-

The acquisition is the first for Hope since a transformative merger last year.

January 23 -

An influx of new people to the Pacific Northwest and Southeast could have big implications for banking, from M&A to de novo efforts.

January 10 -

Columbia Banking System in Tacoma, Wash., landed the first sizeable deal of the New Year with an agreement to buy Pacific Continental in Eugene, Ore.

January 10 -

Pacific Financial in Aberdeen, Wash., is looking for a new chief credit officer.

December 7 -

Banks in Texas and Washington are joining the growing list of financial institutions selling common stock.

December 6 -

Plaza Bank in Seattle has promoted its chief lending officer to become CEO. The $65 million-asset bank said in a press release Monday that Michael Anderson also succeeded Michael Clabby as president on Nov. 23.

December 5 -

Some banks are set to get a fourth-quarter earnings boost from their MSR portfolios, thanks to a sudden spike in yields on Treasury bonds. Add to that the prospect of further rate hikes and the potential dismantling of Basel III, and more banks could be encouraged to re-enter the servicing business.

November 30 -

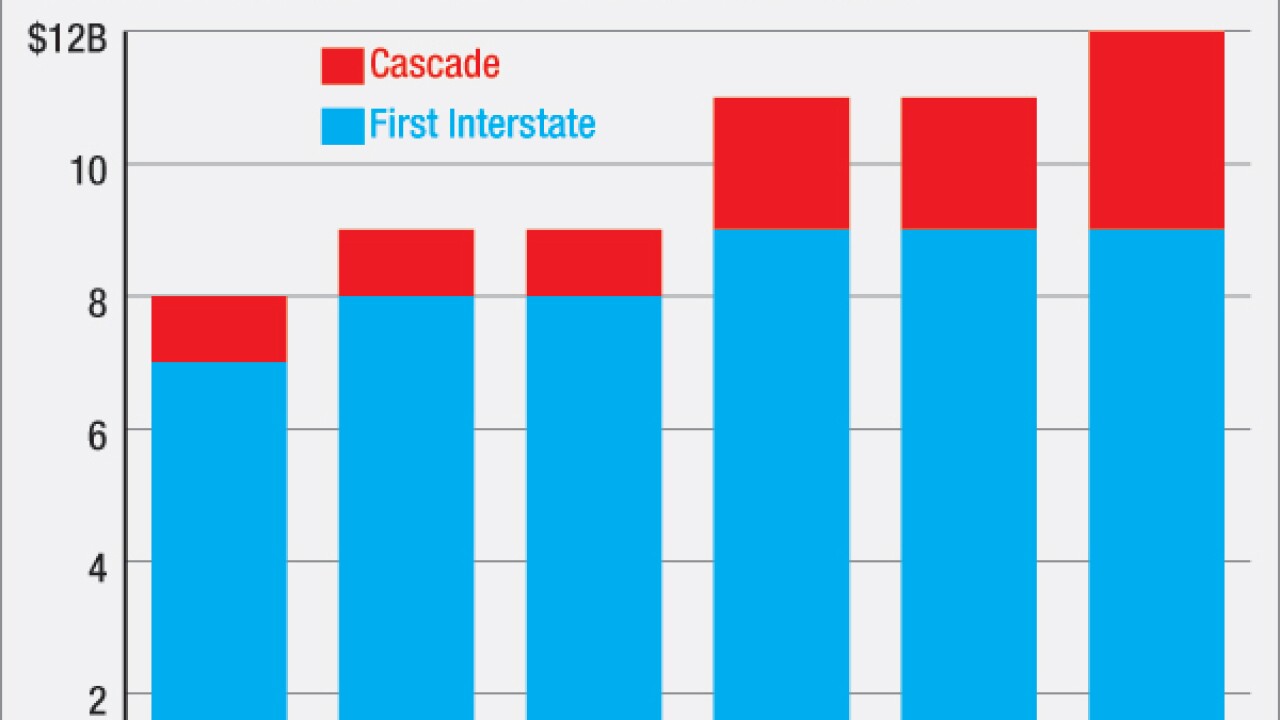

Montana's biggest bank will have to compete in cities such as Seattle and Portland, Ore., after buying Cascade Bancorp. But the company is arguably more excited about its chances to grow in central Oregon and Idaho, which are more like its existing markets.

November 18 -

Sen. Jeff Sessions is one of the marijuana industry's staunchest foes. He could upend efforts by the Obama administration to persuade banks that it is safe to work with cannabis firms.

November 18 -

Community banks in the Pacific Northwest and New England completed acquisitions late in the week, and the TIAA-EverBank deal has moved a step closer to reality.

November 11 -

The $70 million-asset bank said in a press release that Thomas Dungan 3rd, Yong Li, Wendy Mitchell and Paul Zhu have joined its six directors.

November 8 -

The president of the Kansas City Federal Reserve Bank is best known for her dissenting votes on monetary policy, but that's not the only way she stands out. Her background as a farmer and former bank examiner gives her a unique perspective among Fed officials.

October 30 -

Community bankers say that reclassifying "reciprocal deposits" as a less risky type of deposit will help them to compete with large banks. Some deposit brokers are crying foul, arguing that the proposed legislation would put them at a competitive disadvantage. Observers, meanwhile, say the bill is so narrowly written that it would hardly affect competition.

October 5 -

Riverview Bancorp in Vancouver, Wash., has agreed to buy certain assets and liabilities of MBank in Gresham, Ore.

September 29 -

WASHINGTON -- The Chamber of Digital Commerce has opened a new outpost in the nations capital. But instead of looking for a staid law office, the bitcoin advocacy group formed a partnership with local incubator 1776 to launch the DC Blockchain Center.

September 27 -

A bipartisan duo of lawmakers announced Monday they are forming the Congressional Blockchain Caucus in an effort to educate policymakers on digital currency and related issues.

September 26 -

Washington Federal in Seattle has named Erin Lantz, a general manager of mortgages at Zillow Group, to its board. Lantz, 37, worked at Bank of America from April 2003 to 2010, eventually serving as senior vice president of program management.

September 15 -

Washington Trust, No. 48 in the overall ranking, is No. 8 in the category for banks with $3 billion to $10 billion of assets.

August 28 -

United Bankshares in West Virginia has quietly become a $14 billion-asset player in its region thanks to the M&A strategy of its highly respected leader, Richard Adams, who has a way of establishing a rapport with community bank chiefs. One recent seller is a repeat customer.

August 23 -

Banks in cities such as Seattle and New York are getting creative with branching, adding some that are smaller than modest apartments.

August 18