-

The Michigan-based institution also recorded increases in earnings, deposits and membership.

July 25 -

A growing number of credit unions are moving their headquarters to revitalized urban areas, and while some say that could help recruit new staff, it also carries the risk of being associated with gentrification.

July 10 -

Membership continues to rise across the Wolverine State, though at a slower pace, but lending overall is on the decline.

July 1 -

As the industry continues to consolidate, operating branches in states far removed from headquarters could move from the exception to the rule.

June 27 -

Credit unions can usually limit attrition of consumer accounts after a bank acquisition, but maintaining relationships with business customers is the bigger challenge.

June 25 -

Sterling Bancorp must enhance its BSA policies and hire an outside firm to review its account activity.

June 24 -

The Michigan-based CUSO has acquired a stake in NestReady, giving it exclusive industry rights on the mortgage technology firm's products.

June 20 -

One consultant offers tips on how to better understand – and compete with – new entrants to the financial services marketplace.

June 10 -

Northpointe Bancshares sold stock to an affiliate of Castle Creek Capital.

June 4 -

The Michigan-based institution is one of a handful of credit unions that have bought or announced deals to acquire banks over the last two years.

June 3 -

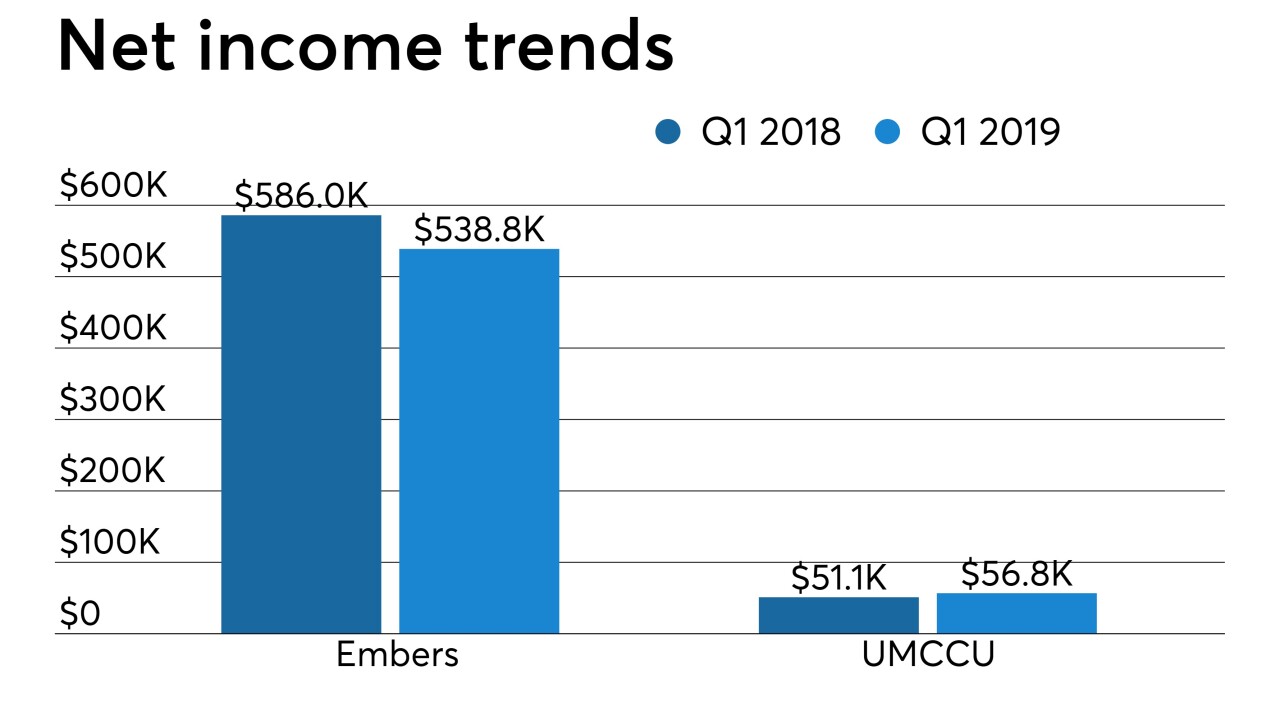

Embers Credit Union and Upper Michigan Community CU will open their doors as a merged institution on June 3, nearly a year after members voted to approve the deal.

May 31 -

The East Lansing-based credit union plans to open two branches in the Traverse City area, more than three hours north of its headquarters.

May 24 -

While regulation and nonbank competition are spooking some banks and credit unions, others believe low funding costs and the right relationships can help them succeed.

May 22 -

While regulation and nonbank competition are spooking some banks, others believe low funding costs and the right relationships can help them succeed.

