It always pays to be ready.

WashingtonFirst Bankshares' executives and directors had been contemplating the Reston, Va., company’s sale well before

Shaza Andersen, WashingtonFirst’s president and CEO, and Joseph Bracewell, its chairman, began thinking about a sale in early 2014 as the $2.1 billion-asset company celebrated its tenth anniversary, according to a regulatory filing tied to the deal. As part of the process, they began meeting informally with other bankers to “get acquainted … on a face-to-face basis.”

That early canvassing would pay off, as would a decision in late 2016 — nearly two months before WashingtonFirst’s investment bank formally began reaching out to potential acquirers — to establish a virtual data room that would simplify due diligence for potential suitors.

Those moves allowed WashingtonFirst to act nimbly when a window of opportunity suddenly opened up.

The first big break came in August 2016 when a competitor agreed to sell itself at a healthy premium. Though the filing did not identify the bank, Cardinal Financial in Tysons Corner, Va., agreed at that time to sell to United Bankshares in Charleston, W.Va., for

Bank valuations also began to rise following the presidential election.

By November, Andersen and Bracewell were prepared to conduct serious discussions. They asked WashingtonFirst’s investment bank to reach out to an unnamed bank to gauge its interest in a deal. Though keen on WashingtonFirst and the Washington market, the bank said it was not ready to pursue an acquisition.

In mid-December, Daniel Schrider, president and CEO of the $5.3 billion-asset Sandy Spring, requested a meeting with Andersen. The executives met for lunch on Feb. 9, at which point Schrider said he was interested in a merger with WashingtonFirst.

Andersen, however, did not tell Schrider that WashingtonFirst was considering a sale.

WashingtonFirst, meanwhile, had asked its investment bank to gauge interest from certain banks, including Sandy Spring. There was a catch: The banks could not learn of WashingtonFirst’s identity until they signed a nondisclosure agreement.

Eighteen banks were contacted in February; half signed the nondisclosure agreement and were allowed to conduct due diligence. The filing only discusses one other bank with a serious interest; the unnamed institution never submitted an offer and backed off as WashingtonFirst’s discussions with Sandy Spring heated up.

Sandy Spring on March 7 proposed an all-stock deal that valued WashingtonFirst at $38 a share. The offer provided pricing that, after about a year, would have been equal to 60% of the stock appreciation WashingtonFirst was targeting in its five-year plan.

Still, WashingtonFirst’s board wanted some protection from an unexpected decline in Sandy Spring’s stock price. Sandy Spring agreed to make an adjustment to the proposal’s pricing mechanism based on a 20-day-volume-weighted average price.

Things moved quickly from that point, with the parties signing an exclusivity agreement on April 27 and announcing a deal on May 16.

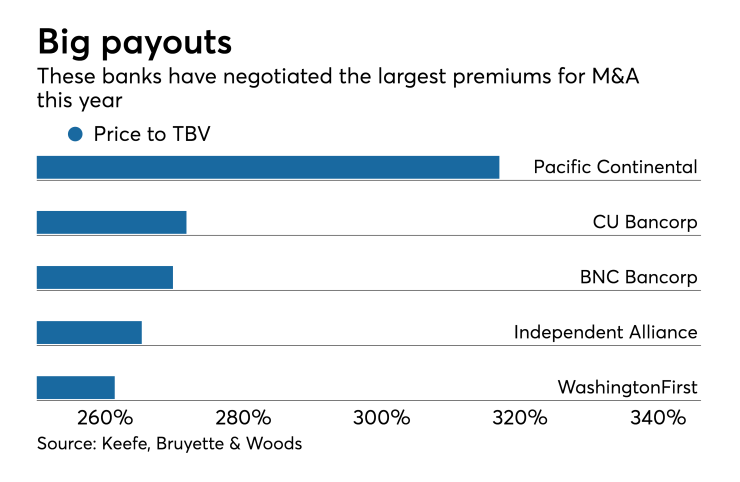

The deal, which is expected to close in the fourth quarter, priced WashingtonFirst at 256.3% of its tangible book value. Andersen and Bracewell will join Sandy Spring’s board and serve on the company’s executive committee.