-

The Atlanta company partners with banks and merchants to offer consumer installment loans. It could seek to raise as $1 billion as early as this summer, according to a published report.

April 2 -

No reason was given for his exit by the Silicon Valley lender, which named another prominent economist, Susan Athey of Stanford, to its board of directors.

March 28 -

Some investors fear BBVA is taking a big risk by getting into unsecured personal lending long after online lenders have established themselves, but bank officials argue the bank’s cost of funds and in-depth knowledge of its customers will help it to outdo the competition.

March 28 -

Even as many venture capitalists retreat from the online lending industry, Upstart Network is hoping to find investors still willing to bet on the business.

March 27 -

The San Francisco-based online lender reported a net loss of $115 million for 2017, more than half of which was connected to warrants issued in a deal that stabilized the struggling firm.

March 26 -

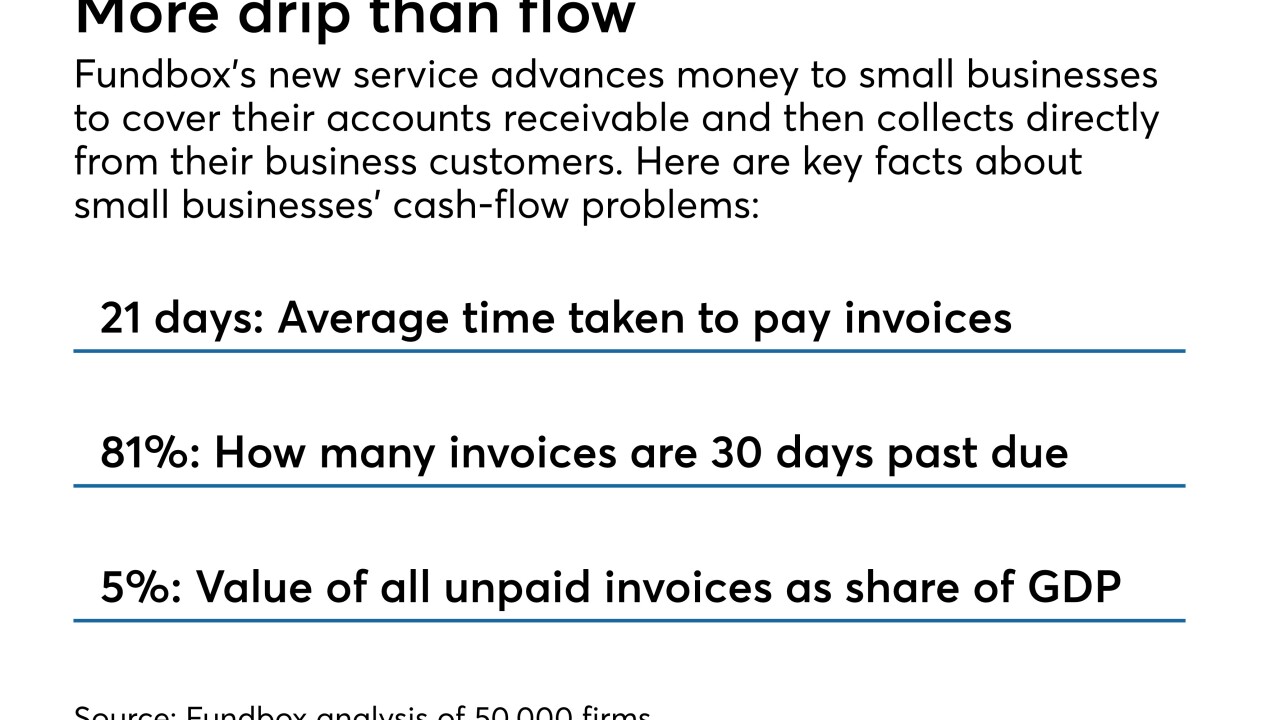

Fundbox is testing a payments and credit network for small businesses and their business clients that may offer an alternative to traditional lenders, credit card issuers and supplier financing.

March 14 -

The online lender is hiring Kenneth Brause, a CIT Group executive, to succeed CFO Howard Katzenberg.

March 13 -

House legislation to reverse a federal court decision on state interest rate caps would increase access to credit, not expand predatory lending as critics have argued.

March 7 The Clearing House Association

The Clearing House Association -

Financial agencies must prepare themselves to evaluate the practical effects of automated decision-making in lending and other programs to better detect fair-lending violations.

March 7 Deciens Capital

Deciens Capital -

Online lenders build a seamless customer journey from screening to underwriting to origination to servicing to funding, writes Krista Morgan, CEO and co-founder of P2Binvestor.

March 5 P2Binvestor

P2Binvestor -

LendingClub, Marlette and others are looking at additional changes to both their securitization and whole-loan-sale programs that could further broaden their investor bases.

March 1 -

House legislation to reverse a federal court decision on state interest rate caps would increase access to credit, not expand predatory lending as critics have argued.

February 28 The Clearing House Association

The Clearing House Association -

In an interview during his first day on the job, Anthony Noto also spoke about improving the firm's culture and the prospects for an IPO.

February 26 -

The online lender continues to contend with the fallout of a 2016 scandal that led to the ouster of its founder and CEO.

February 20 -

Their partnership aims to make it easier for community banks and other institutional investors to vet loans that they could buy from online lenders.

February 16 -

The legislation, introduced by Rep. Patrick McHenry, R-N.C., would essentially reverse a court ruling that marketplace lenders say has blocked them from helping more consumers access credit.

February 14 -

The online small-business lender is enjoying a payoff from its year-old push to cut costs and tighten underwriting standards. It is also set to announce another lending agreement with a major bank this year, its CEO said Tuesday.

February 13 -

Neptune Financial plans to use technology to improve the efficiency in making loans to companies with $10 million to $100 million in annual revenue.

February 13 -

Marquette Bank is proof that community banks don't have to be the fastest or flashiest to compete with online lenders. Instead, the Chicago bank closely mirrored fintech offerings while promoting personal service to set itself apart.

February 8 -

Social Finance set an internal goal of lending more money in 2017 than it had in the previous five years combined. It was an aggressive target and one that counted on everything going exactly right.

February 2