-

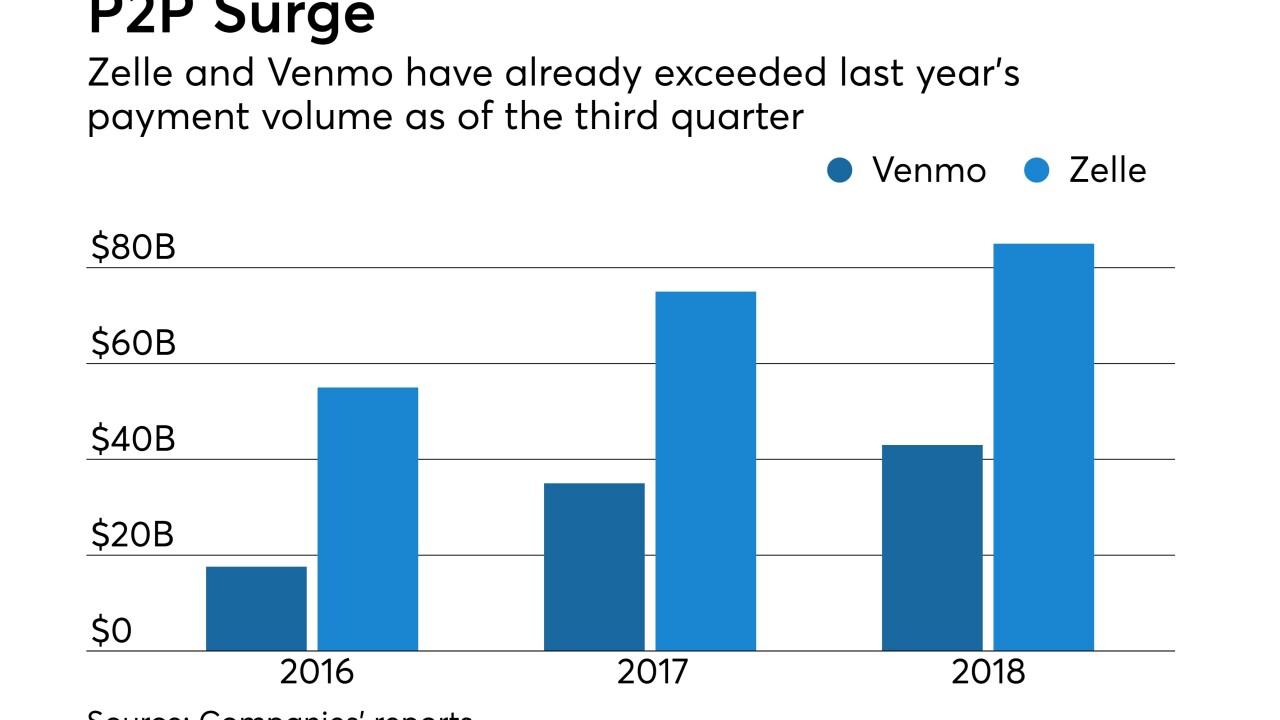

Zelle processed 116 million transactions during the third quarter as its payment volume jumped to $32 billion, while Venmo's volume increased 78% to nearly $17 billion.

October 23 -

A new credit score that includes consumers' cash flow alongside their credit score is winning praise for its potential to help expand access to credit, but some worry it gives the credit bureaus even more data that could be compromised.

October 23 -

The personal lending boom continues: HSBC's U.S. arm is teaming up with Avant, a closely held online lender, to offer unsecured loans to new and existing customers.

October 23 -

Zelle processed 116 million transactions during the third quarter as its payment volume jumped to $32 billion, while Venmo's volume increased 78% to nearly $17 billion.

October 23 -

The firm is disbanding its consumer and commercial banking division and will make the Marcus brand one of the new business offerings that can be sold to its wealth management unit’s expanding roster of clients.

October 22 -

The $380-billion asset company will soon join the parade of big banks and tech companies that are migrating online to meet the demands of business owners.

October 22 -

The $286.4 million deal is an important test for Upgrade, which has raised $142 million of equity over the past two years but has yet to turn a profit.

October 18 -

ODX will pursue deals with banks that want to use the New York lender’s technology to offer online small-business loans.

October 16 -

Among the three measures is a requirement for boards of publicly traded firms to include more women.

October 1 -

The Department of Justice and the Securities and Exchange Commission announced settlements Friday related to alleged misconduct that occurred during Renaud Laplanche’s tenure atop the online lender.

September 28 -

The bank seeks to answer the threat posed by disruptors with quick online loans and a card that rewards small businesses for more kinds of spending.

September 25 -

Using software from Eastern Bank spinoff Numerated, Bremer Bank says it will be able to approve automated loans to farmers within a minute.

September 13 -

If Gov. Jerry Brown signs the legislation headed to his desk, it would be the first law of its kind in the U.S. It is designed to allow small-business owners to make comparisons between offers in the often bewildering world of online business lending.

September 5 -

The LendingClub founder responded to being booted from his company by starting a new one with involvement from former investors — and a loan buyer he had supposedly wronged.

August 29 -

Upgrade, a marketplace lender founded by Laplanche just a few months after he was ousted from LendingClub, has secured more than $100 million in equity capital and says it is poised to offer more consumer credit products.

August 23 -

Rep. Emanuel Cleaver, D-Mo., released a survey of lending practices that he said point to practices such as forced arbitration clauses and extracting a customer’s credit score to determine creditworthiness.

August 17 -

It bothered Jeannie Tarkenton, founder of Funding University, that too many kids from lower-income families didn't graduate because they lacked just a few thousand dollars and couldn't get a loan.

August 13 -

The online lender’s president, Steve Allocca, shares how the company weathered scandal and hints at future plans to grow its product set.

August 9 -

The marketplace lender recorded an impairment charge tied to the acquisition of a specialty lending business and is still being hit with costs stemming from the scandal that toppled its previous CEO.

August 7 -

The online small-business lender was aided by loan growth, wider margins and stable credit trends. Its shares surged by 25% after second-quarter earnings were announced.

August 7