-

On his watch, the $170 billion-asset HSBC USA became the first bank in the world to deploy a customer-facing robot in a branch. It's also the first bank to use wearable technology to help front-line branch staff.

June 4 -

John Rosenfeld once led the A-Team of a free-fall parachute unit. Now he's taking a different kind of leap, spearheading the creation of the institution’s first digital-only bank.

June 3 -

Wells began rolling out its online-bank brand in November. Peggy Mangot, senior vice president and head of Greenhouse development, shares what she’s learned so far.

May 28 -

Pangea says it is developing a digital account after customers complained that the bank relationship they had wasn't "for them."

May 17 -

The Italian family that founded a bank in the 14th century and pioneered branches and letters of credit is now setting up a tech-forward, crypto-friendly disruptor in the United States.

May 15

-

Digit's savings app, relying on JPMorgan Chase's new real-time payments service, will offer customers an instant withdrawals feature that uses savings as a cushion against checking overdraws.

May 14 -

Expense Wizard uses AI to make it easier to file expense reports, especially for infrequent travelers.

May 9 -

A digital challenger bank is relying heavily on artificial intelligence to provide low-cost banking to low-income people and small businesses.

May 8 -

Consumers expect financial institutions to provide mobile applications that combine ease of use with top-class security features. Biometrics could help credit unions keep up with these high-stakes technology demands.

May 8 ThumbSignIn

ThumbSignIn -

Mariel Beasley, co-director of Duke University’s Common Cents Lab, who studies consumers’ financial behavior, says savings "nudges" in apps often fall flat. Here's why.

May 7 -

Alex Carriles, who runs mobile, online and digital accounts at BBVA Compass, describes how updates like account aggregation and expense analysis have helped increase use of its app.

April 30 -

Many banks rely on the location data they get from carriers through data aggregators to spot fraudulent transactions. With telecom companies shutting that source down, banks are worried it could significantly hurt their capacity to detect fraud.

April 29 -

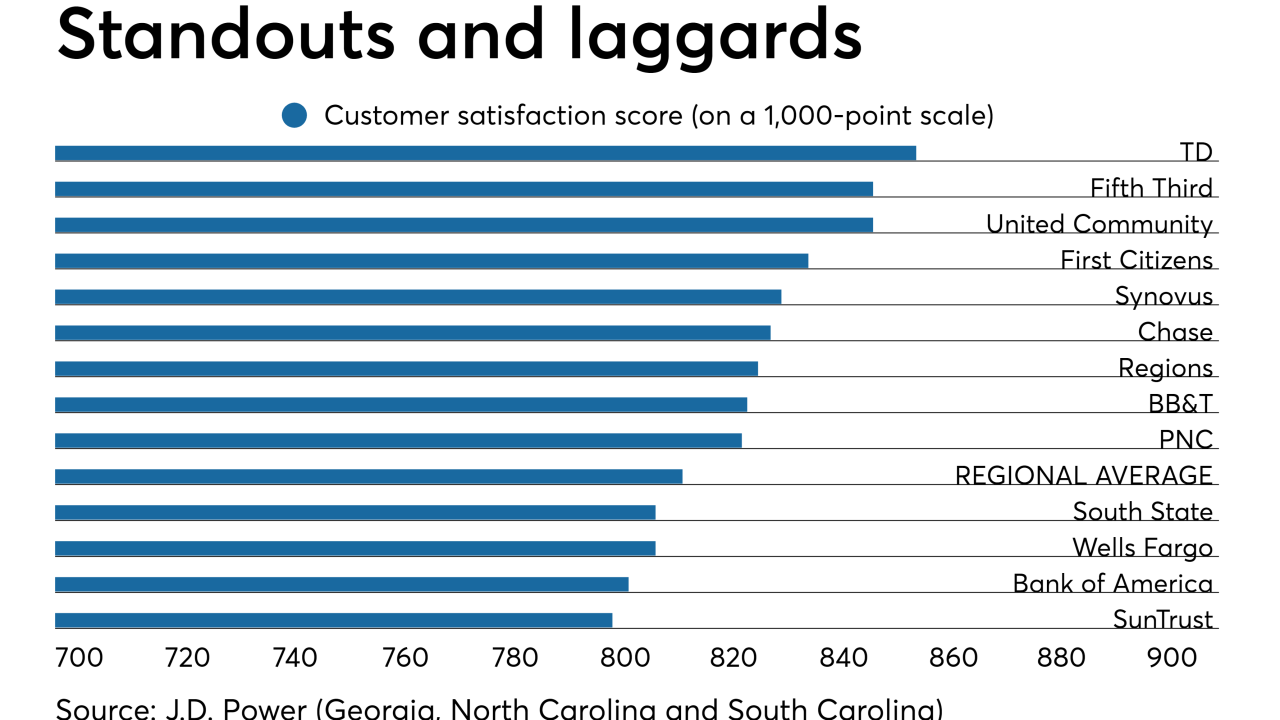

Larger institutions in particular have made banking so convenient that customers see little reason to move their accounts, according to a new report from J.D. Power.

April 25 -

David Tyrie, the bank’s new head of digital banking, discusses plans to offer customers constant course corrections and its new Life Plan product, and the latest on the virtual assistant Erica.

April 24 -

Leaders in bank innovation have ideas for improving financial services with high-speed, highly responsive 5G networks — ideas they say could be implemented relatively quickly.

April 22 -

The move is an extension of a pilot project begun in the fall. T-Mobile says it sought to give customers a better deal on digital banking and stand out from its rivals.

April 18 -

With branch traffic on the decline, some CUs have taken steps to tweak their facilities in order to help brick and mortar stay relevant in a digital world.

April 17 -

Karen Andres at the Center for Financial Services Innovation talks about the financial problems of people over 50 and how banks can help.

April 16 -

KeyBank is deploying new technology designed to improve the online and mobile banking experience and to guide branch employees' conversations with customers. The move comes on top of steps to modernize its IT infrastructure.

April 15 -

Derek White, an alumnus of BBVA and Barclays, will oversee digital innovation across all lines of business at the bank.

April 15