M&A

M&A

-

Katz Investment agreed to buy Camp Grove Bancorp in March 2019. The Federal Reserve approved the buyer's application to form a bank holding company earlier this year.

April 12 -

The Louisiana credit union holds just $3.5 million of assets and could not find a successor for its retiring chief executive.

April 12 -

Bank of Montreal agreed to sell its Europe, Middle East and Africa asset management unit to Ameriprise Financial for 615 million pounds ($847 million), marking CEO Darryl White’s biggest move yet to trim the bank’s portfolio of noncore businesses.

April 12 -

BancorpSouth would have $44 billion of assets after it buys Houston-based Cadence. The company will be rebranded, while the bank will retain the Cadence name.

April 12 -

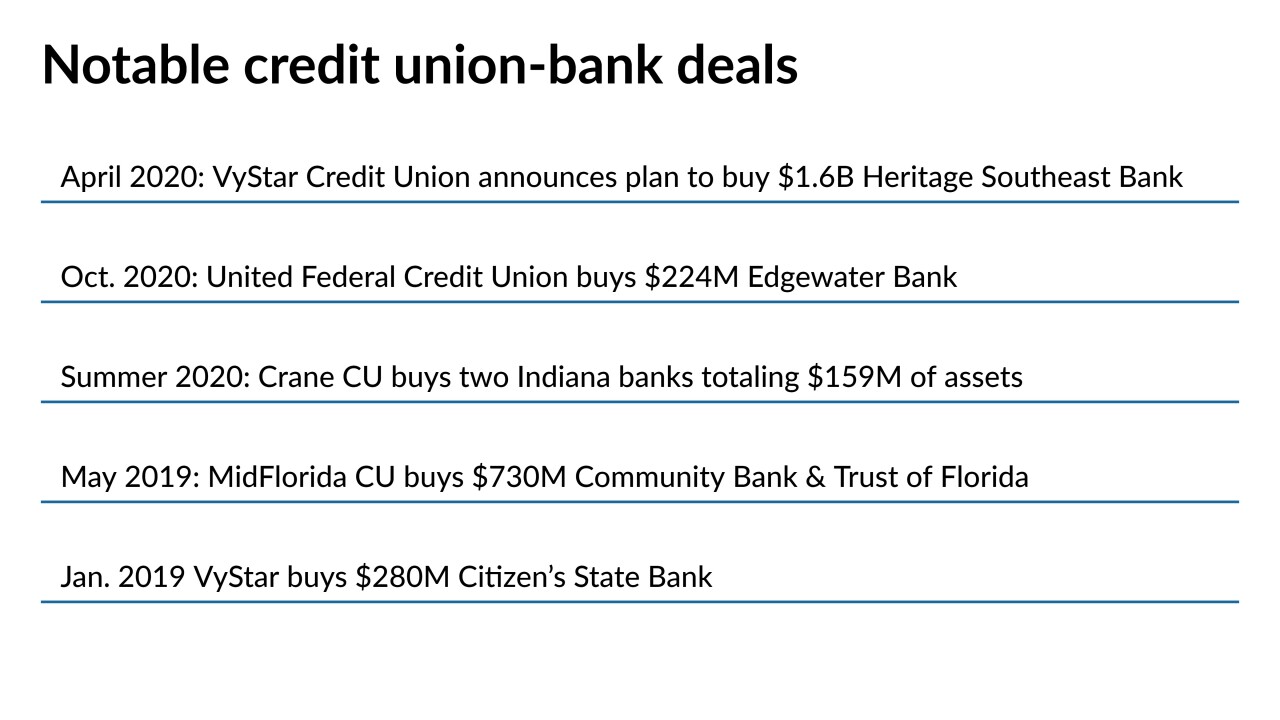

Banking trade groups have called for congressional hearings following the Jacksonville, Fla.-based credit union's agreement to purchase the $1.6 billion-asset Heritage Southeast Bank, the largest deal of its kind to date.

April 12 -

The deal will see the $16 million-asset Georgetown FCU join the $258 million-asset PAHO/WHO. The combined institution will serve more than 7,500 members.

April 9 -

With its deal for Century Bancorp, Eastern will significantly boost its deposit share in greater Boston while gaining an entrée into several new business lines, including cannabis banking.

April 8 -

The Chicago fintech, which currently offers personal loans and credit cards, will add deposit accounts with the acquisition of Level.

April 8 -

The announcement comes about six months after Boston-based Eastern raised $1.7 billion through an initial public offering.

April 7 -

The Department of Justice in the Trump administration hatched a plan to consider reforming its bank-merger review process, raising industry hopes about overhauling the outdated regime. But progressives want the agency to give more thought to the harm bank combinations cause consumers, including further branch closings.

April 7 -

HoldCo Asset Management is trying to convince shareholders ahead of an April 27 vote that the deal's $900 million price is too low, while Boston Private's board characterized its negotiations as "carefully designed and calibrated."

April 7 -

The Boston company has acquired three insurance agencies since becoming fully stock-owned in October 2020.

April 6 -

The Brink's Company has expanded its cash management and payment solutions portfolio through the acquisition of PAI Inc., a privately held provider of ATM services in the U.S.

April 6 -

Longstanding familiarity with each other and years of informal talks helped the companies negotiate their $7.6 billion merger in just two months.

April 6 -

The bank's purchase of AxiaMed gives it a digital gateway to the medical industry, speeding deployment amid growing competition.

April 5 -

The bank's purchase of AxiaMed gives it a digital gateway to the medical industry, speeding deployment amid growing competition.

April 5 -

While competitors are turning to traditional mergers and acquisitions to build market share and boost profits, Cleveland-based KeyBank is betting it can keep pace by rolling out a digital bank for affluent doctors and dentists.

April 5 -

Truity Credit Union in Oklahoma is selling its only branch in the state.

April 5 -

Bank of America acquired the health care technology company Axia Technologies as the financial giant continues to build out its products for helping merchants take payments.

April 5 -

The Independent Community Bankers of America asked lawmakers to investigate credit unions' M&A activity after VyStar announced what would be the biggest purchase of a bank by a credit union.

April 2