-

The Treasury Department will take a huge hit when Cecil Bancorp sells its bank, while 1st Mariner Bank in Baltimore will see its equity stake completely wiped out. Cecil opted for bankruptcy court when it was unable to resolve an impasse over its trust-preferred stock.

July 11 -

Severn said it believes Mid Maryland Title Co. will complement its existing dealings in mortgages, commercial banking and commercial real estate.

July 10 -

Rob Kunisch will succeed Jack Steil as CEO of 1st Mariner Bank, which has been seeking to right itself after years of difficulties.

July 3 -

Martin Breland, who is only the second CEO in the Maryland-based credit union’s history, will be succeeded by current EVP Rick Stafford.

February 3 -

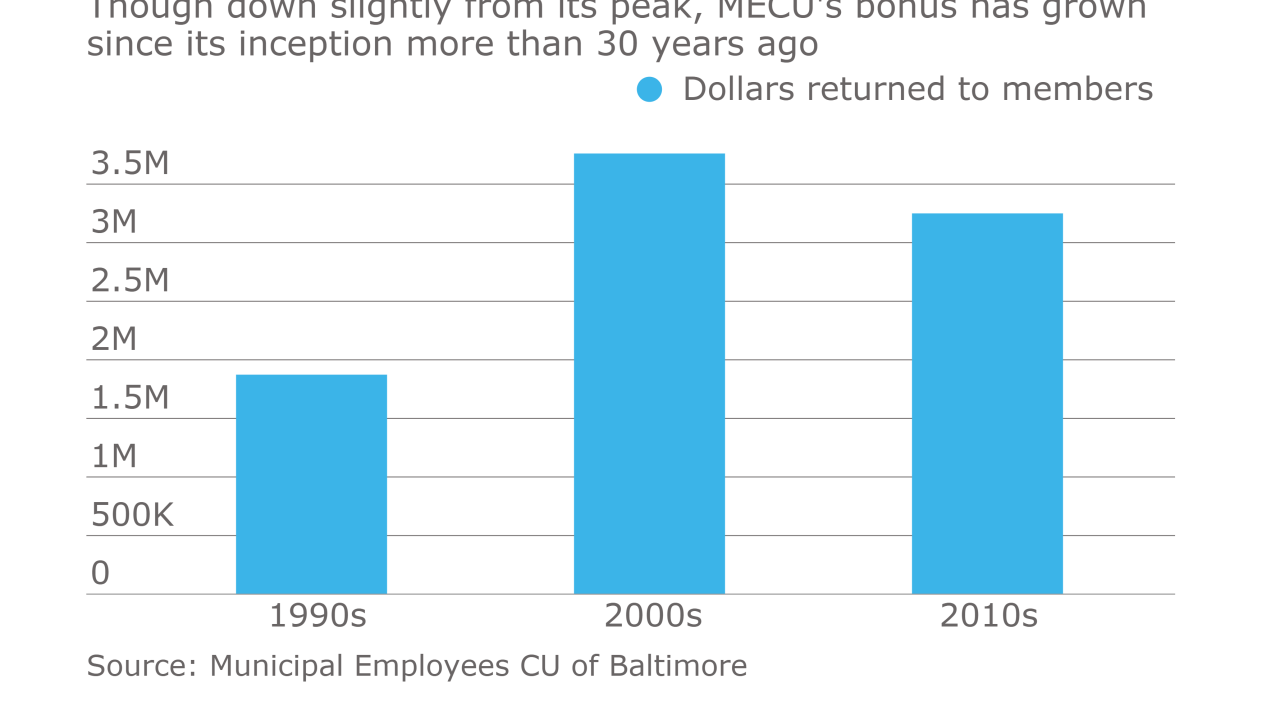

The $1.2 billion CU has returned more than $80 million to members over the last 36 years that it has been issuing annual bonuses to its membership.

January 31 -

The company said it could use proceeds for repaying debt and acquisitions, among other things.

January 27 -

Shore Bancshares in Easton, Md., has agreed to buy three branches around Baltimore from Northwest Bancshares in Warren, Pa.

January 10 -

Glen Burnie Bancorp in Maryland has announced an executive departure for the second time in three months.

November 29 -

ACNB Corp. in Gettysburg, Pa., is planning to enter Maryland with its agreement to buy New Windsor Bancorp in Taneytown, Md.

November 22 -

First United in Oakland, Md., is looking to raise up to $9.3 million through a rights offering.

November 8 -

Back in the black and looking increasingly healthy for the first time in a decade, First Mariner is poised to accelerate growth next year.

