-

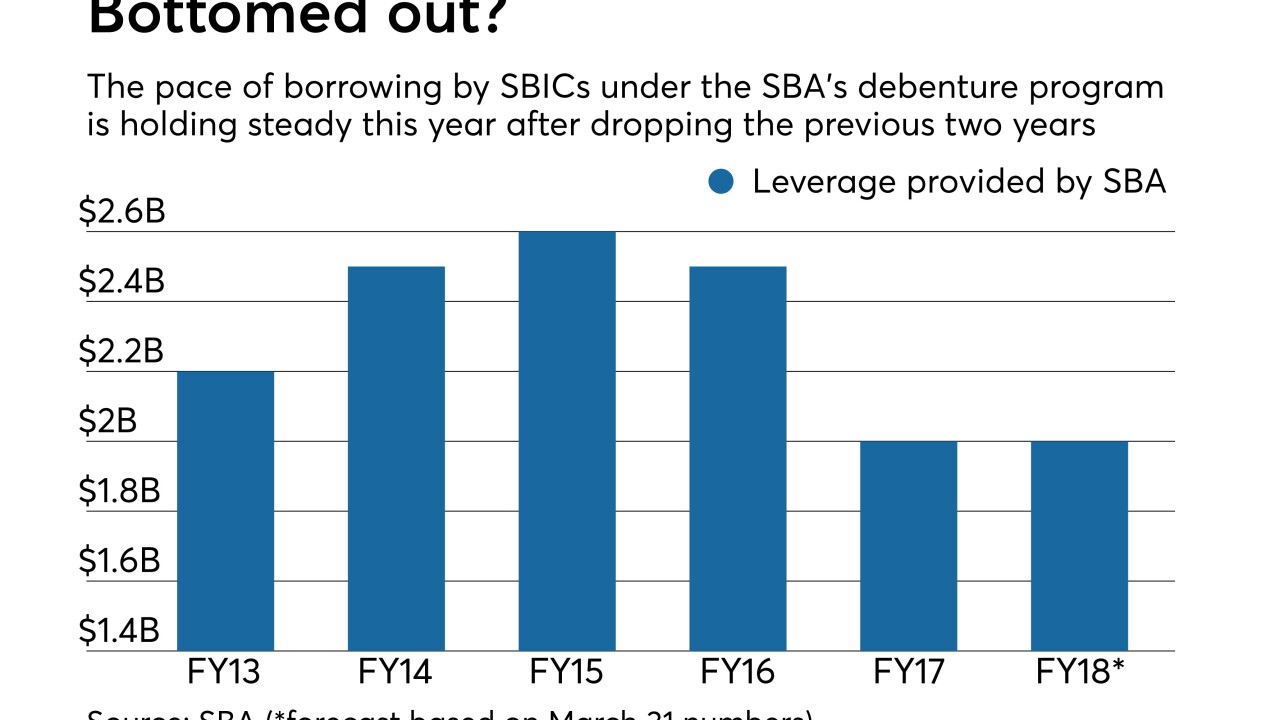

While the Small Business Investment Companies program has reported disappointing results since its 2015 peak, participating funds are getting more looks from curious bankers.

July 12 -

Moxy Bank would focus on low- and moderate-income depositors in the nation's capital, while operating a lending platform in North Carolina.

July 11 -

VisionBank is the second de novo effort that would focus on the nation's capital.

July 9 -

Trade associations hail move that would push back implementation of risk-based capital rule to 2021.

June 27 -

Legislation with bipartisan support would raise the threshold for reporting suspicious activity, a goal banks have long sought.

June 12 -

Groups representing banks, credit unions, the housing industry and others argue in favor of a bill requiring the CFPB to issue timely guidance on its rules.

June 12 -

The bill is one of two SBA-related measures the Senate approved late Tuesday and sent to President Trump to sign into law.

June 6 -

The bill is one of two SBA-related measures the Senate approved late Tuesday and sent to President Trump to sign into law.

June 6 -

A coalition of free-market-oriented groups is calling on Senate Finance Committee Chairman Orrin Hatch to rethink his push for a new tax on credit unions.

May 23 -

Total loans at Old Dominion National Bank have tripled since 2016.

May 17 -

The most common credit union mergers involve a small credit union being acquired by a much larger one, but that could be changing, as three recent deals involving credit unions with more than $300 million in assets as the ones being merged out.

May 16 -

Bigger credit unions present a formidable challenge for banks in areas such as business lending.

May 16 -

The two major national credit union trade associations have sent recommendations for improving the Consumer Financial Protection Bureau’s enforcement processes.

May 15 -

Rebeca Romero Rainey, who has been on the job for less than a week, has already slammed postal banking and pressed for more regulatory relief. In a Q&A, she discusses her plans to foster innovation, tackle succession issues and encourage more banks to stay independent.

May 10 -

Christopher Bergstrom led Cardinal Financial when it sold itself to United Bankshares in 2017.

May 3 -

CUNA and NAFCU have both submitted letters requesting civil investigative demands from the bureau be more specific as to the conduct under investigation.

April 27 -

On one hand, banks could face regulatory pressure to restrict services to the firearms industry. But banks that take a strong stand also risk the wrath of GOP lawmakers opposed to such restrictions.

April 26 -

Both national credit union trade associations submitted letters in advance of CFPB acting director Mick Mulvaney's House Financial Services Committee hearing.

April 11 -

Credit unions will know soon how much regulatory relief they might see from Congress and the Consumer Financial Protection Bureau.

April 9 -

Congress has left Washington for a two-week recess, and credit union leaders are being urged to make their case for reg relief while legislators are back at home.

March 26