The City of Scottsdale, Ariz., is backing away from credit cards as a payment option for utility bills, starting Sept. 1, in an effort to rein in its transaction processing expenses.

City officials said the move will save Scottsdale more than $350,000 a year, and could reduce its potential exposure to fines and fees for credit card data breaches by millions of dollars.

Observers say many other cities are facing similar problems, and some are looking for ways to reduce their payments fees.

Scottsdale has accepted credit cards for 15 years; when the new policy takes effect, people will no longer be able to use them online or over the phone, but they will still be able to make in-person credit card payments. City residents pay one monthly utility bill that covers both water and garbage collection; the average bill is $148.46.

A city spokesman said many residents are upset, but Scottsdale has no plans to repeal the new policy.

"People are mad," he said. "They don't like the change, and a lot of them are saying they will punish us by going back to sending checks, which they think are a bigger hassle for us."

But checks cost the city "far, far less" to process, he said. And because the payments are associated with utilities, fraud and bad checks are "inconsequential."

Nancy Atkinson, a senior analyst with the Boston research company Aite Group, said cards are a popular option for utility payments, but expensive for cities. "Consumers like paying their bills with credit cards because they look to make routine payments like utilities as late as possible, and credit cards accomplish that pretty neatly while also delaying their out-of-pocket expenditures," she said.

But cities nationwide are "feeling the crunch of tight budgets," and more cities may follow Scottsdale's lead, Atkinson said.

"Organizations looking at their costs are focusing on credit card transaction fees, which include a chunk of interchange, and municipalities are in the unique position of being able to say no to cards because their customers are obligated to pay one way or another," Atkinson said.

"That's not true of retailers; they have to take card payments or risk losing a sale."

MasterCard Inc. does not view Scottsdale's policy as part of a larger trend. "In fact, consumer bill payments and payments to government entities via payment cards are both categories that have been growing for us," a MasterCard representative said.

Visa Inc. said that thousands of utilities around the country continue to accept Visa payment cards. "Visa payments provide tremendous value, and in the long run reduce costs for handling checks and cash," a representative said.

But Scottsdale's data shows otherwise.

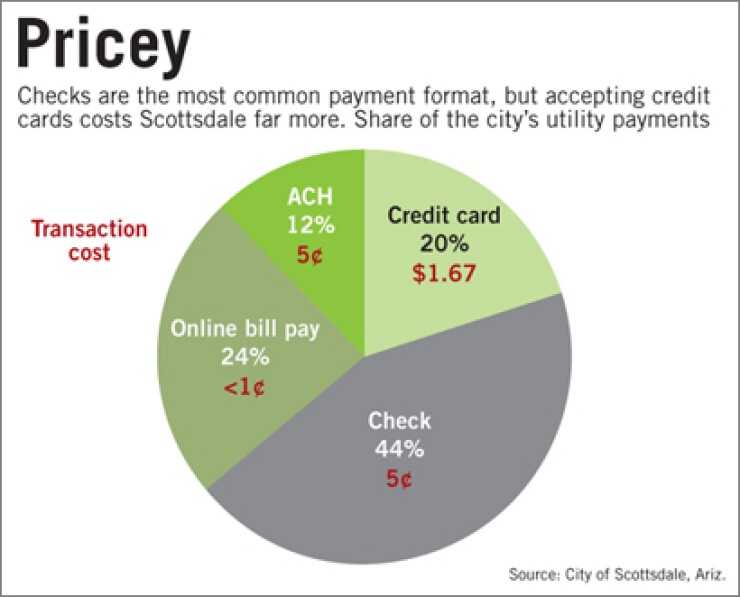

Twenty percent of its 90,000 utility customers routinely pay with credit cards, mainly by phone and online, according to a city report.

Another 44% pay their bills with paper checks, 24% through online banking services and 12% have set up automated clearing house debits from their bank accounts through SurePay, a third-party service the city provides.

Credit card utility payments cost Scottsdale about $1.67 each to process, far more than other payment options, amounting to more than $350,000 annually on more than 200,000 individual credit card payments, according to the city's data.

Paper checks and ACH payments cost it roughly 5 cents each to process, while payments through online banking sites cost a fraction of a cent each to process, according to the city's report.

Scottsdale officials also calculate that the city risks exposure to approximately $70 million in potential fines and fees if it is ever involved in a major credit card data breach, based on requirements to comply with the Payment Card Industry Data Security Standard.

Eliminating routine credit card acceptance for utility payments by phone and online from the city's website will reduce Scottsdale's exposure to potential data-breach costs by about half, city officials said.

"Simply moving most credit card payments to in-person transactions will reduce a lot of the potential card-fraud risk," Atkinson said.

Utility payments account for the majority, about 57%, of Scottsdale's estimated $41 million in credit card payments received annually, the city said. Court fees represent 26% of card payments and community services and other miscellaneous fees make up the remaining 17% of credit card payments. Scottsdale plans to continue accepting credit cards for nonutility payments.

To help ease the transition from credit cards, Scottsdale is establishing a new website payment option that enables customers to pay utility bills directly from their bank accounts through ACH channels, augmenting its existing SurePay service.

The new service will cost the city 25 cents per customer per month for those who use it, plus 5 cents per transaction.

The city will require those choosing its new ACH option to sign up for electronic billing, and the costs will be offset by reduced bill-mailing expenses. Scottsdale estimates that it costs about 50 cents to mail each customer their utility bill.