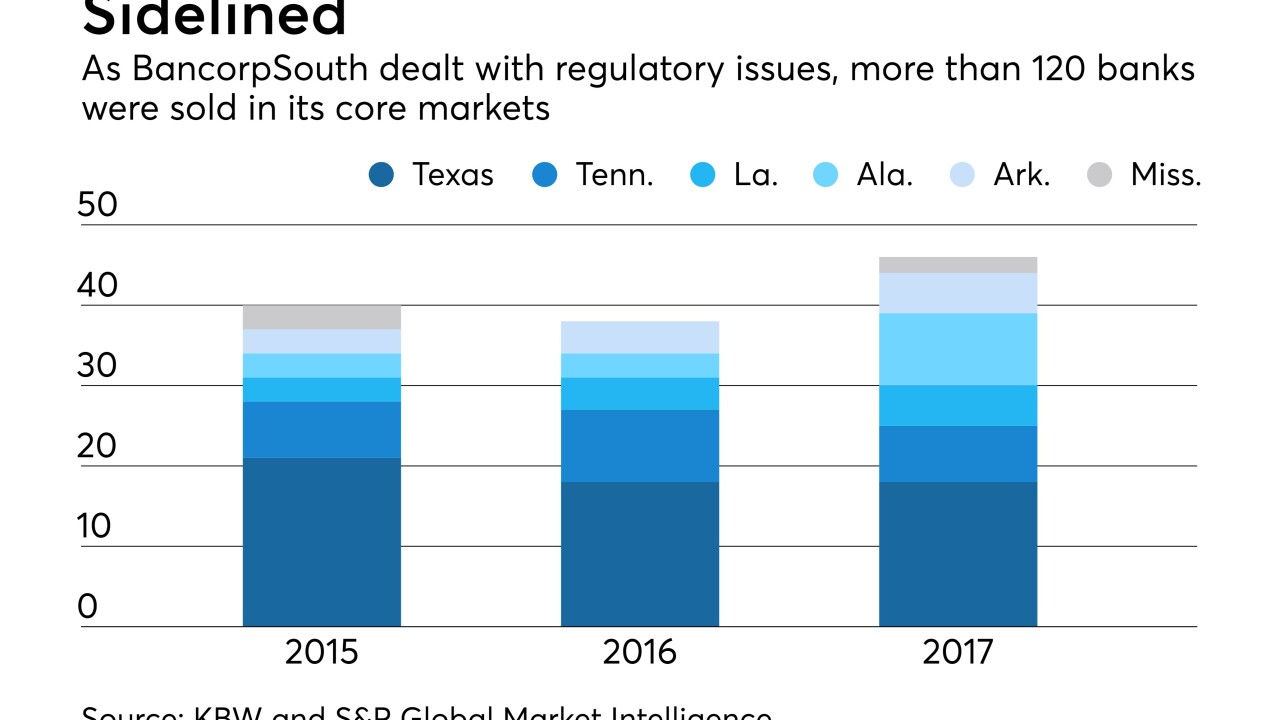

Dan Rollins engineered nearly a dozen deals while at Prosperity Bank. Now CEO at BancorpSouth, he has returned to M&A after spending four frustrating years dealing with compliance issues.

April 26 -

The Louisiana company has vowed to meaningfully improve investor returns and efficiency over the next two years.

April 20 -

The 106-year-old bank is looking to raise $90 million, with plans to use half of the funds to redeem outstanding preferred stock.

April 12 -

Louisiana credit union says secondary capital influx helped fuel earnings.

January 30 -

The Louisiana company recorded charges tied to recently passed tax reform and the purchase of Sabadell United Bank.

January 25 -

The assessment from the central bank means MidSouth faces restrictions on board appointments and executive duties. Last year the OCC called the Louisiana company a "troubled institution."

January 2 -

The purchase will significantly increase Hancock's assets under management and administration.

December 18 -

The credit union was conserved in order for the regulator to help "correct operational weaknesses."

December 15 -

The bank, which agreed to acquire Hibernia Bancorp for $28 million, will adopt the seller's name after completing the deal.

December 11 -

Alabama-based CU had operated under conservatorship since June.

December 5 -

Jefferson Financial Credit Union in Louisiana struck a deal to bring in $12 million in secondary capital, which is believed to be the biggest haul to date for a credit union. Will it embolden other CUs to pursue similar fundraising efforts?

November 20 -

Jefferson Financial in Louisiana struck a deal to bring in $12 million in secondary capital, which is believed to be the biggest haul to date for a credit union. It could also embolden other credit unions to pursue similar fundraising efforts.

November 17 -

Louisiana-based credit union says its request is one of the largest ever approved by NCUA.

November 14 -

Here's a look at the 12 housing markets with the largest percentages of mortgages over $500,000 — the new threshold House Republicans have proposed for the mortgage interest deduction in their tax plan.

November 9