-

The phony-accounts scandal at Wells Fargo illustrates how sales quotas can incent bad behavior. Is your bank effectively mitigating the risk of 'managing to metrics'? Or could it be in danger of becoming a 'cargo cult'?

January 2 -

Ray Davis is stepping down as Umpqua's CEO at yearend and transitioning to a new role as head of its year-old innovation lab. In his 22 years, he built Umpqua from a sleepy local bank into a regional powerhouse and internationally recognized brand.

December 5 -

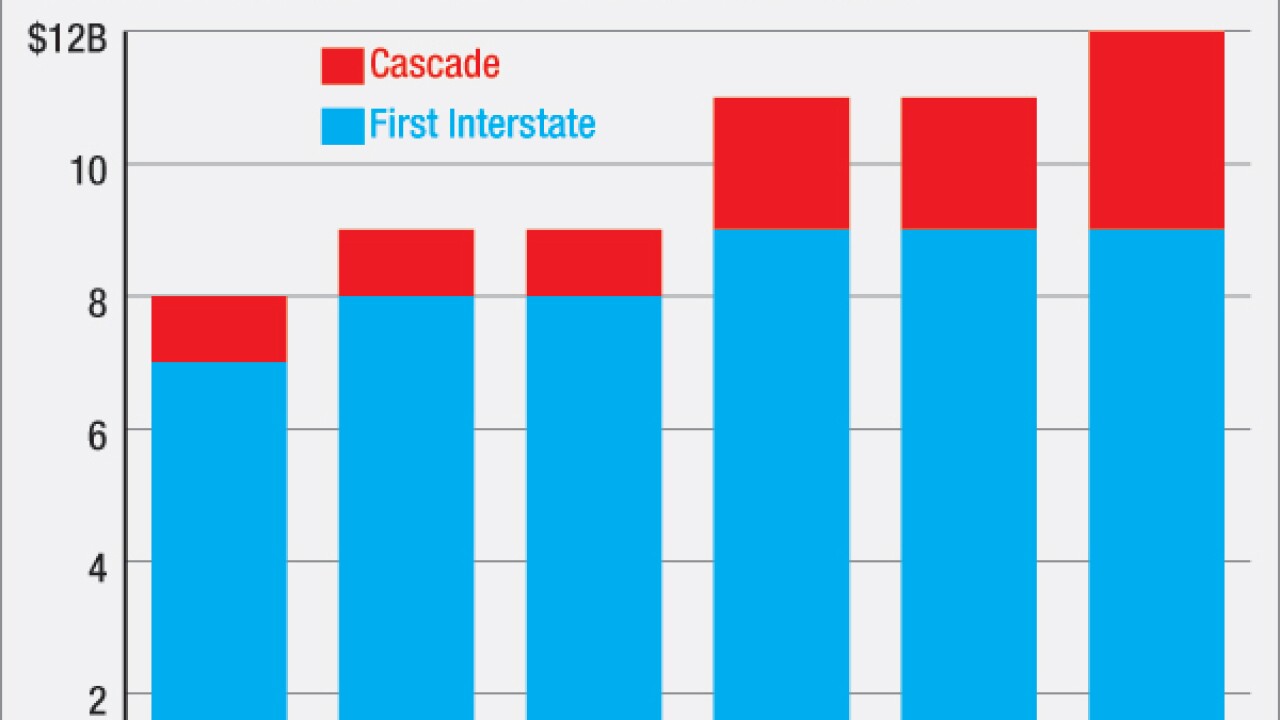

Montana's biggest bank will have to compete in cities such as Seattle and Portland, Ore., after buying Cascade Bancorp. But the company is arguably more excited about its chances to grow in central Oregon and Idaho, which are more like its existing markets.

November 18 -

Sen. Jeff Sessions is one of the marijuana industry's staunchest foes. He could upend efforts by the Obama administration to persuade banks that it is safe to work with cannabis firms.

November 18 -

The Klamath Falls, Ore.-based CU said Olney, a native of Southern Oregon, is a graduate of George Fox University and the Atkinson Graduate School of Management at Willamette University.

October 12 -

Umpqua Holdings in Portland, Ore., has formed a corporate lending office and hired Richard Cabrera to oversee it.

October 5 -

Pacific Continental in Eugene, Ore., has found a key position for an executive from a bank it recently bought.

September 8 -

Pacific Continental in Eugene, Ore., has appointed two former directors of a bank it bought to its own board.

September 7 -

Four years after the first states legalized marijuana, most bankers still want nothing to do with it.

July 31 -

His title may be changing, but Ray Davis' goal of altering the banking landscape remains the same. Davis, who will step down as Umpqua's CEO, will still run its innovation unit with a hope of influencing digital banking in the same way that he shook up retail banking.

June 23 -

WASHINGTON Marijuana businesses and banks looking to open their doors to the potentially lucrative clients suffered a blow Wednesday after House Republicans blocked an amendment that would have prevented federal regulators from pursuing enforcement actions against banks dealing with the businesses in states with legalized pot.

June 22 -

WASHINGTON Banks in states with legal marijuana businesses may warm up to them as customers if an amendment to a Senate appropriations bill becomes law.

June 20 -

Pacific Continental in Eugene, Ore., is planning to issue $35 million in subordinated debt that could help it fund future acquisitions.

June 20 - Oregon

Umpqua Holdings in Portland, Ore., will have a new chief executive in 2017. The company said Monday that Ray Davis, 67, will step down as president and CEO, effective Jan. 1. Davis, who will become executive chairman, will be succeeded by Cort O'Haver, who was named president of Umpqua Bank in April.

June 20 -

Umpqua Holdings in Portland, Ore., has found a bank partner to join in its bid to bring new banking technologies to market.

June 10 -

HomeStreet in Seattle has agreed to buy most of the assets and deposits of Bank of Oswego, including the Lake Oswego, Ore., bank's branches.

May 11 -

Umpqua Holdings in Oregon has promoted a business-banking executive to president of its bank unit.

April 27 -

Pacific Continental in Eugene, Ore., has agreed to buy Foundation Bancorp in Bellevue, Wash.

April 27 -

Cascade Bancorp in Bend, Ore., has agreed to buy Prime Pacific Financial Services in Lynwood, Wash.

April 27 - Washington

Umpqua Holdings in Portland, Ore., plans to close 26 branches in Oregon, California, Idaho and Washington state in an effort to cut costs.

March 17