Banks are still working to rebuild their reputations following the financial crisis and, luckily for them, the phony-accounts scandal that erupted at one of the nation's most prominent retail banks did not drag down the broader industry.

While Wells Fargo's image is in tatters — and

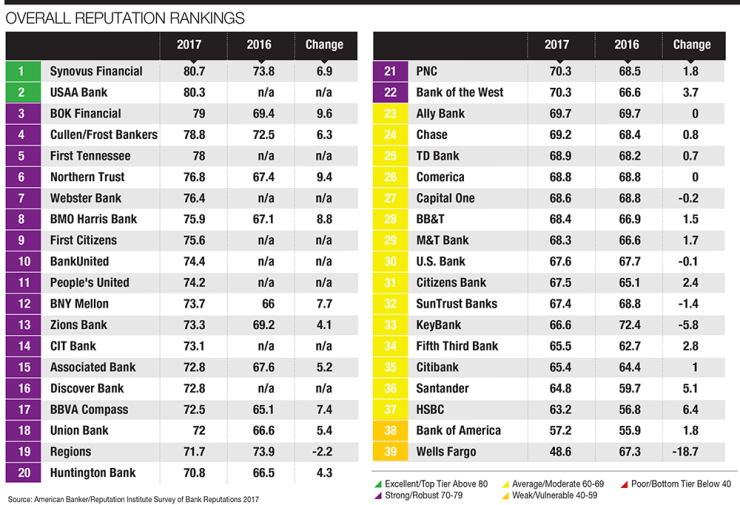

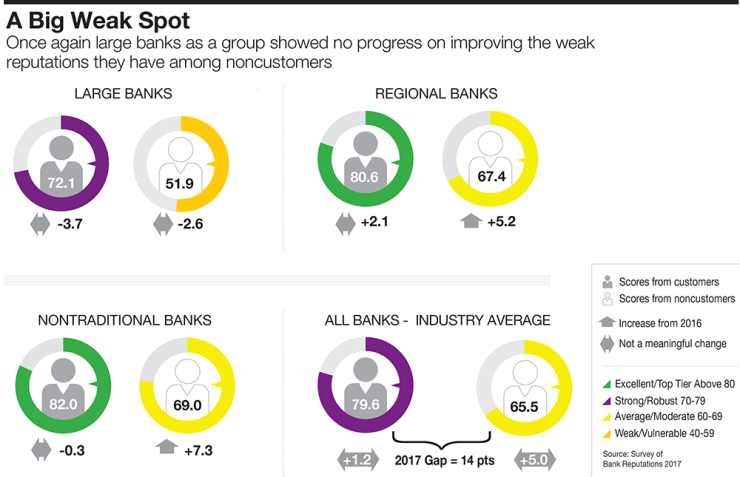

The 2017 survey revealed that the banking industry overall extended its multiyear reputation recovery among U.S. consumers, achieving a reputation score that qualified as "strong" (above 70 on a 100-point scale) for the first time since the Survey of Bank Reputations began in 2011.

Better delivery of products and services has helped, as has looser lending practices. But the biggest influence has been banks' behavior.

Simply put, banks are acting more responsibly with customers — no longer processing transactions in a way that will more quickly trigger overdrafts, for example. They also are making their community activities more prominent. And these efforts are paying off in higher reputation scores.

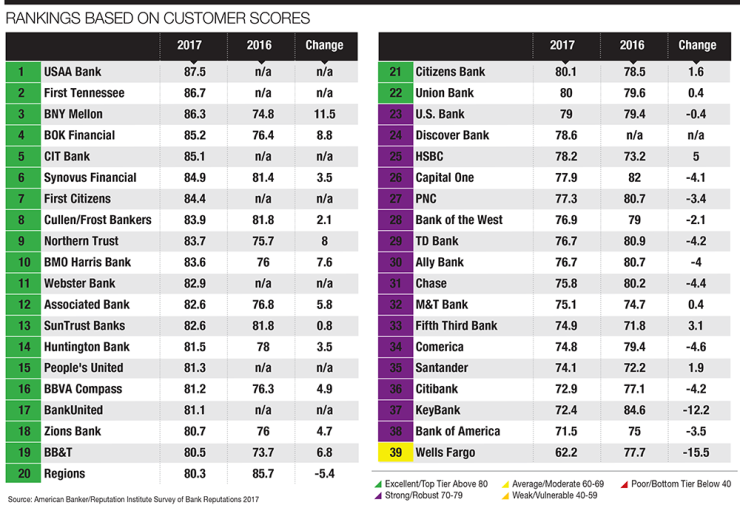

Of the 39 banks evaluated in this year's survey, more than half of them received "excellent" marks from their existing customers, up from just under a third of the banks in

Stephen Hahn-Griffiths, an executive vice president at the Reputation Institute, said that while providing quality products and services is obviously important, it's a company's governance — or how it conducts business — that can make or break a reputation these days.

