-

Sound Bank is now Dogwood State Bank after its sale to an investor group. The buyers also moved Dogwoods State's corporate offices from eastern North Carolina to the state's capital.

October 2 -

The North Carolina company agreed to buy the much-smaller Community Financial Holding.

September 24 -

Forget Facebook and Twitter. For Coastal FCU and others, social media is happening inside the credit union.

September 23 -

Skip Brown, an executive with Winston-Salem Banking Group, says it has signed a letter of intent to buy a community bank three months after withdrawing a charter application.

September 6 -

The 2020 election is shaping up to be a key yardstick for legislation expanding cannabis firms’ financial services access.

August 14 -

Marc Schaefer, who has led the credit union since 1995, has announced plans to retire. President Todd Hall will take the helm on Jan. 1, 2020.

July 22 -

Will the new commitment, which is 5% over what the banks have reinvested recently on their own, assuage advocacy groups' concerns about the merger?

July 22 -

The company, based in Charleston, S.C., will buy Carolina Trust in western North Carolina for $100 million.

July 15 -

The Pittsburgh regional, once among the most industry’s most active acquirers, hasn’t bought a bank in more than two years — and it’s in no rush to do so.

July 1 -

Organizers of Community Bank of the Carolinas in Winston-Salem said that they will return capital to investors and pursue other alternatives, including buying an existing bank.

June 28 -

Shareholders of both companies will meet separately next month to cast ballots on the $28 billion deal, and BB&T investors will also decide whether the new company should be called Truist Financial.

June 19 -

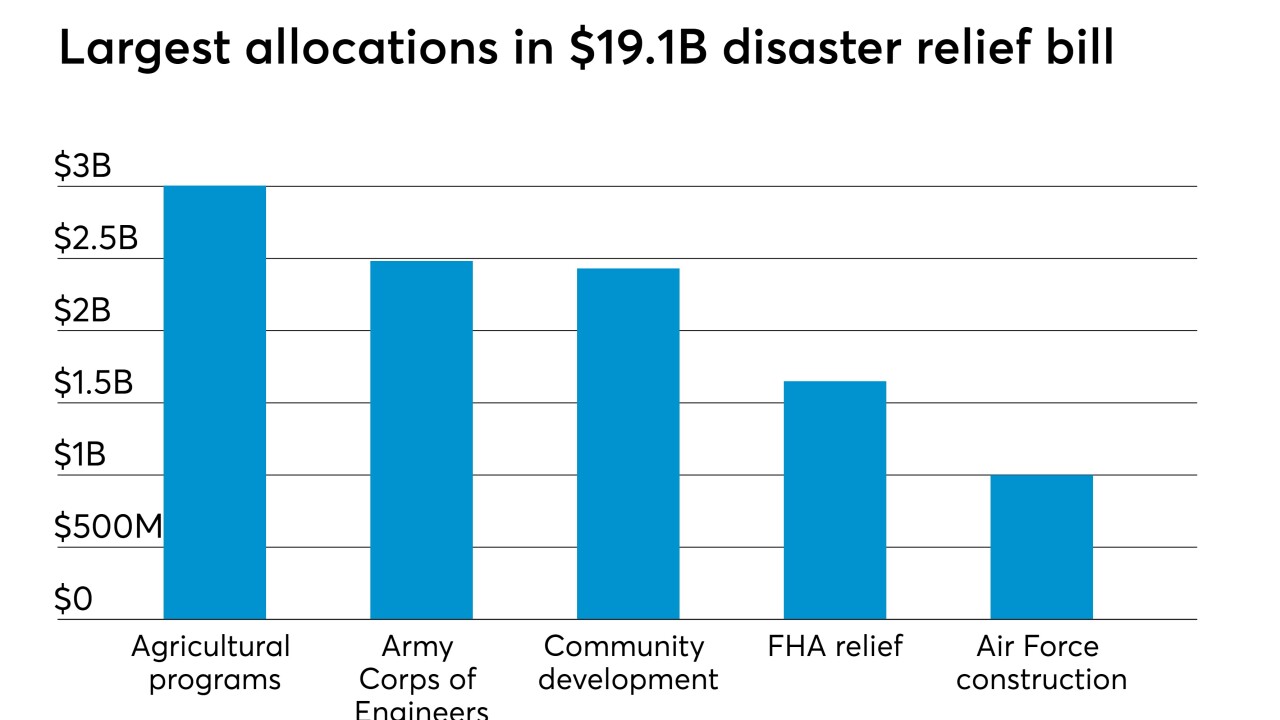

A $19.1 billion aid package signed into law earlier this month is welcome news for credit unions in Nebraska and a host of other regions that have suffered from recent natural disasters.

June 18 -

Truliant Federal Credit Union claims that the BB&T-SunTrust post-merger brand represents trademark infringement and unfair competition.

June 17 -

A shrinking bank landscape is creating potential opportunities, but analysts are mixed as to whether credit unions will see any growth as a result.

June 14 -

Dion Williams, former CEO of Del-One Credit Union, is returning to his native North Carolina to take over for Judy Tharp, who recently retired.

May 28 -

American Bank & Trust opened after organizers raised more than $22.5 million.

May 20 -

The deals lets a North Carolina group skip the de novo process. West Town, which sold the bank, will use the funds to support a fast-growing business line.

May 10 -

Maurice Smith, a former CUNA board chair with more than 35 years in the credit union movement, will receive the award during the African-American Credit Union Coalition's annual conference this summer.

May 9 -

Pinnacle Bank chief Terry Turner never lacks specifics. He wants to expand inside a triangular zone that connects three Southern and mid-Atlantic cities, aims to enter five particular markets, and speaks bluntly about his plans for hiring alums of BB&T and SunTrust.

May 8 -

Triad Business Bank adds to the list of de novo efforts taking place in the state.

May 7