During the dog days of the recession, banks tried all they could to squeeze a few extra basis points of yield from their balance sheets.

Now the tables seem to have turned. A growing number of banks are willing to sacrifice yield in exchange for greater control in managing interest-rate risk.

During the third quarter, many banks shifted the makeup of their securities portfolios toward short-term holdings, such as 1-year or 2-year Treasuries, or certain types of mortgage-backed securities.

It makes sense given the uncertainty surrounding the Federal Reserve’s ongoing program to raise short-term rates. Predictions of the exact pace of the rate hikes keep changing because of questions about the economy, tax reform and other policymaking in Washington, and whom the next Fed chair will be.

“With all fixed-income investors right now, there is clearly concern about interest rate risk,” said Sam Dunlap, a senior portfolio manager at Angel Oak Capital Advisors, which consults community banks on securities portfolio management.

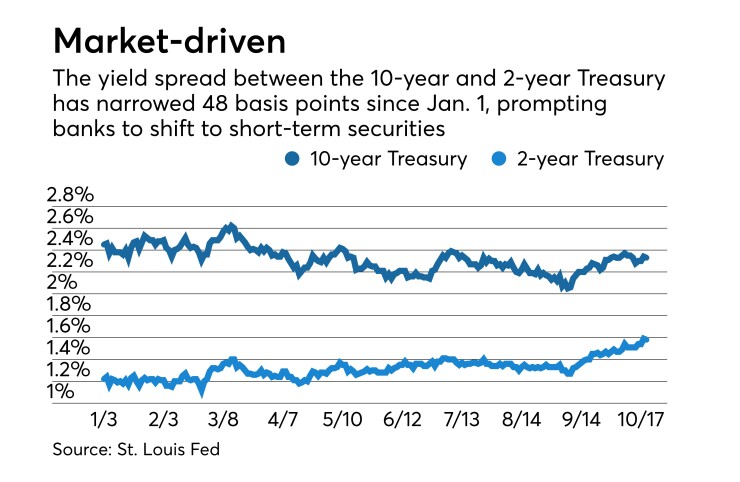

Financial conditions have made it more palatable for banks to move to short-duration securities. From Jan. 1 through Oct.19, the yield on the 10-year Treasury fell 12 basis points to 2.33%. In the same period, the yield on the 2-year Treasury has risen 36 basis points to 1.58%.

“The yield curve getting flatter lets community banks invest in shorter-duration products but not give up as much yield otherwise,” said Ben Eskierka, chief investment officer of United Bankers’ Bank in Bloomington, Minn., which advises community banks on securities portfolio management.

The $20 billion-asset Bank of the Ozarks in Little Rock, Ark., bought about $728 million of short-term mortgage-backed securities during the third quarter. The move will lower the bank’s average yields on earning assets, but it will be worth the trouble, Chief Financial Officer Greg McKinney said.

“Because of the high quality and short duration of these securities, they yield only about 2%,” McKinney said during an earnings conference call. “Despite the relatively low yield, we add these securities for another tool for managing our balance sheet liquidity and trying to avoid any significant interest rate and market risks.”

However, it is a particularly challenging time to sacrifice yield. Bankers are worried that the Fed’s

Third-quarter results at the $10 billion-asset WesBanco in Wheeling, W. Va., provided a good example of the balancing act. Its net interest margin rose to 3.45% at Sept. 30 partly because it managed to extract 26 basis points more of yield from earning assets. The improvement was needed to offset a 14-basis point increase from interest-bearing liabilities.

To achieve the greatest possible flexibility, some banks have opted to hold higher levels of cash. The $20 billion-asset Western Alliance Bancorp. in Phoenix recorded an average daily cash balance of $850 million during the third quarter. Western Alliance opted for higher cash levels because of rate uncertainty, CFO Dale Gibbons said.

“Frankly, we didn’t think it was the best environment to be extending out in securities,” Gibbons said during an Oct. 19 conference call.

The $11 billion-asset Community Bank System in Syracuse, N.Y., plans to adopt a similar strategy during the fourth quarter and retain more cash than usual, CFO Scott Kingsley said during an earnings conference call. After all, cash may generate rock-bottom yields, but it’s still something.

“In a market that expects rising rates, I’m not so sure this is the right time or the inflection point to be piling into securities,” Kingsley said. “I don’t think we would feel bad if we had uninvested cash balances, which you’re going to get returns in the 1% to 1.25% range anyway.”