-

The Treasury Department will take a huge hit when Cecil Bancorp sells its bank, while 1st Mariner Bank in Baltimore will see its equity stake completely wiped out. Cecil opted for bankruptcy court when it was unable to resolve an impasse over its trust-preferred stock.

July 11 -

Severn said it believes Mid Maryland Title Co. will complement its existing dealings in mortgages, commercial banking and commercial real estate.

July 10 -

Rob Kunisch will succeed Jack Steil as CEO of 1st Mariner Bank, which has been seeking to right itself after years of difficulties.

July 3 -

Martin Breland, who is only the second CEO in the Maryland-based credit union’s history, will be succeeded by current EVP Rick Stafford.

February 3 -

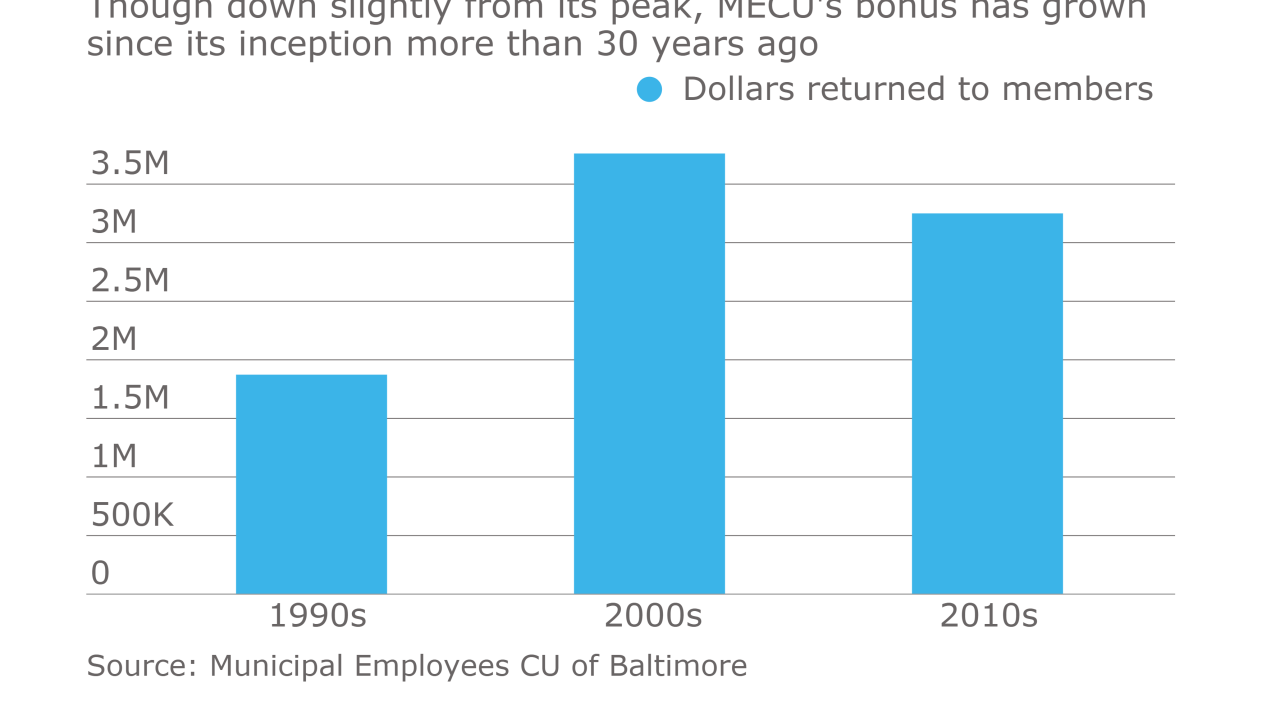

The $1.2 billion CU has returned more than $80 million to members over the last 36 years that it has been issuing annual bonuses to its membership.

January 31 -

The company said it could use proceeds for repaying debt and acquisitions, among other things.

January 27 -

Shore Bancshares in Easton, Md., has agreed to buy three branches around Baltimore from Northwest Bancshares in Warren, Pa.

January 10 -

Glen Burnie Bancorp in Maryland has announced an executive departure for the second time in three months.

November 29 -

ACNB Corp. in Gettysburg, Pa., is planning to enter Maryland with its agreement to buy New Windsor Bancorp in Taneytown, Md.

November 22 -

First United in Oakland, Md., is looking to raise up to $9.3 million through a rights offering.

November 8