-

Renaud Laplanche, one of the first fintech disruptors, is launching an unusual type of credit product at Upgrade, his new company, that is a cross between a credit card and an unsecured loan.

October 10 -

Futurist Lex Sokolin believes buying banking products will be like buying generic pain relievers on Amazon.

October 8 -

Freddie Mac's test of artificial intelligence to make lending decisions could be a significant turning point in broadening the use of the technology.

October 2 -

Digital-first lenders more than doubled their market share in the last four years, according to a report by Experian.

September 25 -

The startup, Drum, provides a marketplace for small businesses to offer promotions to influencers who can help them drum up business.

September 23 -

All of the GOP members on the House Financial Services Committee called on the regulator to consider "administrative decisions" to offset the impact of the 2015 decision.

September 23 -

Building capital will help the mortgage agencies move toward the private sector; Virtual Wellness needs to assure banks it's safe to do business with them.

September 23 -

Salaryo and Joust are among the companies catering to a clientele of underbanked entrepreneurs, Uber drivers and the like. Venture capital dollars are starting to follow.

September 19 -

Melissa Koide, co-founder and CEO of FinRegLab, analyzed loan data from six lenders that use cash-flow data in their underwriting. She shares what she found.

September 17 -

The largest financial institutions have a golden opportunity to capture more market share because of the under-40 crowd’s decided preference for digital banking, J.D. Power says. Yet so do nonbanks.

September 15 -

The online lender’s name will go on a glitzy new stadium scheduled to open next year in Inglewood, Calif. The big question is whether the 20-year deal will contribute to profitability, which SoFi has yet to achieve on a consistent basis.

September 15 -

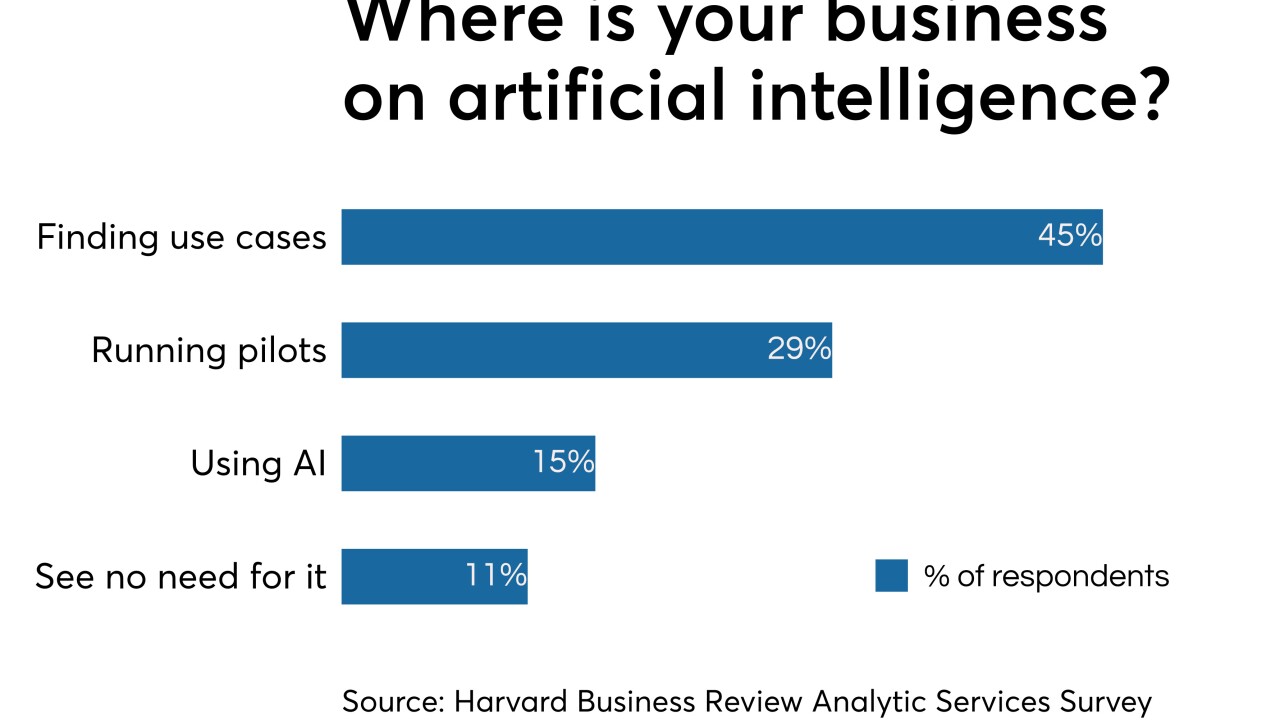

Credit decisions were a natural place to start with artificial intelligence, but now banks and credit unions are taking the technology to all parts of their businesses.

September 11 -

Numerated, a vendor of loan prospecting, marketing and underwriting software that was developed within Eastern Bank, now has $32 million.

September 10 -

The bureau issued three policies removing the threat of legal liability for approved companies that test new products.

September 10 -

The bank helped raise $25 million for the fintech because of its potential to bring banks and nonbanks together in a virtual marketplace.

September 6 -

Enova has used AI in credit decisions for years. Now it’s having AI do the work of document verification, know-your-customer checks and more.

September 5 -

The acquisition of Radius Intelligence fits with the online lender's existing focus on small commercial borrowers.

September 3 -

A year after the major credit bureaus agreed to strip tax liens and civil judgments from consumers' credit files, a new study says it is hampering lenders' credit decisions. But proponents of the move insist it was the right call.

September 3 -

Kristy Kim was an immigrant success story with a degree from Berkeley and a lucrative job — except her lack of credit history precluded her from getting a car loan. She started TomoCredit to help the many young folks who struggle to qualify for a credit card.

August 29 -

An economic downturn is likely to force industry consolidation; the legit firms only offer borrowers things they can get for free, while others are scams.

August 27