For years, banks have used sophisticated technologies, including artificial intelligence, to catch card fraud. Software watches customers every time they use their cards and flags any purchases that seem unusual.

Now Citigroup is applying this idea in corporate banking, using AI to monitor commercial clients' transactions and find anything that might be off, whether the anomaly stems from fraud, hacking, a mistake or any other improper activity.

Citi calls its new technology “outlier detection.”

“Historically, the payments industry outside of cards hasn’t had solutions like this,” said Manish Kohli, global head of payments and receivables at Citi. “And over the last few years, there has been a heightened demand and anxiety among corporates, especially as the payment factories they have are becoming more sophisticated and more automated and the clearing systems are becoming faster. The velocity of money is rapidly increasing.”

The ever-growing risk of cybersecurity attacks and employee fraud also creates demand for a product like this, he said.

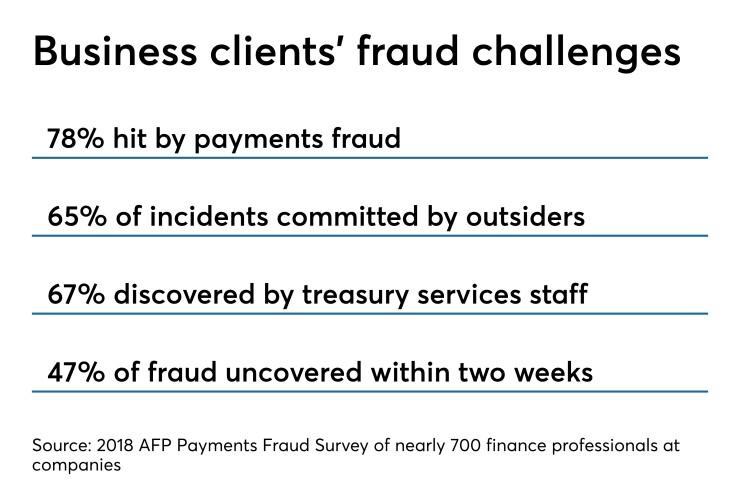

"Corporate clients need help in the fight against fraud," said Patricia Hines, head of corporate banking at Celent, citing the 2018 Association for Financial Professionals Payments Fraud and Control Survey: 78% of organizations experienced attempted or actual payments fraud in 2017. Another study the same group conducted last year found that 24% of finance professionals are using AI to manage risk within treasury and finance operations; 76% say they are currently evaluating the use of such technology.

Other large banks use AI and machine learning models for fraud prevention, but no others have publicly announced this technology for treasury services clients.

"Some banks are using analytics to identify suspicious activity there, but they haven’t made a formal product out of it as Citi has done," said Shirley Inscoe, senior analyst at Aite Group. "This may change rapidly since better protecting commercial accounts will likely become a competitive advantage in the market."

Fraud executives Inscoe has spoken with say they are achieving strong results with the use of AI in fraud detection, "and the regulators to date have been more accepting of machine learning models used to combat fraud than to detect money laundering," she said.

Why AI is called for

Rules-based systems do not do a good job of detecting large companies’ outlier transactions, Kohli said.

“The problem with rules-based systems is by the time you write the rules, they’re already outdated as the client’s business model has changed, the suppliers they’re dealing with have changed, the composition of their flows has changed,” Kohli explained. “Every corporate client is different from the next corporate client. You can’t say that about consumers and their card behavior.” Citi has corporate clients in 90 countries.

Machine learning, on the other hand, studies each individual client’s payment activity and begins to distinguish normal from abnormal behavior.

“Who best can write the rules for a client than the client’s own historical payment activity?” Kohli said.

Citi data scientists and machine learning experts built the system in the bank’s innovation lab in Dublin with

The system ingests each client’s payment activity and preferences to create the outlier detection models.

“Different clients have different risk appetites,” Kohli said. “Some want a 90% assurance rate before a payment goes out, and some would want a payment to go out real-time and review outliers later. That’s why we had a rather elongated pilot period, about five quarters, which is unusual. We were very keen for something as important as this to spend a good amount of time testing it with our client.”

Citi has been piloting the technology with 20 clients since early 2018. Clients have asked the bank to support other locations and other groups within their organizations.

“The feedback was resounding that this is hitting home to a very important client problem, so we decided to make this a global solution,” Kohli said.

Citi formally launched the service internationally in late June. Outlier detection is now part of its CitiDirect and CitiDirect electronic banking software, and it is priced as part of a relationship bundle. Some customers might pay extra for the service.

Early results

So far, the outlier detection software has caught a few Citi client mistakes, like unintended payments. In some cases clients found they were paying for subscriptions they should not be. The software has not found any instances of fraud or hacking yet, according to Kohli.

One client has asked for the system to be enhanced to tell them about payments they should have been making, but perhaps someone forgot.

“I never thought of using an outlier solution to also do that,” Kohli said. “It demonstrates to me that our clients were very engaged in giving good, robust feedback during the pilot phase.”

Why don’t more banks offer this?

Kohli surmises that the complexity of the technology and the scarcity of expertise make this kind of system challenging to build.

“This is not about identifying cats in photographs on the internet, where you can be wrong and it’s fine,” he said. “This is about real money. And hence you need a lot of payment domain expertise, and you need the keenness to use either your own proprietary technology or an openness to work with partners, and you need the right scale because as everybody knows, machine learning tools are only good as the amount of data they consume. When you put all of that together, I don’t think there are too many companies that have that orientation, that domain expertise and that scale.”

Hines concurs with that assessment.

"The payment volumes of global banks the size of Citi are extraordinary," she said. "Citi processes $4 trillion of client payments daily. Not many banks have the AI expertise, required technology and scale to develop a solution to detect payment outliers across geographies, distinct payment systems, and diverse clients."