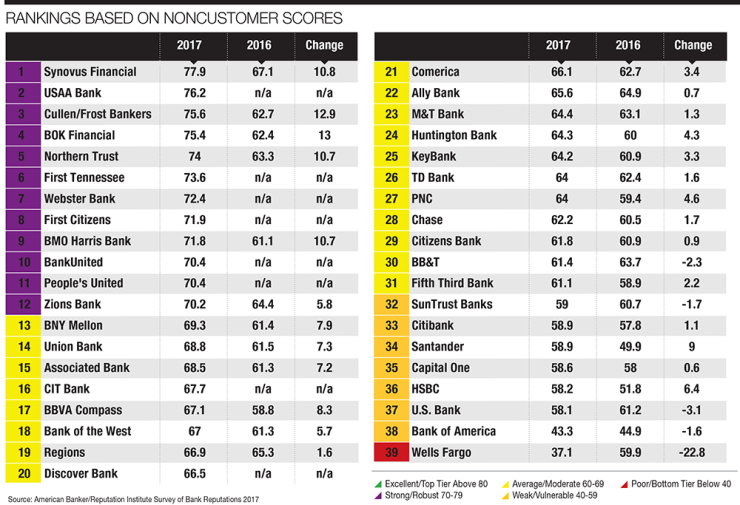

Wells Fargo is an obvious case in point. In last year's survey, Wells scored a respectable 67.3 in the overall ranking, outpacing many of its peers. This year its score went into free fall, plunging to 48.6, by far the lowest of any bank. (A score under 50 is considered "weak." Scores between 60 and 69 are "average;" between 70 and 79, "strong;" and above 80, "excellent.")

“In the court of public opinion, Wells Fargo is the poster child for bad behavior," said Hahn-Griffiths. Creating fake accounts to meet sales targets is "an egregious act that goes against everything good governance stands for. It's not ethical. It's not honest. It's not transparent."

He suggested that the reputations of other banks — rather than being tarnished by

"In many ways, it's kind of reaffirmed the loyalty to your other banks," Hahn-Griffiths said, "because you start to say, 'At least my bank isn't Wells Fargo.' It's a bit of a reverse psychology play, there."

Whatever the reason, banking now has moved ahead of some other industries that had it beat reputationally last year, including the health care and energy sectors. Banking also moved ahead of the broader finance industry, which scored a 69.

Across the 17 industries the Reputation Institute tracks, consumer goods had the strongest reputation, with a score of 76.5, and energy the weakest, with a score of 59.7.

Within the banking industry, the regionals are faring particularly well. Eight of the 10 highest-scoring banks in the overall ranking — including

Three of the country's four largest banking companies, Citigroup, Bank of America and Wells Fargo, placed in the bottom five of the overall ranking. Of the big four, JPMorgan Chase ranked highest, with a score of 69.2.

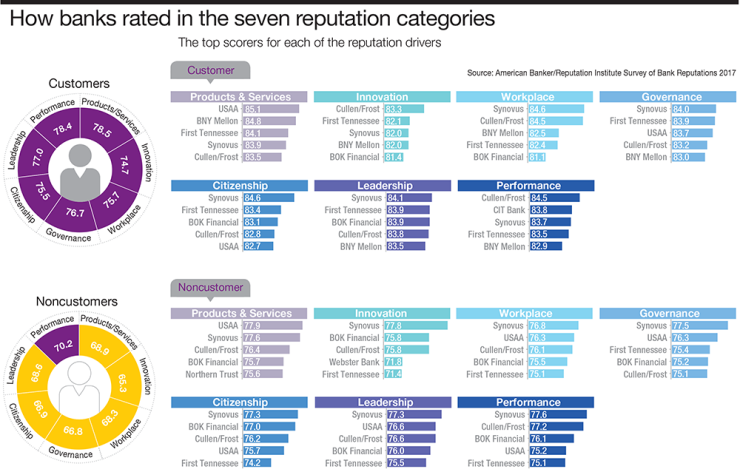

The survey rates banks in seven categories: products and services, innovation, leadership, workplace, performance, citizenship and governance.