October 28 -

Community bankers say that reclassifying "reciprocal deposits" as a less risky type of deposit will help them to compete with large banks. Some deposit brokers are crying foul, arguing that the proposed legislation would put them at a competitive disadvantage. Observers, meanwhile, say the bill is so narrowly written that it would hardly affect competition.

October 5 -

MB Bancorp in Forest Hill, Md., has lined up a new chief executive.

September 30 -

Revere Bank in Laurel, Md., has raised $31 million in a subordinated debt offering that it plans to use for M&A and other purposes.

September 29 -

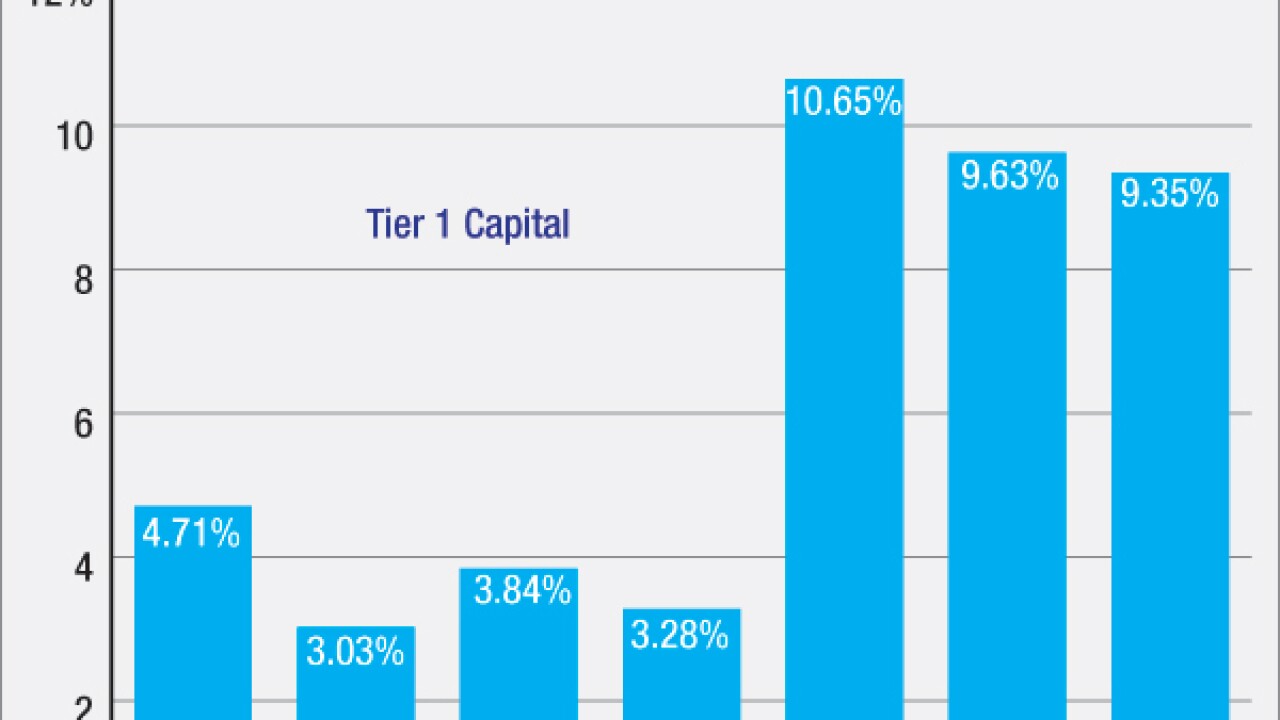

Severn Bancorp in Annapolis, Md., has redeemed the last shares tied to the Troubled Asset Relief Program.

September 9 -

Howard Bank in Ellicott City, Md., has recruited a trio of BB&T executives to grow its commercial business.

August 22 -

Old Line Bancshares in Bowie, Md., has issued $35 million in subordinated debt to help pay for an acquisition and for growth moves down the road.

August 11 -

Sandy Spring Bancorp in Olney, Md., said that its insurance unit bought The Advantage Group, which offers personal, business and life insurance to clients in Maryland, northern Virginia and Washington.

August 4 -

Community Bank of the Chesapeake in Waldorf, Md., has handed its chief risk officer some serious additional duties. James Burke became president of the $1.2 billion-asset bank on July 28; he will remain risk chief and an executive vice president, also.

August 3 -

Eagle Bancorp in Bethesda, Md., has issued $150 million in subordinated debt after increasing the amount it originally planned to sell.

July 22