Want unlimited access to top ideas and insights?

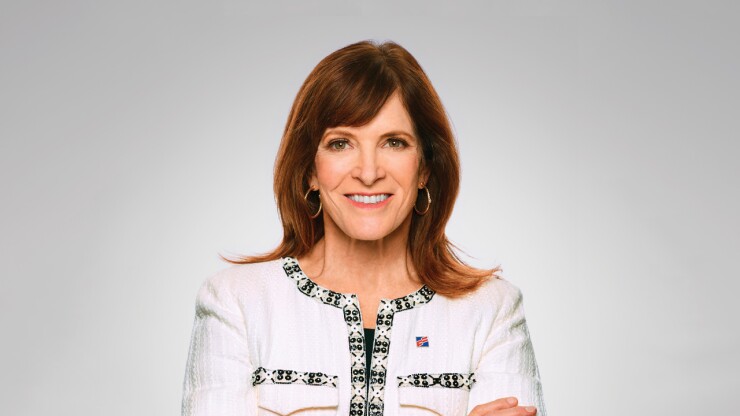

Hope Holding Bryant commands nearly half of First Citizens Bank's balance sheet.

Last year, the North Carolina-based financial institution increased general bank loans by $3.9 billion, a 6.3% year-over-year growth. As of Q4 2024, general bank loans accounted for $66.8 billion – 48% of total loans. On the other side of the balance sheet, last year general bank deposits grew $9.4 billion to $73.1 billion, which accounts for 47% of total bank deposits.

Holding Bryant, the vice chairwoman, attributes this success to serendipitous acquisitions over the past few years. In April 2019, First Citizens acquired Biscayne Bank. In January 2022, First Citizens merged with CIT Group. And in March 2023, the bank acquired Silicon Valley Bridge Bank.

"We didn't know that bringing these entities together would be a phenomenal way to derisk and position the company for tremendous growth going forward," Holding Bryant told American Banker. "But we have very low costs, a stable deposit base, and that is the key to our companies ability to take advantage of the opportunities we do."

Those opportunities brought First Citizens Bank into several niche markets, including wine and cannabis.

The latter was an effect of the Biscayne purchase, and initially First Citizens wasn't sure they'd be able to bank such businesses. But the strength of their compliance department sparked strategic conversations, according to Holding Bryant.

They were being asked about cannabis from their existing clients too – SMBs in California and Colorado, agricultural businesses on the East Coast, and some of their medical clients. The bank realized with its already strong compliance department, they could manage these businesses expertly.

"Small banks wouldn't be able to afford to put that compliance team together and big banks didn't need the new growth, so we played to the strength of our business banking," Holding Bryant said. "I love niche businesses like that. It's where we feel we can add value and piggyback on the things we're already doing."

With those gains, First Citizens Bank has also been giving back during recent years when natural disasters have become more severe. Holding Bryant said she's proud of the bank's response to the 2024 hurricanes Hellene and Milton.

"We've been doing so much culture work with two large acquisitions, and our team's response to these tragedies was amazing," she said. "It put a lot of teeth in the work we've been doing there."

First Citizen Bank deployed $3.5 million on the East Coast in hurricane relief and $2 million on the West Coast for fire relief.

"The credit losses were minimal in those markets. We figured out how to help clients and get them back on their feet," Holding Bryant said.

"Our Consumer and Wealth businesses reached new heights in 2024, both in terms of financial performance and operational milestones," Michael Wilson, wealth and consumer banking executive at First Citizens Bank said. "Hope has been an instrumental leader throughout, cementing a culture of empowerment, achievement and efficiency – all while ensuring we are staying true to our DNA as a client-centric, relationship-focused organization."