In the wake of the

The CFPB received over a quarter-million complaints in 2018 — a record — which was a 6% increase from the previous year, according to a new

The analysis by U.S. PIRG's Education Fund comes as the consumer advocacy organization and others like it urge the CFPB to continue allowing the public to view the complaint database. PIRG has released a total of 14 reports about the complaint database since 2013.

“Going forward, we encourage the CFPB to maintain public access to a vibrant, transparent, and complete consumer complaint database that encourages consumers, competitors, academics and other researchers, and the complained-about companies themselves to study ways to reform the marketplace,” the report said.

The three credit bureaus — Equifax, Experian and TransUnion — received a third of all complaints last year, and generally received three times as many complaints as the largest banks, according to the report. Consumers filed 257,111 complaints with the CFPB last year. In 2017, complaints jumped 21% to 242,986.

PIRG said complaints against the three nationwide credit bureaus "are particularly worrisome since consumers do not choose to do business with these companies."

"A consumer can respond to wrongdoing by a bank, for example, by simply choosing a competitor," the report said. "But with credit bureaus, you cannot vote with your feet.”

JPMorgan Chase and Wells Fargo ranked fourth and fifth among the top five companies by volume of complaints.

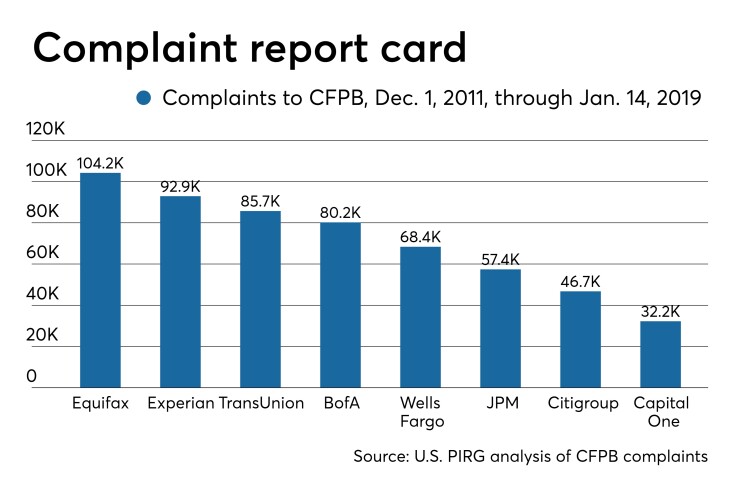

The consumer group also analyzed aggregate complaint data from late 2011, when the CFPB database became publicly available, to Jan. 14 of this year. The three credit bureaus again ranked highest with volume of complaints during the longer time period — Equifax with 104,208 complaints, Experian with 92,905 and TransUnion with 85,696.

Over the seven-year-plus period, BofA and Wells rounded out the top five, with 80,215 and 68,368 complaints, respectively. Yet industry representatives are quick to point out that relatively high complaints against the largest banks are a given with their market footprint, and that consumer complaints have dropped dramatically since the financial crisis.

“No one should be surprised larger institutions have more complaints, which the CFPB does not confirm the validity of, in the database," said Richard Hunt, president and CEO of the Consumer Bankers Association. "As a percentage of overall customers, the number of complaints is low and customer satisfaction is evident by how infrequently people change banks.”

Mortgage complaints have declined over the past five years, while debt collection complaints are steadily increasing, the PIRG report found.

The complaint database has been used in part for industry guidance, rulemaking and enforcement actions. But it has come under attack by industry groups and former acting CFPB Director Mick Mulvaney, who sought public comment last year on whether to continue allowing complaints to be made public.

Mulvaney, now the acting White House chief of staff, didn’t like the idea of a public database, once

Current CFPB Director Kathy Kraninger has made no decision yet on whether to keep the database public.

“It is on the agenda this year to address what is the public kind of discussion about what the database should be,” Kraninger told Reuters in an interview in February. A CFPB spokeswoman did not return calls seeking comment.

Consumer advocates say public access to the CFPB’s database keeps financial institutions accountable for how they respond to grievances, and is a factor in what kind of relief consumers receive.

“It’s a resource where problems get resolved, and the public nature is an important part of it,” said Ira Rheingold, executive director of the National Association of Consumer Advocates. “The mere presence of the database changes behavior. It serves a real purpose in keeping financial institutions accountable, and it’s important for consumers to have a place to complain publicly."

The Dodd-Frank Act mandated that the CFPB maintain a complaint database but did not specify that it be made public. Former CFPB Director Richard Cordray made the database public in late 2011. Narratives from consumers describing their experiences were allowed in 2015. That sparked outrage from financial firms because the complaints and narratives are not verified by the CFPB to determine if they are accurate before being made public.

In addition, the CFPB's complaint database was found to be riddled with

Although U.S. PIRG ranked individual companies based on the total volume of complaints received, industry trade groups say that can be misleading and should be given more context based on a company's total customers.

For example, Equifax received 30,060 complaints in 2018 — the most of any company — though those total complaints pale in comparison to the 220 million credit files that the credit reporting giant maintains on consumers. JPMorgan Chase received 8,905 complaints last year from among more than 60 million customers.

The three largest banks receive a high number of complaints because they serve millions of customers and also have a large share of the mortgage market, the report said. The two main issues consumers cited when filing complaints against a large bank were "struggling to pay their mortgage" and "having trouble during the payment process," the report concluded.

The credit bureaus tend to receive an outsize number of complaints because they act as middlemen between consumers and financial firms that may be reporting an adverse action on a credit report. Credit reporting, credit repair services, or other personal consumer reports made up 43% of total complaints in 2018, up from 23% of total complaints in 2016.

“A lot of times a consumer is disputing something on a credit report but the dispute is actually with the bank or debt collector that filed the information with the credit bureau,” said Francis Creighton, president and CEO of the Consumer Data Industry Association, a trade group.

Credit bureaus and companies that furnish data to them are required to maintain the accuracy of consumer data. The CFPB has devoted

"If there were consistent, systemic problems in the credit bureaus, the CFPB has the tools to hold them accountable," Creighton said.

Consumers have filed a total of 1.2 million complaints with the CFPB since 2011; 97% of complaints are addressed in a timely manner, PIRG said.

Half of all complaints are filed against just 10 companies: Equifax, Experian, TransUnion, Bank of America, Wells Fargo, JPMorgan Chase, Citibank, Capital One, Navient and Ocwen.