May 21 -

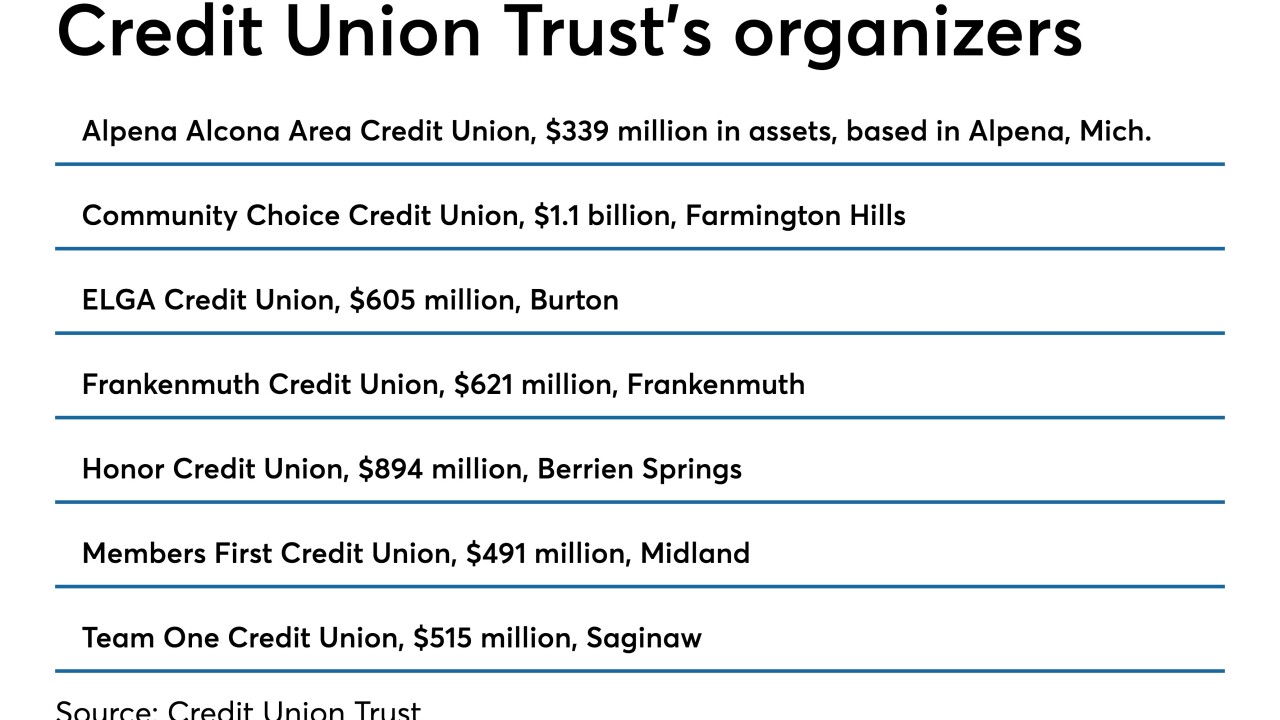

Credit Union Trust, a new credit union service organization, has obtained a bank charter that it will use in offering trust and investment-related services.

May 20 -

The Michigan company said the loan — made to a borrower that plans to shut down its reverse mortgage business — has collateral.

