-

Credit unions need to be thinking about pressure on net interest margins and declining revenues.

March 12 Credit Union National Association

Credit Union National Association -

The answer depends who you ask, but an analysis of deposit and loan trends offers some insight.

March 1 -

Consumer lending margins in the United States strengthened at the Canadian bank, which overall saw more growth in business lending than consumer lines in its fiscal first quarter.

February 26 -

Boat sales have increased since the financial crisis, creating an opportunity for credit unions, but a number of risks mean institutions should tread carefully.

February 11 -

Though banks are generating more revenue from interchange and annual fees, those gains have been offset by declines in income from cash advances and late fees.

February 5 -

Bank of America CEO Brian Moynihan and his fellow executives said they see nothing to suggest a slowdown is imminent. Their outlook was far more upbeat than that of JPMorgan chief Jamie Dimon.

January 16 -

The Dallas company beat earnings estimates even as it reported declines in deposits, total loans and fee income.

January 16 -

Selling $1.6 billion in mortgages, and paying off a similar amount of wholesale borrowings, will allow the company to expand its net interest margin in 2019.

December 21 -

A 2016 law expanded credit union powers in the Great Lakes State, but it also capped how CUs can invest in GSEs – a move that nearly cost one institution $6 million.

November 27 -

Strong growth in the bank's core business of multifamily lending was offset by higher rates it paid on CDs and borrowed funds.

October 24 -

The California company reported increases in loans and deposits, along with a wider net interest margin.

October 18 -

Net income soared 32% thanks to higher interest rates that contributed to a wider net interest margin and its most interest income in a quarter in years.

October 15 -

More than half of all federally insured credit unions have less than $50 million of assets. But challenges, including increased demands for technology, are making it harder for small institutions to thrive, forcing some to look for merger partners.

October 15 -

The Pittsburgh bank reported a double-digit increase in 3Q profits on a mix of higher loan yields in its retail and corporate banking units, higher corporate service fees and several other factors.

October 12 -

The biggest U.S. bank leaned on old-fashioned lending in the third quarter to weather a slump in fixed-income trading.

October 12 -

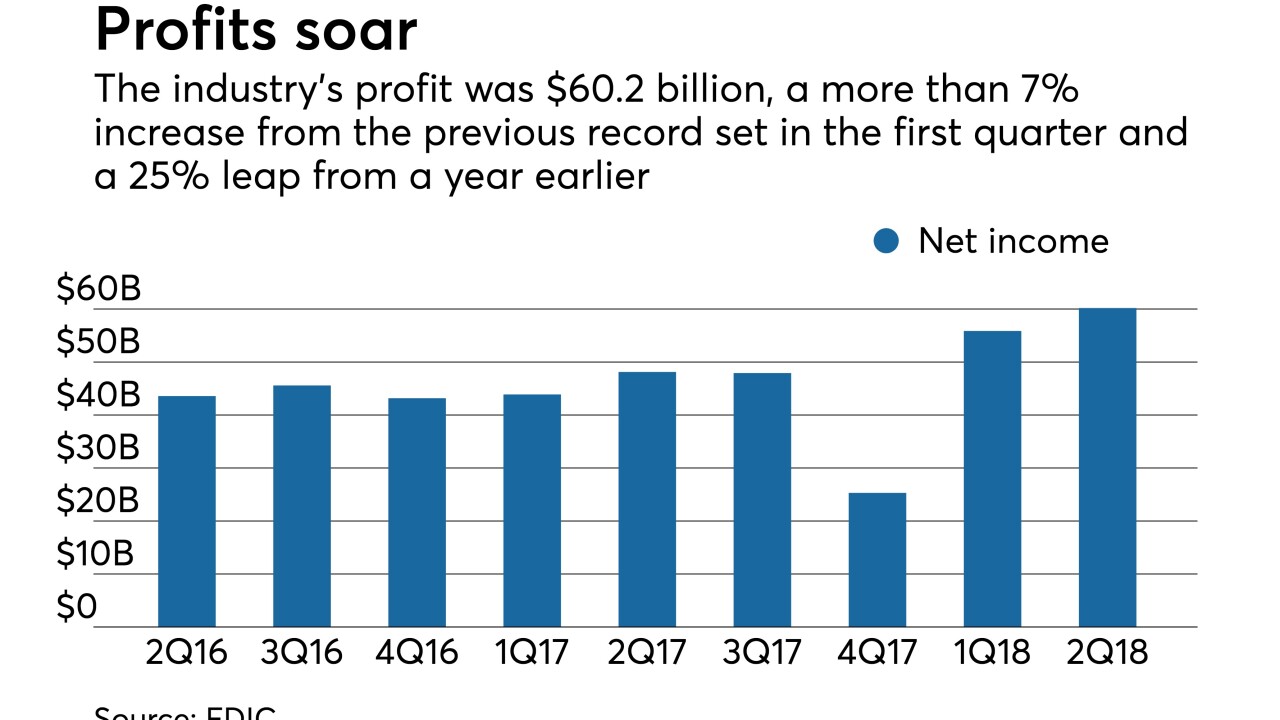

A huge chunk of the profit increase in the second quarter was due to a lower tax rate, but rising net interest margins and loan growth signal that institutions continue to derive revenue from their loan book.

August 23 -

Prosperity Bancshares in Houston said that its earnings increased 19% from a year earlier as its efficiency ratio rose.

July 25 -

BankUnited in Miami Lakes, Fla., said that second-quarter earnings rose 36% as average loan and investment securities balances increased.

July 24 -

The combination of rising interest rates and increased competition from nonbank lenders is prompting many commercial real estate investors to seek better deals elsewhere.

July 23 -

Despite some green shoots in key credit segments, total loan growth was light at many banks last quarter. Rate hikes are threatened, and deposits will get pricier — where will the earnings come from?

July 20