-

Numerated, a vendor of loan prospecting, marketing and underwriting software that was developed within Eastern Bank, now has $32 million.

September 10 -

Enova has used AI in credit decisions for years. Now it’s having AI do the work of document verification, know-your-customer checks and more.

September 5 -

Tina Eide, Amex's senior vice president of global fraud, discusses the card issuer's efforts to strengthen its transaction monitoring.

September 3 -

Sherry Comes, managing director in conversational AI at Deloitte Consulting, says banking in the future will take place through a home, car or phone speaker.

August 27 -

Banks are using Receptiviti’s software to find signs of stress, collusion and questionable sales practices among employees.

August 26 -

Blooma has developed a software product that combs databases to create property profiles for commercial real estate lenders. It can drastically cut origination costs and approval times and help banks identify safer loans, the company says.

August 23 -

Capacity, formerly Jane.ai, originally designed its chatbot to answer consumers' questions, but when employees started using it, that gave the startup an idea for a new business line.

August 21 -

The technology can help banks get the most out of the vast amounts of information at their disposal.

August 13 Sinequa

Sinequa -

Banks need to mitigate potential bias in algorithmic predictive models using artificial intelligence, as regulators are weighing how to oversee the emerging technology.

August 6 Regions Bank

Regions Bank -

The FDIC chief said it is critical to give the industry clarity on using emerging technologies, particularly for the thousands of community banks her agency oversees.

August 2 -

The bank is taking a concept that has worked for years in the credit card world — artificial-intelligence-based fraud detection — and applying it to corporate customers' transactions.

July 15 -

As lawmakers meet this week to discuss artificial intelligence, they should work with regulators to create universal and workable definitions.

June 28 Kabbage Inc.

Kabbage Inc. -

Readers respond to how Congress should address AI, concerns on Facebook's Libra and its logo, a report challenging card fraud prevention and more.

June 27 -

Among other things, Kai, the insurance firm's AI assistant, will tell customers how to avoid the bank's monthly fee.

June 27 -

As lawmakers meet this week to discuss artificial intelligence, they should work with regulators to create universal and workable definitions.

June 25 Kabbage Inc.

Kabbage Inc. -

Some banks are setting up their own parallel digital banks, while others form innovation labs. Roman Regelman says BNY Mellon is transforming the entire institution.

June 24 -

Lincoln Parks, director of marketing at Heritage Bank, explains the bank’s cautious yet forward-thinking approach to its new virtual assistant.

June 4 -

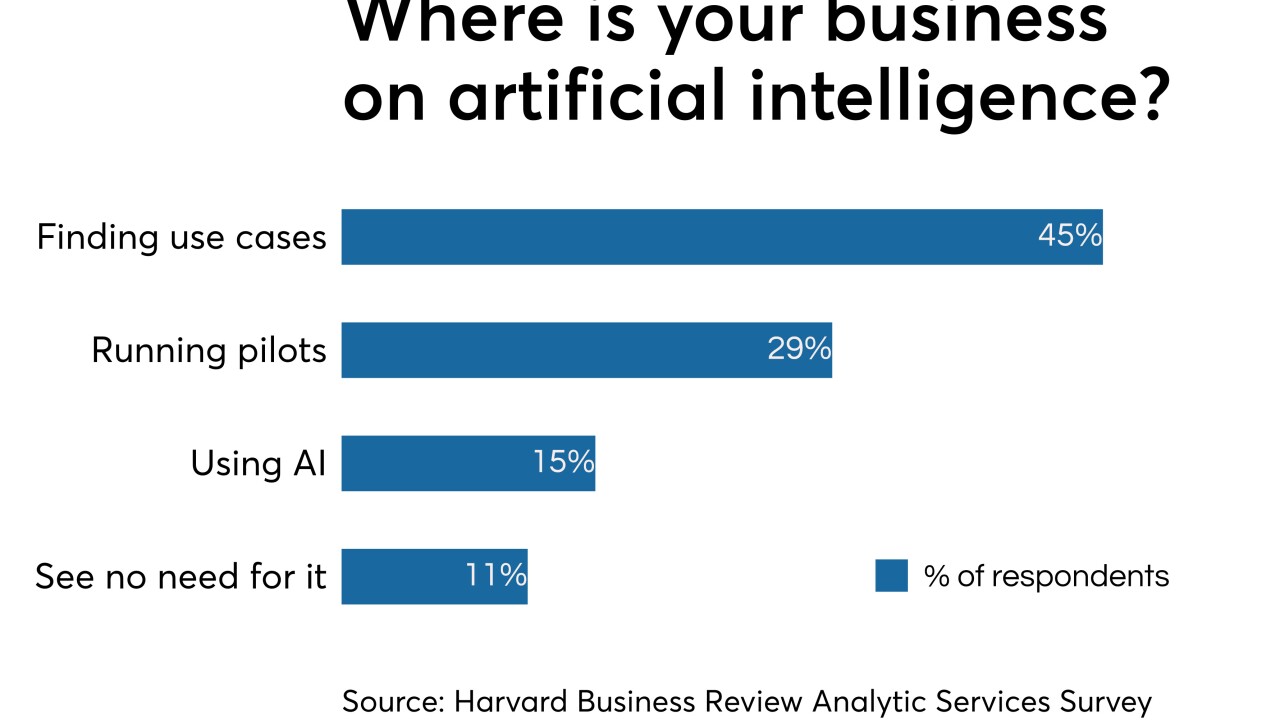

New technologies can increase lending and reduce risk but many management teams don't know where to begin with implementing them.

May 31 ZestFinance

ZestFinance -

A year after it debuted, Bank of America's virtual assistant now counts some 150,000 users per week. It's one of the few large financial institutions pushing such technology.

May 29 -

Banks would be better able to comply with anti-money-laundering laws if all 50 states collected information on the owners of new corporations and published it in a national database, Comptroller Joseph Otting said Monday.

May 20