May 13 -

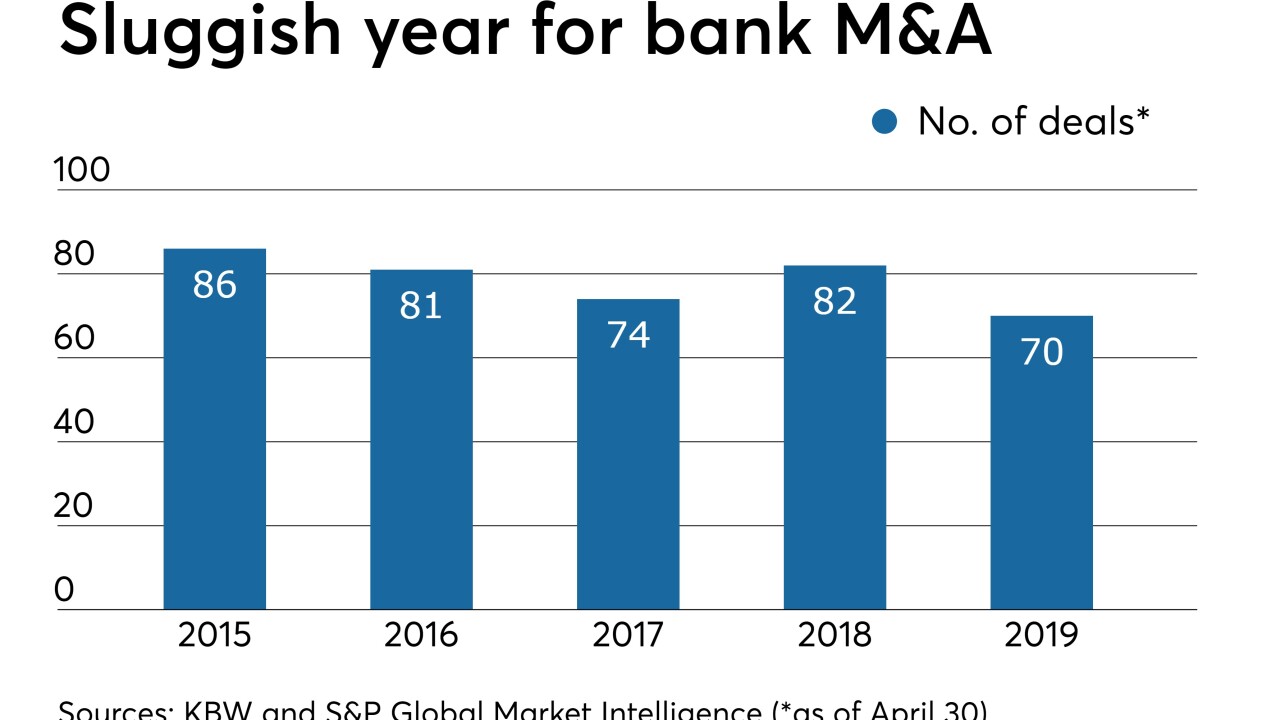

Consolidation activity was ho-hum for most of April before a burst of transactions — and notable ones at that — were announced in the month's final week.

May 8 -

Two attorneys told a credit union audience the growing wave of marijuana legalization could have just as big an impact on financial institutions that don't serve the cannabis industry as those that do.

May 3 -

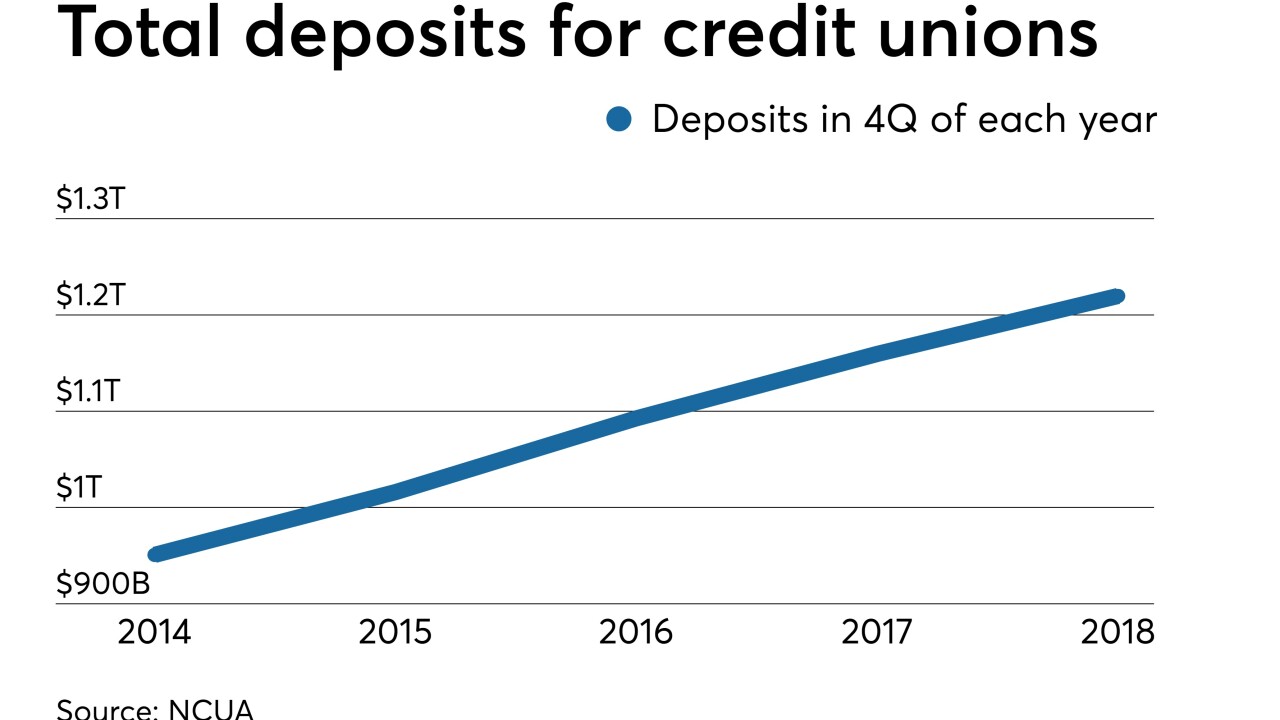

As credit unions attempt to bring in deposits to fund more loans, one institution's success story could offer a path for others.

May 1 -

The Indiana credit union agreed to pay $21.3 million in cash for New Bancorp, which was created when its savings bank converted to a stock-owned company in 2015.

April 26