Which categories most heavily influence people's perceptions of banks can shift from one year to the next, and the three categories that proved to be the top reputation drivers this year are governance, followed by products and services, then innovation.

"The No. 1 thing people are looking for in terms of reputation of a bank is ethical behavior," said Hahn-Griffiths.

Banks that embrace transparency and fairness will find it can be a real differentiator over the next year or two, he said.

Among the banks whose reputations benefited from rising governance scores were

Reymundo Ocañas, BBVA Compass' director of corporate responsibility and reputation, said that the brand is top of mind for executives at the bank, which is a unit of the Spanish banking giant Banco Bilbao Vizcaya Argentaria. (BBVA Compass is a Reputation Institute client.)

For example, he pointed to a five-year commitment the bank announced in 2014 to invest $11 billion in low- and moderate-income communities within its seven-state footprint. In its first full year of that commitment, it made $1.2 billion in loans to more than 24,000 small businesses and $819 million in mortgage loans, providing housing for more than 5,400 families.

Investments aimed at improving the workplace culture (its head of human resources is now called the "

A strong reputation can pay off in myriad ways, influencing people's willingness to buy products from, invest in and even work for a company, according to the Reputation Institute's research.

Of respondents who thought of a company as excellent, 85% said they would buy products from it, and 68% would invest in it.

Banks with excellent scores are also more likely to attract talent, though perhaps not as easily as they once could. Last year, 73% of respondents said they would work for the top-rated banks, but this year that figure fell to 65%.

Hahn-Griffiths offered two possible reasons for the decline. First, he said, many job seekers these days are unwilling to consider certain employers until they know for sure that a company's values line up with their own. Also, "millennials in particular are looking beyond a career job at a large corporation and thinking about other forms of employment, such as starting their own company," he said.

Attracting talent is more challenging for those with less-than-stellar reputations. Only 22% of respondents said they would seek employment with the average companies and just 11% would apply for jobs with the weak ones, according to the Reputation Institute.

-

Under Steven Bradshaw, the Oklahoma bank is engaging employees as never before by investing heavily in training and development. Don't think customers haven't noticed.

June 27 -

Large banks are gaining momentum as regional banks stall in the annual American Banker/Reputation Institute Survey of Bank Reputations. Chase even barreled its way into the top 10 of the customer ranking.

June 27 -

Synovus Financial struggled along with its customers during the financial crisis. Now that it's healthy again, it credits the strong ties it built with those customers, and the involvement of its executives in the communities they serve, with helping restore its status as one of banking's most reputable brands.

June 27

Attracting new customers also gets progressively tougher for companies in the lower reputation categories. While 59% said they would buy products at the companies with strong reputations, only 37% would do so at the average companies. And that drops to 19% for the weak companies.

Wells Fargo, for example, has seen a sharp decline in new account openings since the scandal broke last year. Consumers opened 35% fewer checking accounts at Wells in March than they did in the same month last year and credit card applications were down 42% year over year. Those steep drops are among the reasons profits in its retail banking unit fell 9% in the first quarter from a year earlier, to $3 billion.

Joo-Yung Lee is a managing director and regional head of Fitch Ratings' North American financial institutions group. She said that while reputation is not a key component in determining a bank's rating, it is something she has to pay attention to because a poor one can affect areas such as loan growth, client acquisition and referrals.

Her team put Wells on a "negative" outlook following the scandal. "We do pay attention to brand and the firm's reputation in the context of how it plays a role in the bank's franchise and the business model," Lee said.

Wells Fargo has taken

And, so far, the bank has refunded nearly $3.3 million to customers for fees incurred as a result of "potentially unauthorized" deposit accounts, credit cards and lines of credit, according to a recent one-sheet from Wells outlining its progress.

Like all banks in the reputation survey, Wells performed better with its customers than with noncustomers. Among customers it scored a 62.2, lowest among the 39 banks but still in the range of "average." Its noncustomer score was 37.1, which is "poor."

Less than half of its customers say they would recommend the bank to others, and less than a quarter of noncustomers would do so.

But Wells' recovery effort is starting to pay off. The Reputation Institute runs monthly assessments for Wells, which is a client, and Hahn-Griffiths said its scores are up slightly since spring, when the annual Survey of Bank Reputations was fielded.

"It's going to take a while; there is no overnight cure," he said. "It's all about rebuilding trust and credibility one customer at a time and doing the right thing."